Institutions Double Down on BTC & ETH as Retail FOMO Fuels Altcoin Frenzy: Wintermute Report

The crypto market's great divide is here—Wall Street plays it safe with blue-chip assets while Main Street gambles on moonshots.

Smart money stacks, degenerate money chases

Institutional portfolios are consolidating around Bitcoin and Ethereum like never before, according to Wintermute's latest analysis. Meanwhile, retail traders keep pumping low-cap alts—because nothing says 'financial literacy' like apeing into memecoins during macro uncertainty.

The new two-tiered crypto economy

While hedge funds quietly accumulate BTC through regulated vehicles, Telegram groups vibrate with '100x gem' shilling. This isn't just divergence—it's Darwinism playing out in real-time across order books.

One market, two radically different risk appetites. Guess which group will need therapy sessions when the next liquidation cascade hits?

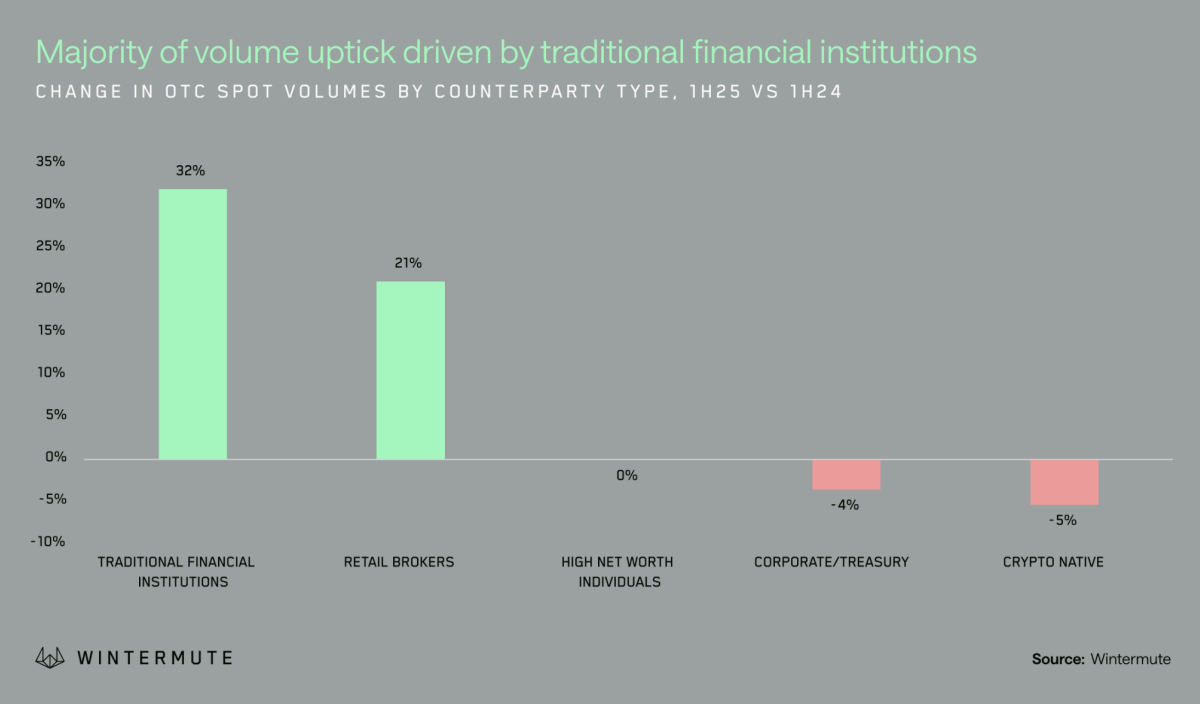

Overall, traditional finance (TradFi) firms were the fastest-growing cohort in OTC trading volumes, growing 32% year-over-year. That growth was being fueled by regulatory developments like the U.S. GENIUS Act and the EU’s ongoing MiCA rollout, which have given larger firms more confidence to participate, the report said.

Retail brokers also saw strong activity, with a 21% rise in volume over the same period. Meanwhile, crypto-native firms dialed back, down 5%.

OTC options volume jumped 412% compared to the first half of 2024, as institutions embraced derivatives for hedging and yield generation, the report noted. Meanwhile, Contracts for Difference (CFDs) doubled in variety, offering access to less liquid tokens in a more capital-efficient way.

Wintermute said its own OTC desk saw spot trading volumes grow at more than twice the pace of centralized exchanges, signaling a shift toward more discreet, large-volume trading favored by traditional finance.

The firm noted that memecoin activity has become more fragmented. While overall retail trading in memecoins declined, the number of tokens traded by individual users doubled, signaling a broadening appetite for micro-cap assets in the long tail of the market.

With that, legacy names like dogecoin DOGE and shiba inu SHIB lost ground to a growing list of niche tokens such as bonk BONK, dogwifhat WIF and popcat POPCAT, the report noted.

Looking ahead to the second half of 2025, Wintermute analysts said to keep an eye on spot Dogecoin ETF filings with spot with a final regulatory decision expected by October.

"The outcome could significantly impact the retail market and set a precedent for other alternative assets," the report said.