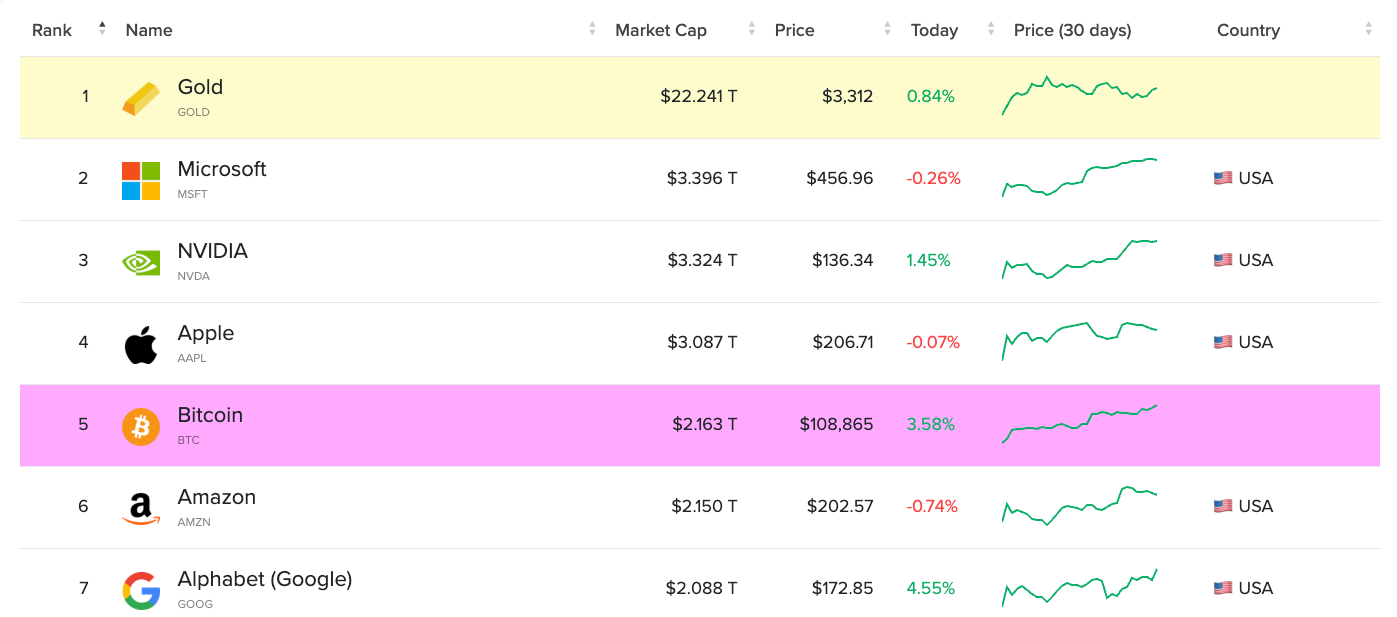

Bitcoin Flips Amazon in Market Cap Showdown—$2.16T Puts Crypto in Big Leagues

Move over, tech giants—Bitcoin just bulldozed past Amazon to claim the fifth-largest asset throne. With a $2.16 trillion market cap, the OG crypto isn’t asking for a seat at the table; it’s flipping the table entirely.

Wall Street’s still scratching its head. Traditional finance’s ‘digital gold’ narrative now looks quaint as Bitcoin outpaces one of the most disruptive companies in history. Guess those ‘meme asset’ skeptics need new talking points.

Here’s the kicker: this isn’t a fluke. Institutions piling in, ETFs sucking up supply, and that relentless halving cycle math—all converging while hedge funds still charge 2-and-20 for underperformance.

Will Amazon strike back? Maybe. But today, the message is clear: the future of value isn’t just digital—it’s decentralized. And frankly, it’s hilarious watching legacy finance try to price that in.

Gold is the largest asset, by far, standing at a $22 trillion market cap, followed by Microsoft (MSFT), NVIDIA (NVDA) and Apple (AAPL) which stand at $3.1 trillion to $3.4 trillion respectively.

As a result of the surge in bitcoin’s price since the win of U.S. President Donald Trump, BlackRock’s iShares Bitcoin Trust (IBIT) recently became the fifth-largest exchange-traded fund (ETF) by inflows this year as it took in roughly $9 billion from investors, according to data from Bloomberg senior ETF analyst Eric Balchunas.