Litecoin Miners Go on Buying Frenzy—Is a Major Rally Imminent?

Litecoin miners are hoarding LTC at levels not seen since the 2023 bull run—and the market's taking notice.

Why the sudden accumulation spree?

Miners typically sell to cover operational costs. When they hold instead, it signals either extreme bullishness... or insider knowledge of upcoming network upgrades. With Litecoin's MWEB privacy feature gaining traction and institutional interest creeping in, both scenarios look plausible.

The cynical take: Wall Street still thinks 'digital silver' is a joke—right until their clients start demanding exposure.

One thing's certain: When miners bet big on their own coin, retail traders should pay attention. The last time this happened, LTC ripped 300% in 90 days.

Litecoin Miner Reserve Has Gone Up During The Last Year

In a new post on X, Litecoin Foundation has shared how the balance of the Litecoin miners has changed during the past year. The indicator of relevance here is the Miner Reserves from the institutional DeFi solutions provider Sentora (formerly IntoTheBlock).

The Miner Reserves metric measures the total amount of LTC that’s sitting in the wallets associated with the large mining pools. These holdings may include not just the amount that the validators have been receiving as mining rewards, but also the tokens that they have acquired through purchases.

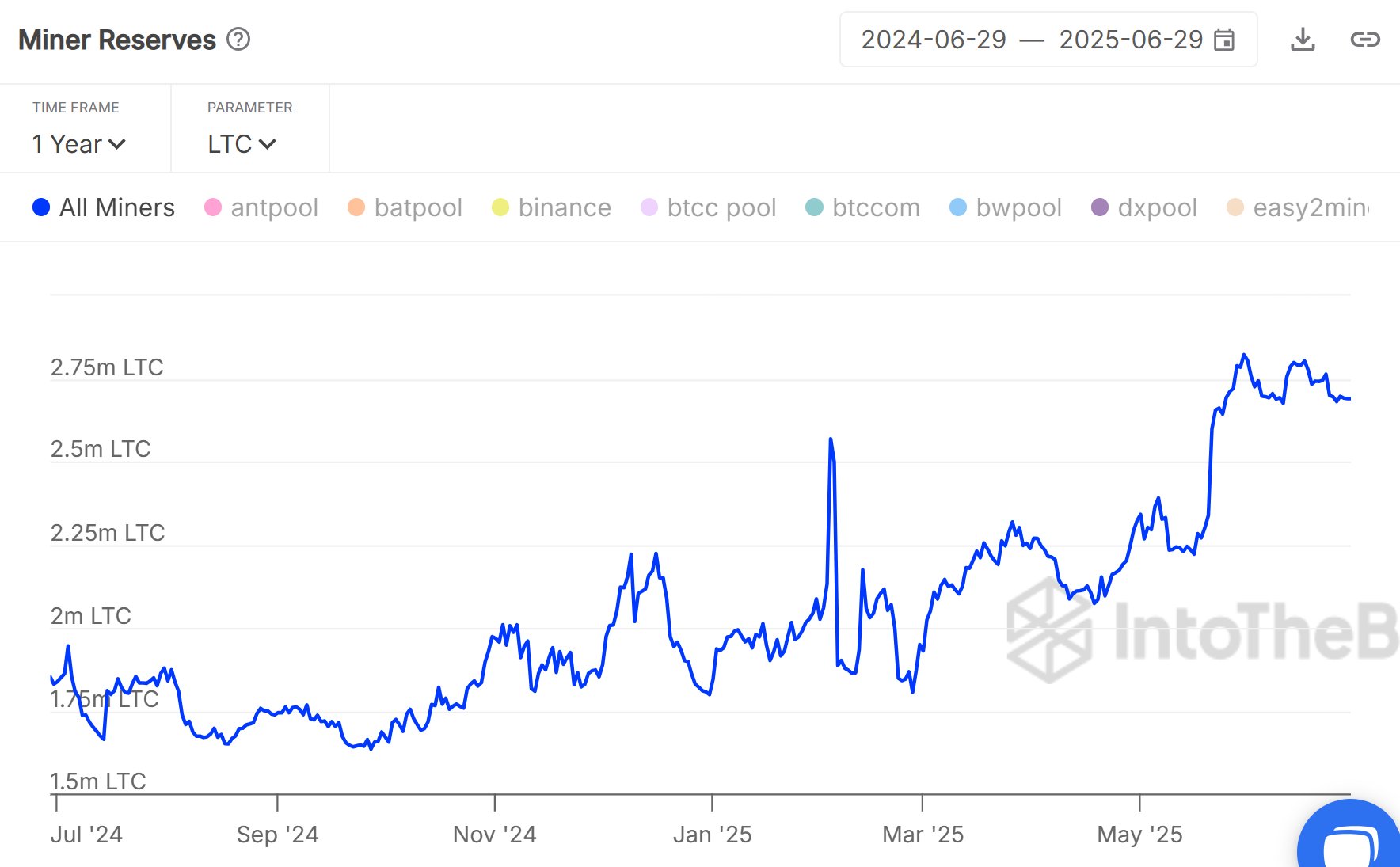

Now, here is a chart that shows the trend in the Miner Reserves for Litecoin over the past year:

As displayed in the above graph, the Litecoin Miner Reserves indicator has followed an upwards trajectory over the last twelve months, a sign that miners have been adding to their holdings.

Miners are entities that have constant running costs in the FORM of electricity bills, so it’s not unusual for them to participate in some selling in order to pay them off. Interestingly, however, the large mining pools have been willing to accumulate LTC lately.

Another metric that helps gauge the sentiment among the network validators is the Hashrate, which measures the total amount of computing power that they have attached to the blockchain.

Below is a chart from CoinWarz that shows the trend in this indicator for Litecoin.

From the graph, it’s apparent that the Litecoin Hashrate has also gone up over the past year, implying miners have been adding more power to the network. Though, the timing of their expansions hasn’t exactly matched their accumulation spree.

Nonetheless, it remains true that both trends point to a bullish sentiment among the chain validators. It only remains to be seen, however, whether the conviction WOULD pay off.

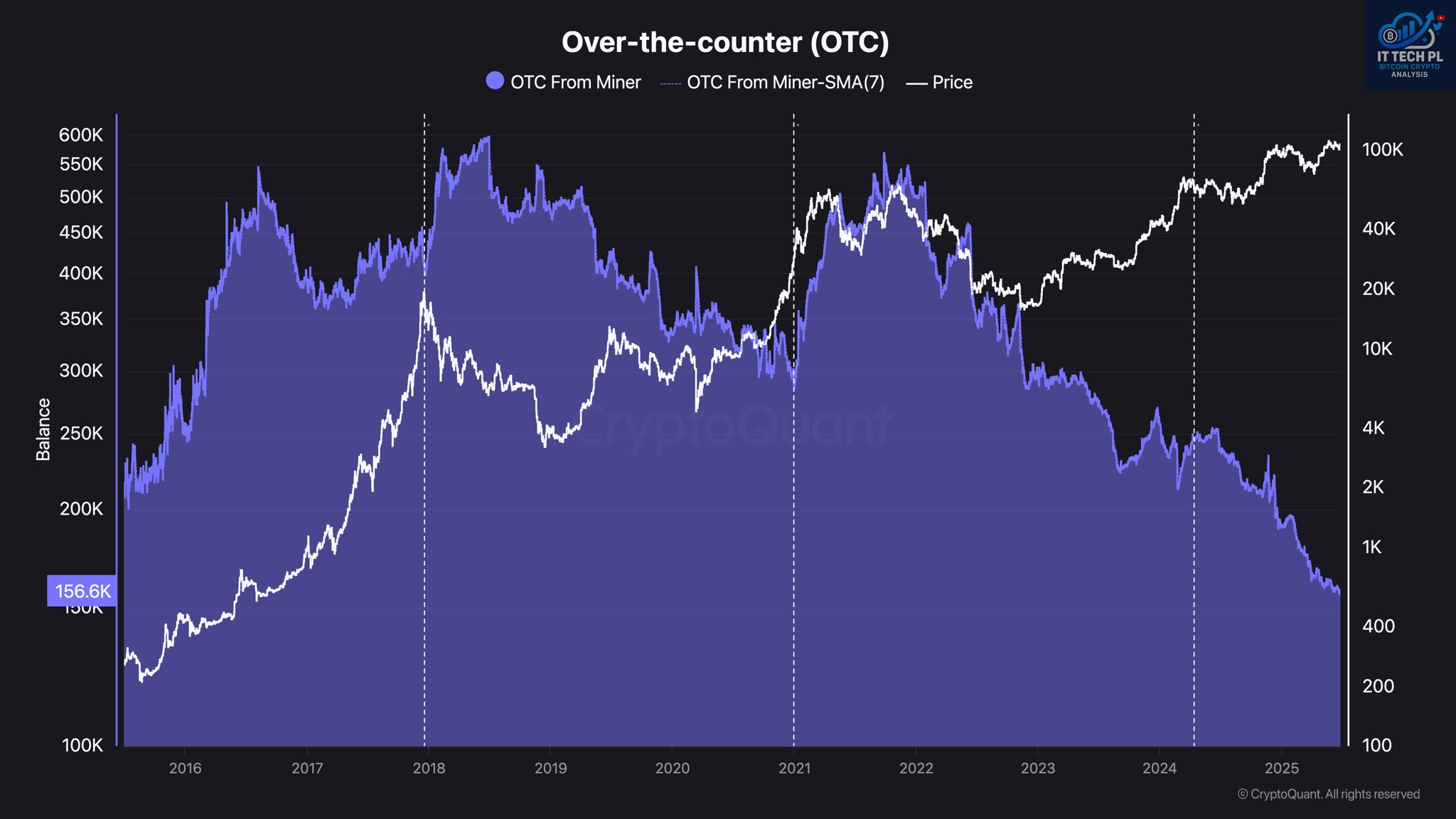

In some other news, Bitcoin miners may also be dropping their sell-side pressure, as CryptoQuant author IT Tech has pointed out in an X post.

The above chart shows the data related to the balance of the over-the-counter (OTC) desks used by bitcoin miners. Clearly, the metric has recently registered a significant decline. “This suggests limited miner liquidity available for institutional block deals, often a precursor to supply-side constraints,” notes the analyst.

LTC Price

At the time of writing, Litecoin is floating around $84, down over 2% in the last 24 hours.