Wall Street’s Bitcoin Takeover: What’s Next for Crypto’s Rebel Heart?

Wall Street finally swallowed Bitcoin whole—now the real drama begins. The institutional embrace is complete, but crypto's soul hangs in the balance.

The Mainstream Squeeze

Goldman Sachs vaults, BlackRock ETFs, and JPMorgan's sudden love affair with blockchain—every suit wants a piece. Liquidity's up, volatility's down, and your anarchist nephew just lost his favorite talking point.

Price Tag vs. Principles

BTC's trading like a blue chip now, but at what cost? The very institutions Bitcoin was built to bypass now control its price action. Irony's dead—we killed it with leverage.

The Cynic's Corner

Watch Wall Street turn decentralization into their newest revenue stream. Coming soon: 'Blockchain-as-a-Service' with 2% management fees and a side of empty promises.

What's left for the true believers? Either adapt or start mining memecoins—the establishment won this round.

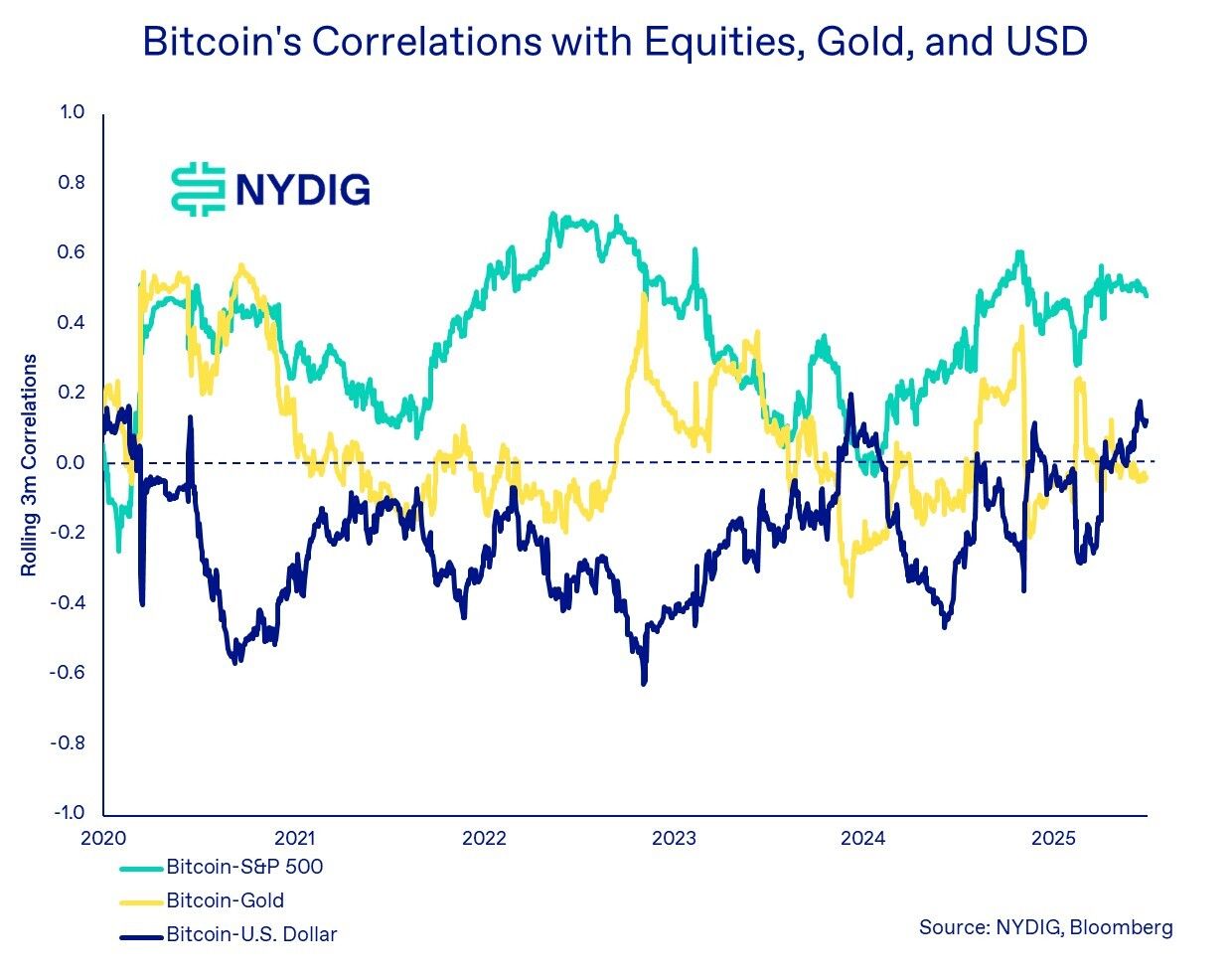

Simply put, when there is blood on the street (Wall Street that is), bitcoin bleeds too. When Wall Street sneezes, bitcoin catches a cold.

Even bitcoin's “digital gold” moniker is under pressure.

NYDIG notes that bitcoin’s correlation to physical Gold and the U.S. dollar is near zero. So much for the “hedge” argument—at least for now.

Risk asset

So why the shift?

The answer is simple: to Wall Street, bitcoin is just another risk asset, not digital gold, which is synonymous with "safe haven."

Investors are repricing everything from central bank policy whiplash to geopolitical tension—digital assets included.

"This persistent correlation strength with U.S. equities can largely be attributed to a series of macroeconomic and geopolitical developments, the tariff turmoil and the rising number of global conflicts, which significantly influenced investor sentiment and asset repricing across markets," said NYDIG.

And like it or not, this is here to stay—at least for a short to medium-term.

As long as central bank policy, macro, and war-linked red headlines hit the tape, bitcoin will likely move in tandem with equities.

"The current correlation regime may persist as long as global risk sentiment, central bank policy, and geopolitical flashpoints remain dominant market narratives," NYDIG's report said.

For the maxis and long-term holders, the original vision hasn't changed. Bitcoin's limited supply, borderless access, and decentralized nature remain untouched. Just don't expect them to impact price action just yet.

For now, the market sees bitcoin as just another stock ticker. Just balance your trade strategies accordingly.