Bitcoin CME Futures Premium Craters—Are Big Money Players Losing Faith?

Wall Street's crypto love affair hits a snag as Bitcoin's CME futures premium tanks.

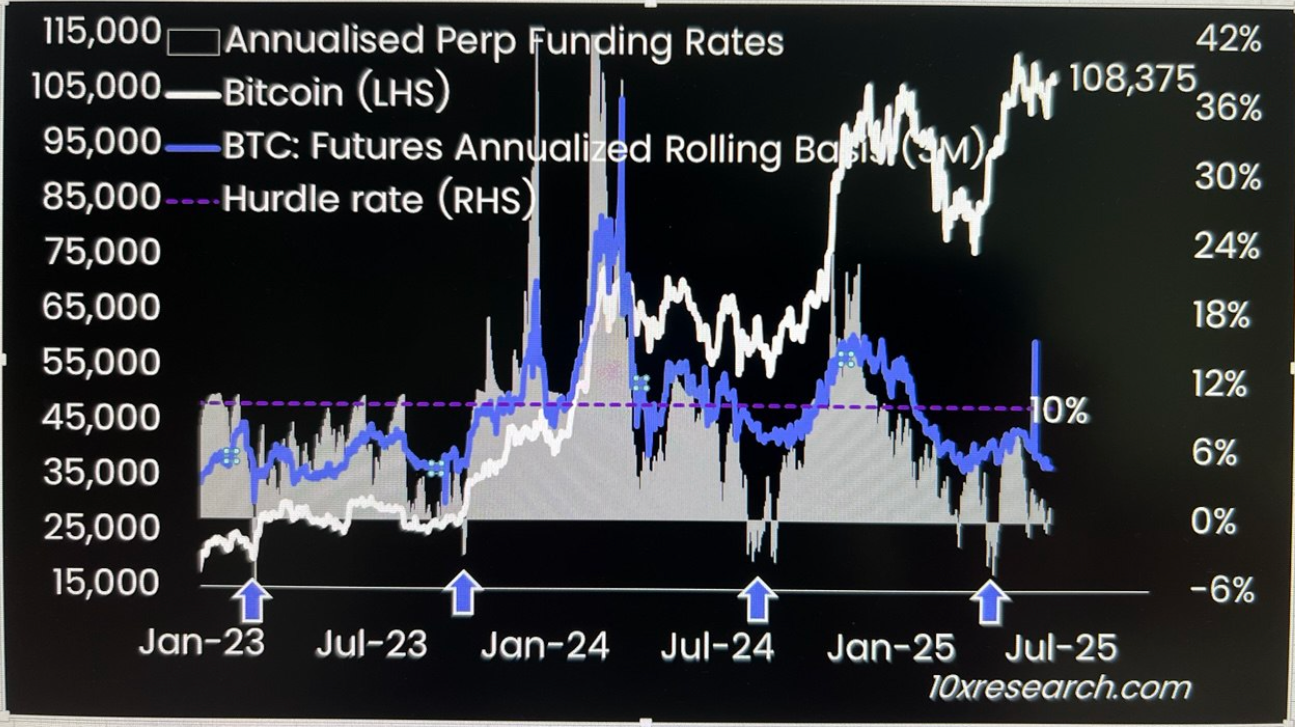

Institutional chill? The premium—a key gauge of professional investor demand—has slipped to multi-month lows, signaling fading enthusiasm from the suits.

Behind the numbers: When CME contracts trade at lower premiums than spot prices, it suggests hedge funds and ETFs might be tapping the brakes. No panic yet, but the smart money's getting pickier.

The irony? This comes just as retail FOMO starts heating up again. Classic case of Wall Street selling the shovels while Main Street buys the dream.

Bottom line: Bitcoin's institutional narrative faces its first real stress test since the last bull run. Either the big players reload—or we'll see who's really hodling when the leverage unwinds.

Thielen added that the drop-off coincides with muted retail participation, as indicated by depressed perpetual funding rates and low spot market volumes.

Padalan Capital voiced a similar opinion in a weekly update, calling the decline in funding rates a sign of retrenchment in speculative interest.

"A more acute signal of risk-off positioning comes from regulated venues, where the CME-to-spot basis for both Bitcoin and ethereum has inverted into deeply negative territory, indicating aggressive institutional hedging or a substantial unwind of cash-and-carry structures.," Padalan Capital noted.