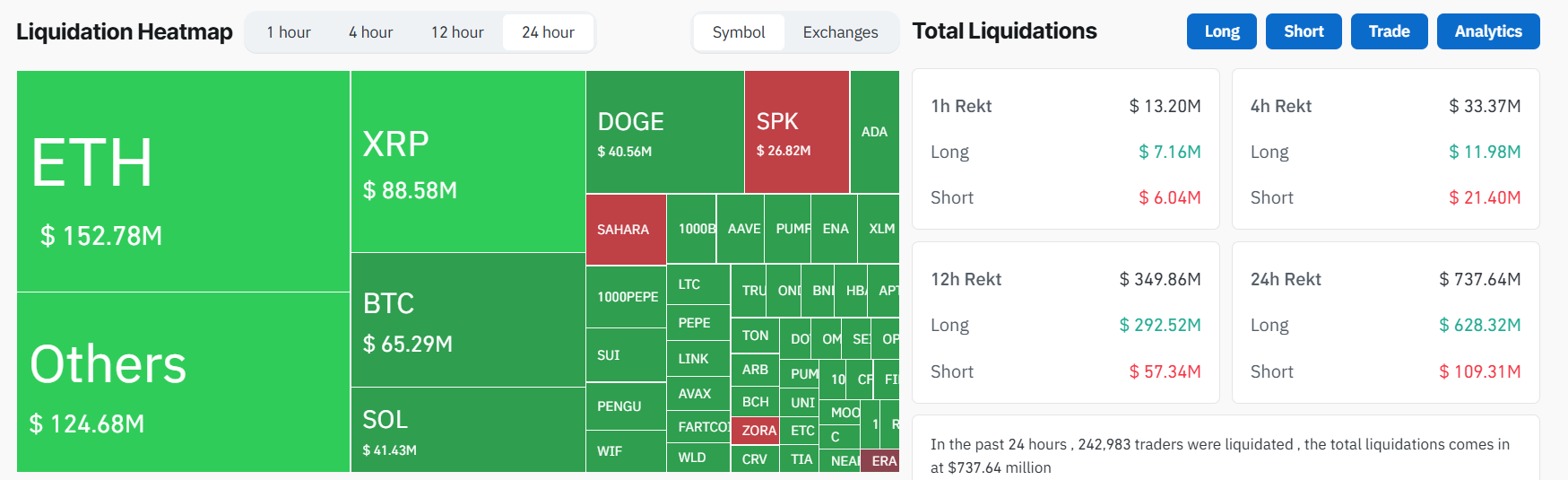

Ether & XRP Get Rekt: $680M Bull Liquidation Bloodbath Leaves Bitcoin Relatively Unscathed

Crypto bulls just took a $680 million punch to the gut—and altcoins bled harder than Bitcoin. Here’s the wreckage.

### Altcoin Carnage Outpaces BTC

While Bitcoin dipped, Ether and XRP traders got steamrolled. Leveraged longs got liquidated en masse—classic crypto overconfidence meets market gravity.

### The $680M Lesson

Another day, another nine-figure reminder that crypto markets eat overleveraged bulls for breakfast. But hey, at least the hedge funds will call it 'volatility arbitrage.'

### Silver Lining Playbook?

Bitcoin’s relative resilience hints at its 'digital gold' narrative holding—while altcoins keep proving they’re speculative rockets with faulty parachutes. Trade accordingly.

While price action across the majors was mostly down by only a few percentage points, the high leverage used by retail traders in altcoins likely amplified their losses. In total, $625.5 million of the liquidations were on long positions, suggesting the selloff caught many bulls off guard after weeks of upward momentum.

Other heavily hit tokens included Solana’s SOL at $41 million, Dogecoin (DOGE) at $40 million, and smaller DeFi tokens like SPK and PUMP seeing over $10 million in positions wiped.

The absence of a clear catalyst and profit-taking NEAR key resistance levels may have exacerbated the selloff. Ether had recently flirted with the $4,000 mark while Bitcoin traded above $118,000 — levels that had already prompted profit booking from larger wallets.

As of writing, ETH is down roughly 3.6% on the day to trade near $3,540, while XRP fell 6% to $3.25, extending its weekly loss to over 12%. Bitcoin fared better, slipping just under 2% to hover around $116,800.

Crypto liquidations occur when Leveraged positions are forcibly closed due to a price move beyond a trader’s margin threshold. This typically results in major losses and can trigger cascade effects during volatile moves.

Traders use liquidation data to gauge market sentiment and positioning. Large long liquidations often signal panic bottoms, while short liquidations may precede a squeeze.

Spikes in liquidations also help identify overcrowded trades and potential reversals. When paired with open interest and funding rate data, liquidation metrics can offer strategic entry or exit points, especially in overleveraged markets prone to sudden flushes or rallies.