Bitcoin Stalls Below $110K as Altcoins Steal the Spotlight—QCP Warns of Looming Squeeze

Bitcoin''s grinding sideways action below $110K has traders eyeing altcoins for bigger moves—because who needs volatility when you''ve got hopium? QCP Capital flags a ''tight range'' ahead, but let''s be real: Wall Street''s still trying to figure out how to short it without getting rekt.

Meanwhile, ETH and friends keep outpacing BTC. Classic crypto rotation play—until the next leverage flush sends everyone back to ''safe'' assets. Pro tip: That ''range'' could snap faster than a overleveraged degen''s stop-loss.

Token Events

- Governance votes & calls

- ApeCoin DAO is weighing scrapping the decentralized autonomous organization and launching ApeCo to “supercharge the APE ecosystem.”

- Optimism DAO is voting to approve eligibility criteria for the Milestones and Metrics (M&M) Council in Seasons 8 and 9, introducing a model where members are selected “based on competencies rather than elections.” Voting ends June 11.

- June 10, 10 a.m.: Ether.fi to host an analyst call followed by a Q&A session.

- June 11, 7 a.m.: Cronos Labs lead Mirko Zhao to participate in a community Ask Me Anything (AMA) session.

- Unlocks

- June 12: Aptos (APT) to unlock 1.79% of its circulating supply worth $53.61 million.

- June 13: Immutable (IMX) to unlock 1.33% of its circulating supply worth $12.82 million.

- June 15: Starknet (STRK) to unlock 3.79% of its circulating supply worth $16.90 million.

- June 15: Sei (SEI) to unlock 1.04% of its circulating supply worth $10.59 million.

- June 16: Arbitrum (ARB) to unlock 1.91% of its circulating supply worth $32.21 million.

- June 17: ZKsync (ZK) to unlock 20.91% of its circulating supply worth $41.25 million.

- June 17: ApeCoin (APE) to unlock 1.95% of its circulating supply worth $10.88 million.

- Token Launches

- June 16: Advised deadline to unstake stMATIC as part of Lido on Polygon’s sunsetting process ends

- June 26: Coinbase to delist Helium Mobile (MOBILE), Render (RNDR), Ribbon Finance (RBN) and Synapse (SYN).

Conferences

The CoinDesk Policy & Regulation conference (formerly known as State of Crypto) is a one-day boutique event held in Washington on Sept. 10 that allows general counsels, compliance officers and regulatory executives to meet with public officials responsible for crypto legislation and regulatory oversight.

- June 14: Incrypted Crypto Conference 2025 (Kyiv)

- June 18-19: Canadian Blockchain Consortium’s 2nd Annual Policy Summit (Ottawa)

- June 19-21: BTC Prague 2025

- June 25-26: Bitcoin Policy Institute’s Bitcoin Policy Summit 2025 (Washington)

- June 26: The Injective Summit (New York)

- June 26-27: Istanbul Blockchain Week

- June 30 to July 3: Ethereum Community Conference (Cannes, France)

Token Talk

By Oliver Knight

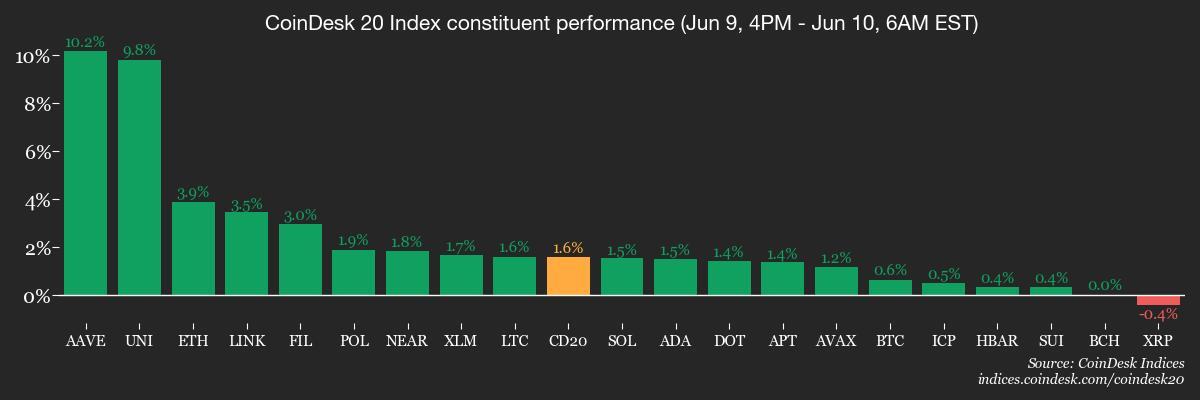

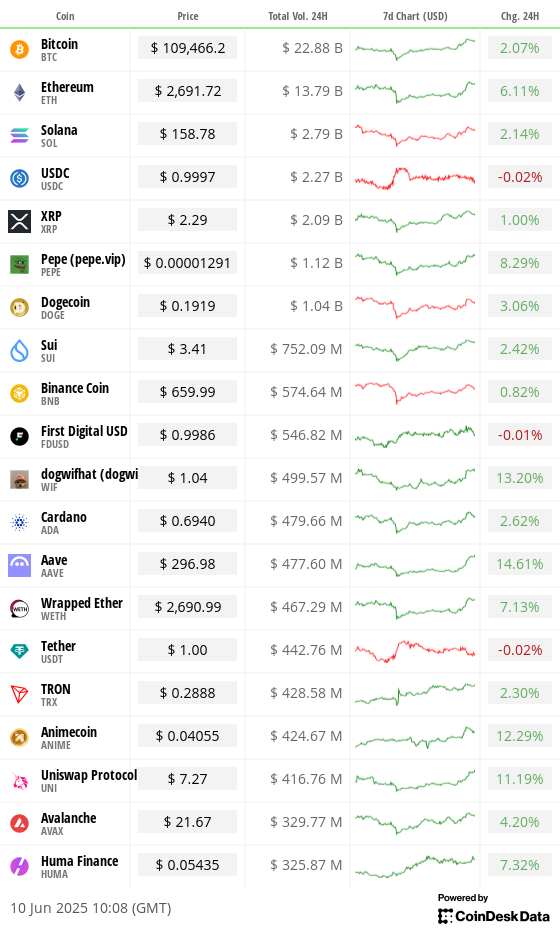

- The SEC announced special exemptions for DeFi projects on Monday, prompting the tokens of of aave (AAVE) and uniswap (UNI) to jump by around 16%.

- Ether (ETH), meanwhile, increased by 7.3% as daily trading volume more than doubled to $26.5 billion.

- A breakout for ETH above the $2,650 level of resistance would open a path towards $4,000, where it briefly traded in December before surrendering those gains in February.

- CoinMarketCap''s altcoin season index has ticked up from 18 to 29 out of a maximum 100 since the turn of the month, suggesting that traders are focusing on the altcoin market instead of bitcoion, even though BTC was dominant throughout the recent cycle.

- Bitcoin has risen by 32% since March, but has been outperformed by a large portion of altcoins including HYPE, SUI and ETH, which are up between 42% and 200% respectively over the same period.

Derivatives Positioning

- Bitcoin options open interest (OI) rose to a June high of $44.33B, led by Deribit at $35.24B, followed by CME ($3.5B) and OKX ($3.24B), according to Coinglass data.

- The BTC options-to-futures OI ratio stood at 57.6%, reflecting strong demand for optionality relative to directional exposure.

- Traders continue to lean bullish with a put/call ratio of 0.57 on Deribit.

- The 140K strike leads in notional terms with $1.79B, while the 27 June expiry dominates the curve with $13.7B in total notional value. The top traded instruments include 120K and 150K calls expiring June and August.

- Futures open interest momentum remains positive across BTC, AXL and altcoins.

- AXL’s OI has surged over 800% in the past 24 hours, Velo data shows.

- BTC funding rates on Deribit reached 36.1% APR, with similarly elevated levels on Hyperliquid (27.5%) and Bybit (11%), highlighting persistent long-side demand.

- On Binance, liquidation leverage rose sharply to $129.3M near the $106.6K price level, reflecting a cluster of open interest that could be wiped out if prices pull back to that zone, according to Coinglass.

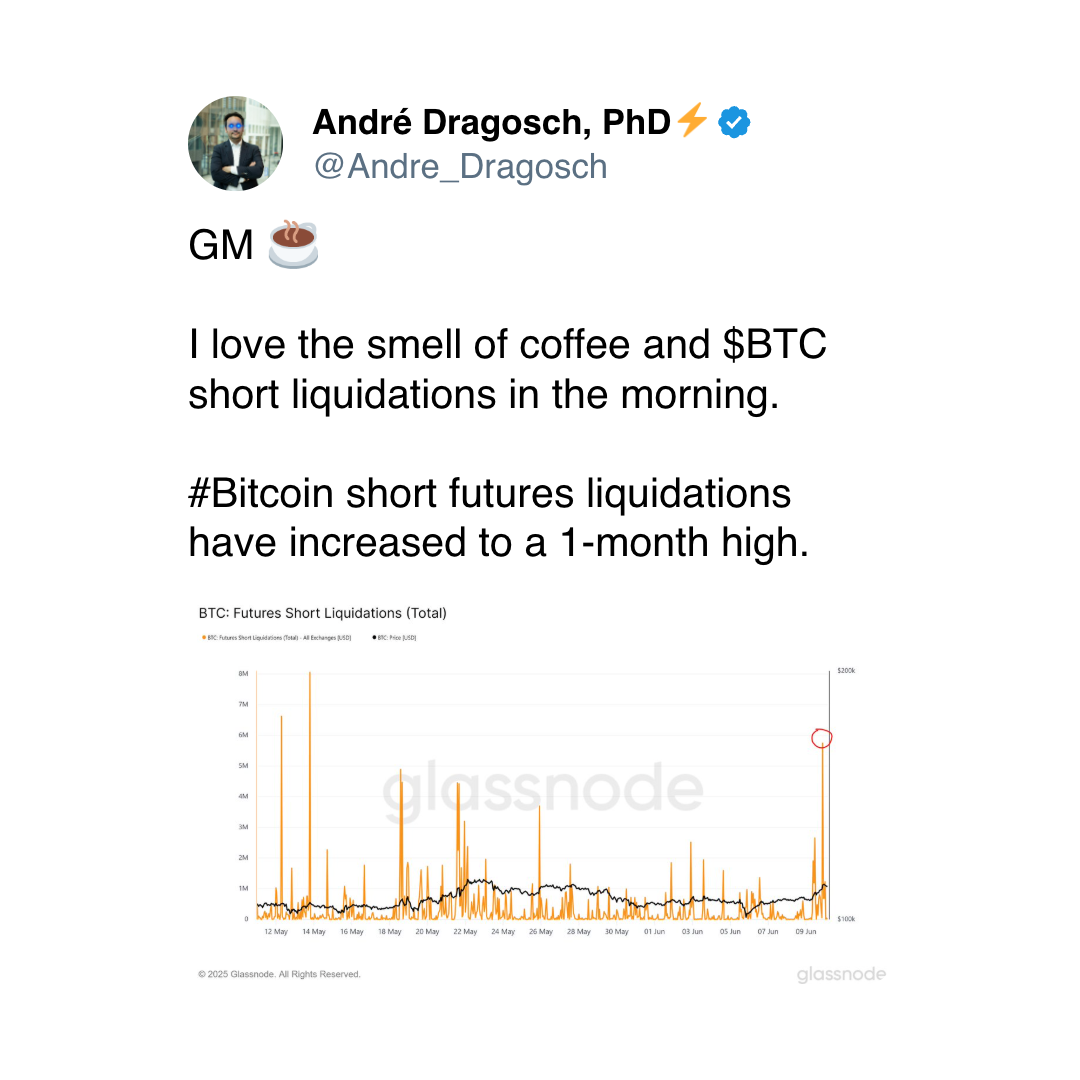

- Over the past 24 hours, actual BTC liquidations totalled $170.74M, dominated by short liquidations of $160.93M, signaling aggressive forced buying as the price surged through key levels.

Market Movements

- BTC is up 0.71% from 4 p.m. ET Monday at $109,535.95 (24hrs: +2.14%)

- ETH is up 3.92% at $2,692.82 (24hrs: +6.18%)

- CoinDesk 20 is up 1.52% at 3,210.97 (24hrs: +3.21%)

- Ether CESR Composite Staking Rate is up 14 bps at 3.08%

- BTC funding rate is at 0.01% (10.95% annualized) on Binance

- DXY is up 0.21% at 99.15

- Gold futures are down 0.13% at $3,350.60

- Silver futures are down 0.44% at $36.63

- Nikkei 225 closed up 0.32% at 38,211.51

- Hang Seng closed unchanged at 24,162.87

- FTSE is up 0.32% at 8,860.46

- Euro Stoxx 50 is down 0.32% at 5,404.14

- DJIA closed on Monday unchanged at 42,761.76

- S&P 500 closed unchanged at 6,005.88

- Nasdaq Composite closed up 0.31% at 19,591.24

- S&P/TSX Composite closed down 0.20% at 26,375.80

- S&P 40 Latin America closed down 0.38% at 2,574.85

- U.S. 10-Year Treasury rate is down 3 bps at 4.45%

- E-mini S&P 500 futures are unchanged at 6,006.50

- E-mini Nasdaq-100 futures are unchanged at 21,805.50

- E-mini Dow Jones Industrial Average Index are down 0.16% at 42,728.00

Bitcoin Stats

- BTC Dominance: 64.53 (-0.18%)

- Ethereum to bitcoin ratio: 0.02445 (+0.99%)

- Hashrate (seven-day moving average): 878 EH/s

- Hashprice (spot): $54.72

- Total Fees: 5.00 BTC / $535,990

- CME Futures Open Interest: 151,915

- BTC priced in gold: 32.7 oz

- BTC vs gold market cap: 9.27%

Technical Analysis

- After trading into the weekly orderblock, Solana has reclaimed the 50-day exponential moving average and 100-day EMA on the daily time frame.

- The price is currently capped by the 50-day measure on the weekly time frame. A decisive break and hold above this level could open the door for a move back toward the prior range highs between $170 and $180.

- In the event of a pullback, bulls will want to see a higher low form, with the weekly order block continuing to hold as a strong support zone.

Crypto Equities

- Strategy (MSTR): closed on Monday at $392.12 (+4.71%), +0.64% at $394.61 in pre-market

- Coinbase Global (COIN): closed at $256.63 (+2.13%), +0.34% at $257.49

- Circle (CRCL): closed at $115.25 (+7.01%), +3.44% at $119.27

- Galaxy Digital Holdings (GLXY): closed at C$28.58 (+4.31%)

- MARA Holdings (MARA): closed at $16.27 (+3.11%), unchanged in pre-market

- Riot Platforms (RIOT): closed at $10.12 (+2.74%), +0.3% at $10.15

- Core Scientific (CORZ): closed at $12.71 (+4.27%), +1.57% at $12.91

- CleanSpark (CLSK): closed at $10.12 (+3.37%), +0.2% at $10.14

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $20.16 (+3.01%)

- Semler Scientific (SMLR): closed at $33.99 (+3.06%)

- Exodus Movement (EXOD): closed at $29.01 (+0.52%), +0.24% at $29.08

ETF Flows

- Daily net flows: $386.2 million

- Cumulative net flows: $44.61 billion

- Total BTC holdings ~1.2 million

- Daily net flows: $52.7 million

- Cumulative net flows: $3.4 billion

- Total ETH holdings ~3.79 million

Source: Farside Investors

Overnight Flows

Chart of the Day

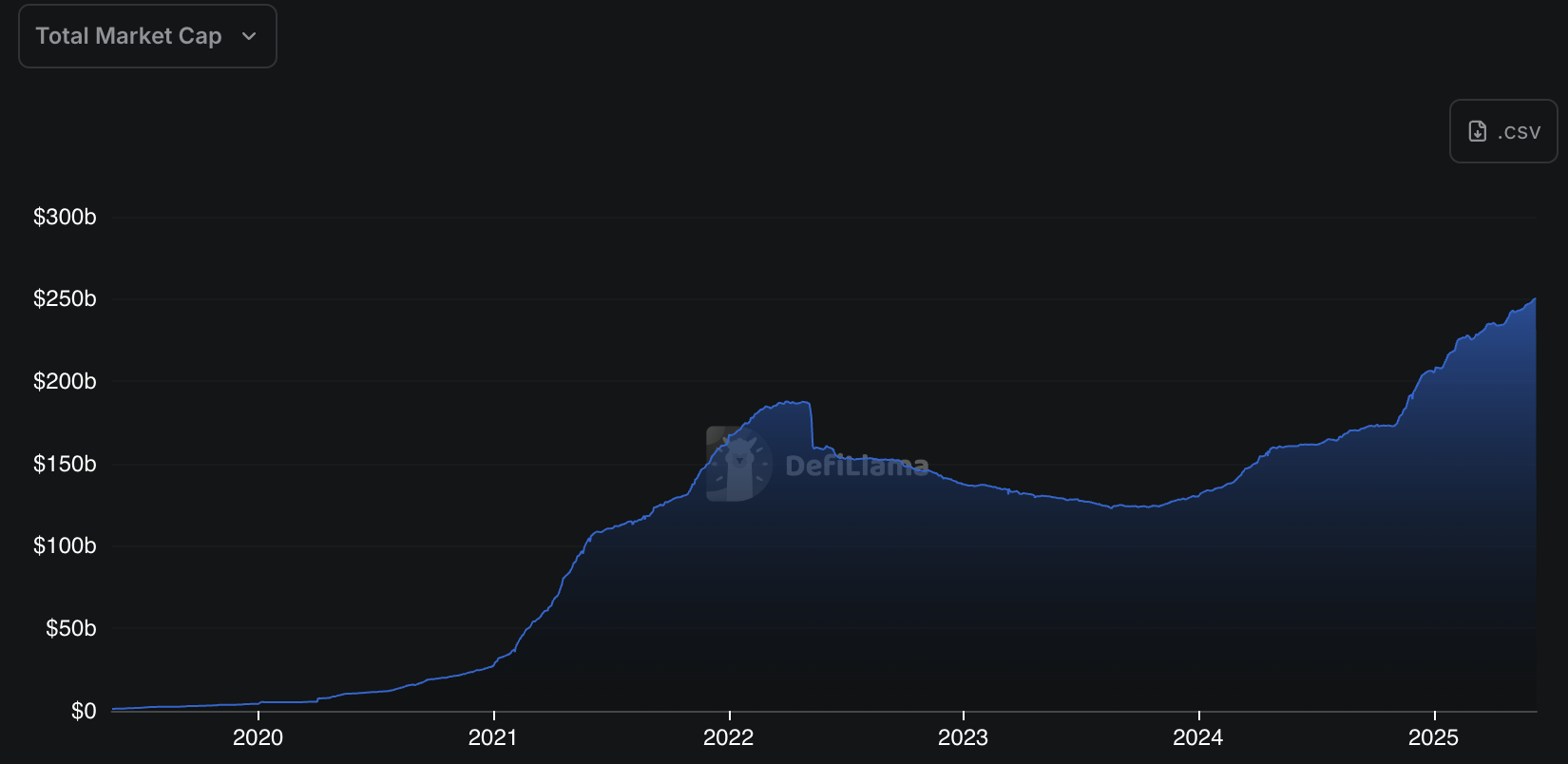

- The total stablecoins market cap surpasses $250 billion for the first time.

While You Were Sleeping

- South Korea’s Ruling Party Unveils Plan to Allow Stablecoins (Bloomberg): The proposed Digital Asset Basic Act lets local firms meeting a minimum equity threshold issue reserve-backed stablecoins, reviving central bank concerns that non-bank issuers could undermine monetary policy.

- SocGen’s Crypto Arm Unveils Dollar Stablecoin on Ethereum and Solana (CoinDesk): SocGen said it became the first global bank to issue a public U.S. dollar stablecoin. USD CoinVertible (USDCV) begins trading in July with BNY Mellon as custodian but excludes “U.S. persons.”

- Riot Sells $1.58M of Bitfarms Shares as Part of Investment Review (CoinDesk): As part of a continuing review of its investment in Bitfarms, Riot sold 1.75 million shares on June 9 at $0.90 each, lowering its stake to 14.3%.

- Trump Administration More Than Doubles Federal Deployments to Los Angeles (The New York Times): The Pentagon’s deployment of 700 Marines raised troop levels in Los Angeles to 4,700, as Trump backed a federal official’s threat to arrest California’s governor for mishandling the deportation protests.

- Price Wars Grip China as Deflation Deepens, $30 for a Luxury Coach Bag? (Reuters): Industrial overcapacity, real estate losses and wage cuts are fueling deflation in China, driving luxury consumers to steep discounts in a booming second-hand market now gripped by price wars.

- UK Will Launch Market for Private Share Sales Later This Year (Bloomberg): The Financial Conduct Authority will pilot a five-year private share market with looser disclosure rules and restricted access, responding to rising demand from firms and investors stalled by delayed IPOs.

In the Ether