Bitcoin Smashes $110K Ahead of Jobs Report – Crypto Markets Braced for Impact

Bitcoin's bull run defies gravity—again—as it punches through $110K resistance like Wall Street's spreadsheet jockeys predicted a 2% drop.

Jobs report looms: Will macro traders get rekt or ride the wave?

Meanwhile, crypto degens stack sats while traditional finance still tries to explain 'decentralization' to their golf buddies.

What to Watch

- Crypto

- July 15: Lynq is expected to launch its real-time, interest-bearing digital asset settlement network for institutions. Built on Avalanche’s layer-1 blockchain and powered by Arca’s tokenized U.S. Treasury fund shares, Lynq enables instant settlement, continuous yield accrual and improved capital efficiency.

- Macro

- July 3, 8:30 a.m.: The U.S. Bureau of Labor Statistics releases June employment data.

- Non Farm Payrolls Est. 110K vs. Prev. 139K

- Unemployment Rate Est. 4.3% vs. Prev. 4.2%

- Government Payrolls Prev. -1K

- Manufacturing Payrolls Est. -5K vs. Prev. -8K

- July 3, 8:30 a.m.: The U.S. Department of Labor releases unemployment insurance data for the week ended June 28.

- Initial Jobless Claims Est. 240K vs. Prev. 236K

- Continuing Jobless Claims Est. 1960K vs. Prev. 1974K

- July 3, 9 a.m.: S&P Global releases June Brazil data on manufacturing and services activity.

- Composite PMI Prev. 49.1

- Services PMI Prev. 49.6

- July 3, 9:45 a.m.: S&P Global releases (final) June U.S. data on manufacturing and services activity.

- Composite PMI Est. 52.8 vs. Prev. 53

- Services PMI Est. 53.1 vs. Prev. 53.7

- July 3, 10 a.m.: The Institute for Supply Management (ISM) releases June U.S. services sector data.

- Services PMI Est. 50.5 vs. Prev. 49.9

- July 4, 8 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases May producer price inflation data.

- PPI MoM Prev. -0.37%

- PPI YoY Prev. 7.27%

- July 4, 8 a.m.: Mexico’s National Institute of Statistics and Geography releases June consumer confidence data.

- Consumer Confidence Prev. 46.7

- July 4, 9:30 a.m.: S&P Global releases June Canada data on manufacturing and services activity.

- Composite PMI Prev. 45.5

- Services PMI Prev. 45.6

- July 9, 12:01 a.m. — Deadline for the European Union and other U.S. trading partners to finalize deals to avoid reinstatement of reciprocal tariffs on imports.

- July 9, 10 a.m.: U.S. Senate Banking Committee holds a hybrid hearing titled “From Wall Street to Web3: Building Tomorrow’s Digital Asset Markets” with CEOs of Blockchain Association, Chainalysis, Paradigm, and Ripple testifying. Livestream link.

- July 3, 8:30 a.m.: The U.S. Bureau of Labor Statistics releases June employment data.

- Earnings (Estimates based on FactSet data)

- None in the near future.

Token Events

- Governance votes & calls

- Arbitrum DAO is voting on lowering the constitutional quorum threshold from 5% to 4.5% of votable tokens. This aims to match decreased voter participation and help well-supported proposals pass more easily, without affecting non-constitutional proposals, which remain at a 3% quorum. Voting ends July 4.

- Compound DAO is voting on invoking the early termination clause of its 2025 security partnership with OpenZeppelin, giving the required 60-day notice and paving the way for a formal RFP process managed by the Compound Foundation on behalf of the DAO.Voting ends July 7.

- Polkadot Community is voting on launching a non-custodial Polkadot branded payment card to “to bridge the gap between digital assets in the Polkadot ecosystem and everyday spending.” Voting ends July 9.

- July 3, 11 a.m.: Zilliqa to host an Ask Me Anything (AMA) session.

- July 4, 10:30 a.m.: Moca Network to host a session on ‘What Makes Moca Chain Different?’ on Binance Live.

- Unlocks

- July 11: Immutable (IMX) to unlock 1.31% of its circulating supply worth $11.43 million.

- July 12: Aptos (APT) to unlock 1.76% of its circulating supply worth $54.63 million.

- July 15: Starknet (STRK) to unlock 3.79% of its circulating supply worth $15.59 million.

- July 15: Sei (SEI) to unlock 1% of its circulating supply worth $15.76 million.

- July 16: Arbitrum (ARB) to unlock 1.87% of its circulating supply worth $32.94 million.

- Token Launches

- July 3: Impossible Cloud Network Token (ICNT) to be listed on Binnace, Bybit, Bitget, Gate.io KuCoin, and others.

- July 4: Biswap (BSW), Stella (ALPHA), Komodo (KMD), LeverFi (LEVER), and LTO Network (LTO) to be delisted from Binance.

Conferences

The CoinDesk Policy & Regulation conference (formerly known as State of Crypto) is a one-day boutique event held in Washington on Sept. 10 that allows general counsels, compliance officers and regulatory executives to meet with public officials responsible for crypto legislation and regulatory oversight. Space is limited. Use code CDB10 for 10% off your registration through July 17.

- Day 4 of 4: Ethereum Community Conference (Cannes, France)

- Day 4 of 6: World Venture Forum 2025 (Kitzbühel, Austria)

- Day 3 of 6: Bitcoin Alaska (Juneau, Alaska)

- July 4-5: The Bitcoin Paradigm 2025 (Neuchâtel, Switzerland)

- July 4–6: ETHGlobal Cannes (Cannes, France)

- July 10-13: Mallorca Blockchain Days (Palma, Spain)

- July 16: Invest Web3 Forum (Dubai)

- July 20: Crypto Coin Day 7/20 (Atlanta)

- July 24: Decasonic’s Web3 Investor Day 2025 (Chicago)

- July 25: Blockchain Summit Global (Montevideo, Uruguay)

- July 28-29: TWS Conference 2025 (Singapore)

Token Talk

By Oliver Knight

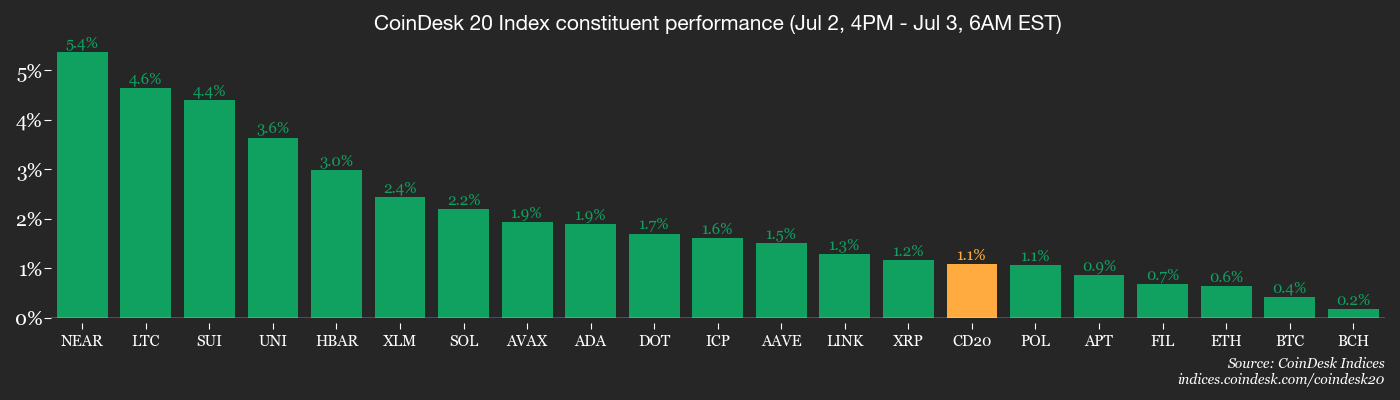

- AI-focused NEAR token is trading at $2.36 having risen by 16.5% since July 1.

- The rally accelerated Wednesday following an announcement from fund manager Bitwise, which is rolling out a NEAR exchange-traded product (ETP) for institutional investors in Europe.

- Daily trading volume doubled over the past 24 hours, hitting $213 million as traders attempt to ride the coattails of NEAR's recent positive shift in sentiment.

- “The NEAR Staking ETP on Xetra opens a new bridge to NEAR for institutions by providing a regulated, exchange-traded way to earn staking rewards," Near Protocol CEO Illia Polosukhin told CoinDesk.

- NEAR's move also reflects broader altcoin market strength, with the CoinDesk DeFi Select Index rising by 7.74% in the past 24 hours and CoinDesk's memecoin index is up by 13.2% in the same period.

- Memecoins BONK and WIF are leading the pack, up 21% and 15% respectively on Thursday.

Derivatives Positioning

- DOGE, LTC, XMR have seen the biggest increases in open interest in perpetuals listed on offshore exchanges. BTC, XRP perpetual futures open interest has jumped over 5% in 24 hours, validating the spot price rise.

- TRX and BCH continue to see a bias for shorts, as evidenced by the negative funding rates. Meanwhile, funding rates for XMR have surged to an annualized 40%, signifying potential overcrowding of long positions.

- Block option flows on Deribit featured bull put spreads in BTC — a net credit strategy that profits from price rise or consolidation.

- In ETH's case, a $2,800 call expiring on July 25 was lifted while someone sold a call at $3,400.

Market Movements

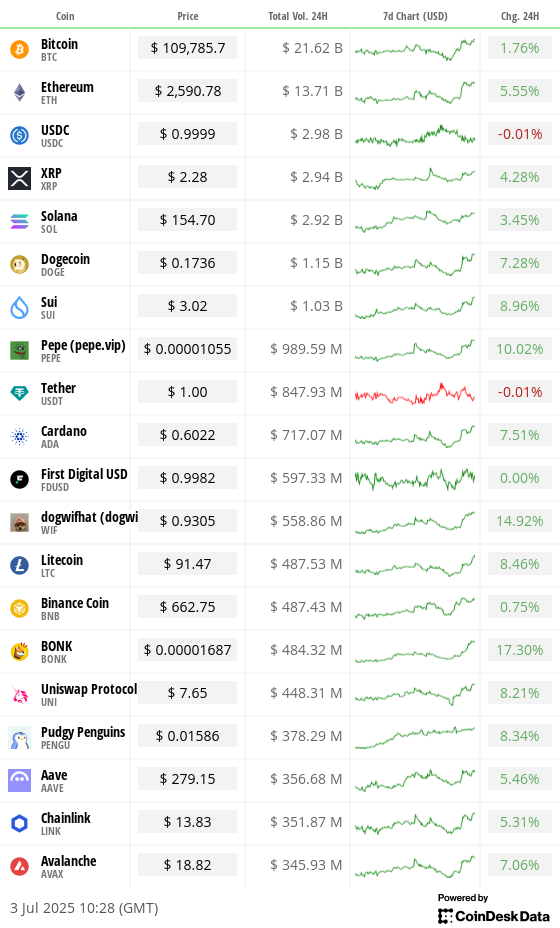

- BTC is up 0.72% from 4 p.m. ET Wednesday at $109,970.87 (24hrs: +1.75%)

- ETH is up 0.33% at $2,599.77 (24hrs: +5.63%)

- CoinDesk 20 is up 1.51% at 3,149.61 (24hrs: +4.23%)

- Ether CESR Composite Staking Rate is down 2 bps at 2.98%

- BTC funding rate is at 0.0049% (5.3217% annualized) on Binance

- DXY is up 0.05% at 96.83

- Gold futures are unchanged at $3,356.90

- Silver futures are up 0.81% at $37.03

- Nikkei 225 closed unchanged at 39,785.90

- Hang Seng closed down 0.63% at 24,069.94

- FTSE is up 0.34% at 8,804.35

- Euro Stoxx 50 is down 0.26% at 5,305.14

- DJIA closed on Wednesday down 0.02% at 44,484.42

- S&P 500 closed up 0.47% at 6,227.42

- Nasdaq Composite closed up 0.94% at 20,393.13

- S&P/TSX Composite closed unchanged at 26,869.66

- S&P 40 Latin America closed up 0.99% at 2,727.94

- U.S. 10-Year Treasury rate is down 2.8 bps at 4.265%

- E-mini S&P 500 futures are unchanged at 6,273.75

- E-mini Nasdaq-100 futures are unchanged at 22,838.25

- E-mini Dow Jones Industrial Average Index are unchanged at 44,798.00

Bitcoin Stats

- BTC Dominance: 65.21% (-0.09%)

- Ether to bitcoin ratio: 0.02362 (unchanged)

- Hashrate (seven-day moving average): 872 EH/s

- Hashprice (spot): $59.65

- Total Fees: 4.48 BTC / $483,647

- CME Futures Open Interest: 151,540 BTC

- BTC priced in gold: 32.7 oz

- BTC vs gold market cap: 9.27%

Technical Analysis

- The chart shows daily changes in the cumulative open interest in BTC perpetuals listed on major exchanges.

- Open interest in BTC terms has broken out of a descending channel, indicating renewed demand for leveraged bets.

- The breakout comes as the spot price rises above $110K, suggesting a bias for bullish plays.

Crypto Equities

- Strategy (MSTR): closed on Wednesday at $402.28 (+7.76%), -4.83% at $382.85 in pre-market

- Coinbase Global (COIN): closed at $354.45 (+5.7%), -3.8% at $340.99

- Circle (CRCL): closed at $177.97 (-7.56%), +5.91% at $188.49

- Galaxy Digital (GLXY): closed at $22.22 (+4.27%), -2.07% at $21.76

- MARA Holdings (MARA): closed at $17.80 (+13.38%), -10.28% at $15.97

- Riot Platforms (RIOT): closed at $12.20 (+8.25%), -5.33% at 11.55

- Core Scientific (CORZ): closed at $17.56 (+1.8%), -2.11% at $17.19

- CleanSpark (CLSK): closed at $12.48 (+12.64%), -8.65% at $11.40

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $25.15 (+8.92%), -7.24% at $23.33

- Semler Scientific (SMLR): closed at $39.54 (+11.63%), -8.19% at $36.30

- Exodus Movement (EXOD): closed at $29.44 (+1.52%), -0.65% at $29.25

ETF Flows

- Daily net flows: $407.8 million

- Cumulative net flows: $49.02 billion

- Total BTC holdings ~1.25 million

- Daily net flows: -$1.9 million

- Cumulative net flows: $4.27 billion

- Total ETH holdings ~4.13 million

Source: Farside Investors

Overnight Flows

Chart of the Day

- The Polymarket-listed betting contract "June jobs report prints negative?" indicates that traders perceive an 11% chance that Thursday's nonfarm payrolls report will reveal job losses in June.

- In other words, the bar of negative expectations has been set low and the market may react violently if the data does show job losses.

- Weaker labor market data will likely strengthen the chance of Fed rate cuts, breeding bullish bitcoin volatility.

While You Were Sleeping

- Trump’s Megabill Advances in the House After GOP Divisions Nearly Derail It (CNBC): Despite internal GOP divisions over Medicaid cuts and a higher debt ceiling, House Republicans passed a procedural vote 219-213 early Thursday, clearing the way for debate ahead of a final vote.

- A Major Currency Outpaces Bitcoin With More Possible Momentum Ahead: Macro Markets (CoinDesk): As U.S. fiscal fears mount and ECB rate cuts near their end, the euro’s surprising rally is forcing global investors to rethink their dollar bets.

- Pakistan Pitches Nobel, Crypto and Rare Earths to Woo Donald Trump (Financial Times): To secure a favorable trade deal, Pakistan is pledging to build a strategic bitcoin reserve, allocate 2,000 MW to crypto mining and partner with Trump-affiliated crypto firms like World Liberty Financial.

- Trump Trade War Fuels Use of Currency Options as Hedge in Europe (Bloomberg): Following Trump’s “Liberation Day” tariffs, daily FX option volumes hit record highs in April, with BNP Paribas reporting a 2x jump in 2025 sales as European firms favored options over forwards.

- Russia Poses Growing Military Threat to NATO Members, Italy Says (Reuters): Italy’s defense minister warned Russia could pose a military threat to NATO within five years and added Russian public support for the Ukraine war remains strong despite one million troop losses.

- Swiss Bank AMINA Introduces Custody, Trading With Ripple’s RLUSD Stablecoin (CoinDesk): The bank said it would start with providing custody and trading for RLUSD for institutional clients and professional investors, with plans to expand services in the coming months.

In the Ether