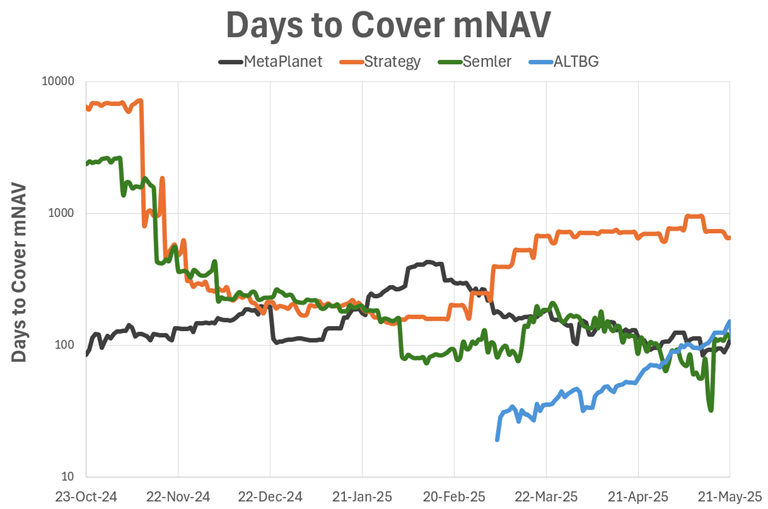

‘Days to Cover mNAV’ Becomes the Bitcoin Equity Metric That Actually Matters

Wall Street’s latest obsession? A little thing called ‘Days to Cover mNAV’—the new benchmark for separating Bitcoin’s winners from its hype-stocks. Forget P/E ratios; crypto’s playing by its own rules now.

Why it’s catching fire: Traders are ditching traditional valuation methods for this liquidity-focused metric—because nothing says ‘trust the process’ like ignoring fundamentals entirely. (Take that, SEC.)

The bottom line: When the next correction hits, you’ll want to know which equities can actually cover their NAV—not just flaunt their Satoshi-themed PowerPoint decks.

In a sector defined by speed and volatility, Days to Cover mNAV provides a clear, data-driven lens through which to evaluate long-term sustainability and upside potential.