Forget P/E Ratios—’Days to Cover mNAV’ Is Wall Street’s New Bitcoin Equity Benchmark

Move over, traditional metrics. Crypto-native analysts are flipping the script with a laser focus on ’Days to Cover mNAV’—the make-or-break stat for Bitcoin-linked stocks.

Why it matters: When your underlying asset moons 200% in a year, old-school valuation tools become relics faster than a Lehman Brothers HR manual.

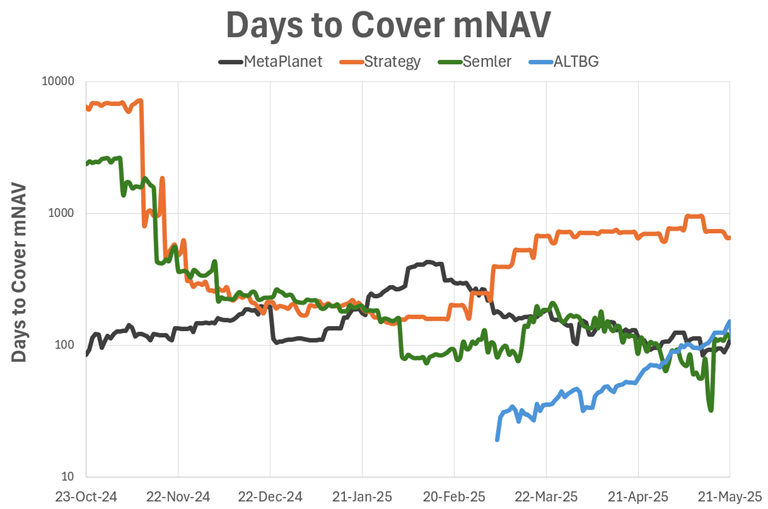

The new playbook: Funds now track how long it’d take to cover short positions against a company’s modified net asset value—because in crypto-land, balance sheets can go from hero to zero between coffee breaks.

Bonus jab: Somehow, this feels more rigorous than the ’discord sentiment analysis’ that passed for research in 2021.

In a sector defined by speed and volatility, Days to Cover mNAV provides a clear, data-driven lens through which to evaluate long-term sustainability and upside potential.