Monero Traders Double Down: Futures Open Interest Spikes as Price Plummets $100 in 72 Hours

Privacy coin takes a nosedive—but the smart money might see blood in the water.

While retail panics, derivatives traders pile into XMR contracts. Classic Wall Street playbook: buy when there’s fear, sell when there’s greed. Except here, the suits are replaced by pseudonymous whales.

Three-day freefall meets surging open interest. Either this is the dumbest contrarian bet since someone bought Lehman Brothers stock in 2008... or the market knows something we don’t.

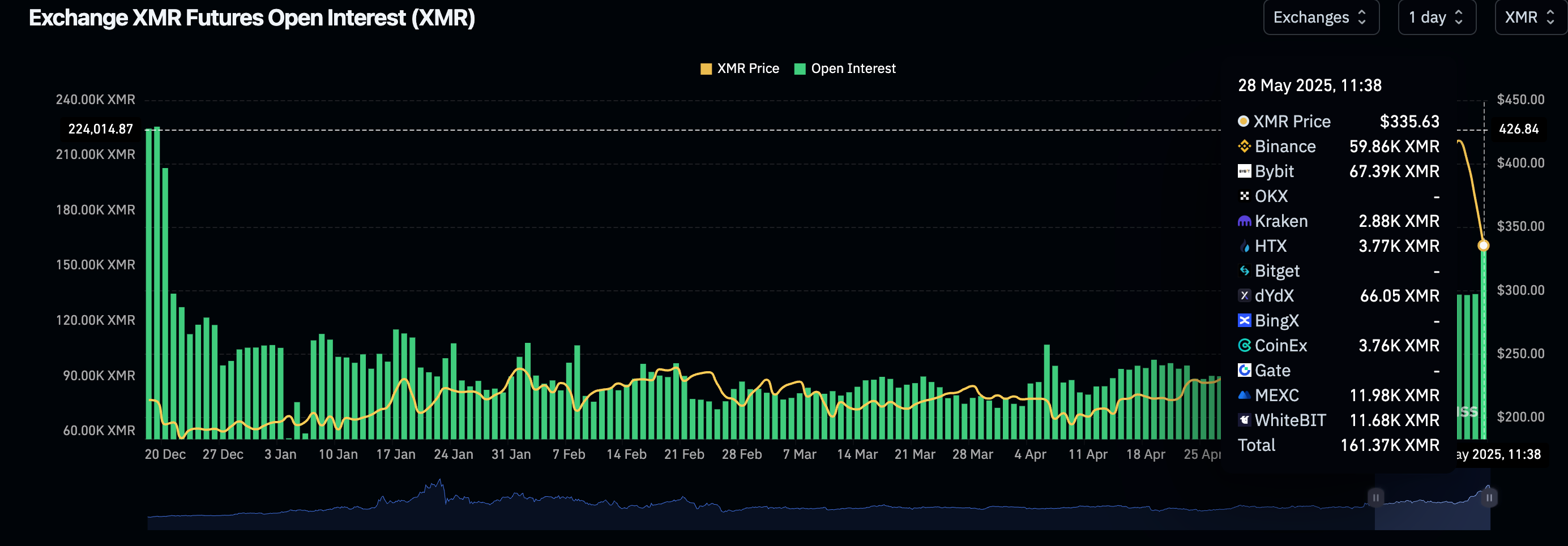

An increase in open interest alongside a price drop is typically interpreted as representing a bearish sentiment, with more traders taking short positions in anticipation of a price decline.

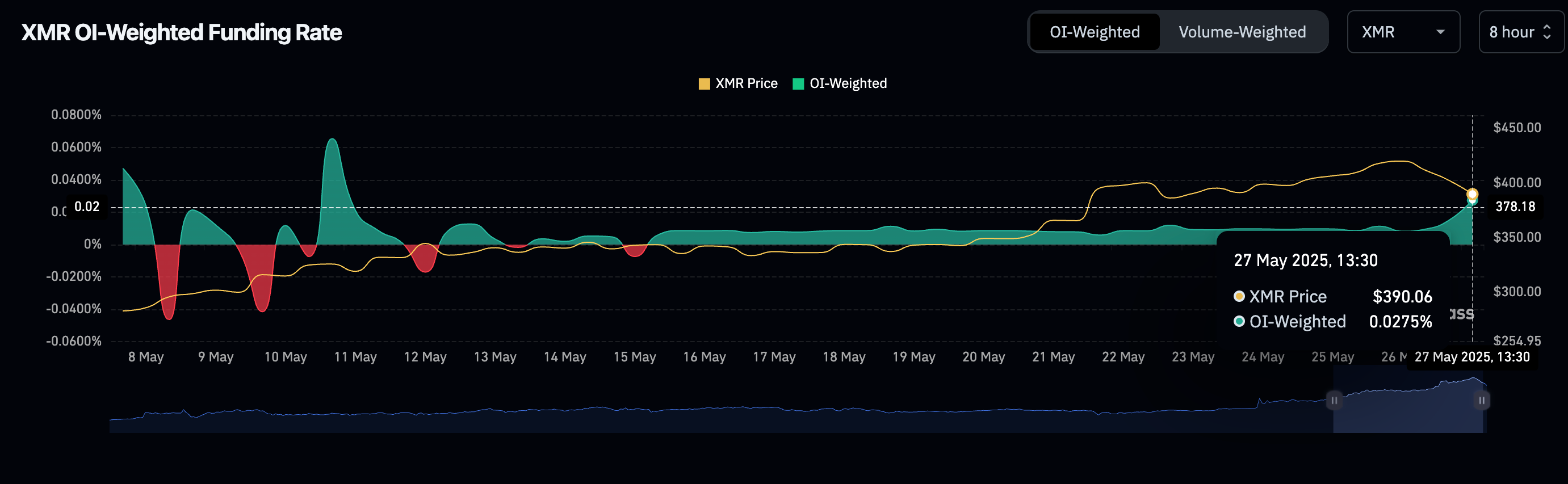

Funding rates hold positiveThat’s not necessarily the case with XMR, as the perpetual funding rates continue to be positive, indicating a bias for long positions. Funding rates, charged every eight hours, represent the cost of holding levered futures bets, with positive values representing a dominance of bullish long bets.

Therefore, the uptick in XMR’s open interest likely represents a "buy the dip" mentality – traders taking long positions on the price dip, anticipating a quick recovery.