Retail Traders Pile Into Altcoins—And Bitcoin Pays the Price

Mainstream crypto investors are ditching blue-chip assets for riskier plays—and the market’s feeling the shockwaves.

Bitcoin and Ether take a hit as speculative capital floods into meme coins and low-cap tokens. Volatility spikes while ’number go up’ addicts chase the next 100x.

Wall Street analysts shrug: ’Same pattern as 2021—just with fancier jargon and worse haircuts.’

What to Watch

- Crypto:

- May 16, 9:30 a.m.: Galaxy Digital Class A shares to begin trading on the Nasdaq under the ticker symbol GLXY.

- May 19: CME Group is expected to launch its cash-settled XRP futures.

- May 19: Coinbase Global (COIN) will replace Discover Financial Services (DFS) in the S&P 500, effective before the opening of trading.

- Macro

- May 15, 8 a.m.: The Brazilian Institute of Geography and Statistics releases March retail sales data.

- Retail Sales MoM Est. 1% vs. Prev. 0.5%

- Retail Sales YoY Est. -0.5% vs. Prev. 1.5%

- May 15, 8:30 a.m.: The U.S. Bureau of Labor Statistics releases April producer price inflation data.

- Core PPI MoM Est. 0.3% vs. Prev. -0.1%

- Core PPI YoY Est. 3.1% vs. Prev. 3.3%

- PPI MoM Est. 0.2% vs. Prev. -0.4%

- PPI YoY Est. 2.5% vs. Prev. 2.7%

- May 15, 8:30 a.m.: The U.S. Census Bureau releases April retail sales data.

- Retail Sales MoM Est. 0% vs. Prev. 1.5%

- Retail Sales YoY Prev. 4.9%

- May 15, 8:30 a.m.: The U.S. Department of Labor releases unemployment insurance data for the week ended May 10.

- Initial Jobless Claims Est. 229K vs. Prev. 228K

- May 15, 8:40 a.m.: Fed Chair Jerome H. Powell will deliver a speech ("Framework Review") in Washington. Livestream link.

- May 16, 10 a.m.: The University of Michigan releases (Preliminary) May U.S. consumer sentiment data.

- Michigan Consumer Sentiment Est. 53 vs. Prev. 52.2

- May 15, 8 a.m.: The Brazilian Institute of Geography and Statistics releases March retail sales data.

- Earnings (Estimates based on FactSet data)

- May 15: Bit Digital (BTBT), post-market, -$0.05

- May 15: Bitdeer Technologies Group (BTDR), pre-market, -$0.42

- May 15: Fold Holdings (FLD), post-market, N/A

- May 15: KULR Technology Group (KULR), post-market, N/A

- May 28: NVIDIA (NVDA), post-market, $0.88

Token Events

- Governance votes & calls

- Uniswap DAO is voting on a proposal to fund the integration of Uniswap V4 on Ethereum in Oku and add Unichain on Oku in a bid to enhance Uniswap’s reach and liquidity migration to V4. Voting ends May 18.

- May 15, 11 a.m.: Yield Guild Games to host a Q1 2025 community update Ask Me Anything (AMA) session.

- May 15, 10 a.m.: Moca Network to host a Discord townhall session discussing network updates.

- May 21, 6 p.m.: Theta Network to host an Ask Me Anything session in a livestream.

- Unlocks

- May 15: Starknet (STRK) to unlock 4.09% of its circulating supply worth $23.53 million.

- May 15: Sei (SEI) to unlock 1.09% of its circulating supply worth $14.22 million.

- May 16: Immutable (IMX) to unlock 1.35% of its circulating supply worth $17.8 million.

- May 16: Arbitrum (ARB) to unlock 1.95% of its circulating supply worth $39.06 million.

- May 17: Avalanche (AVAX) to unlock 0.4% of its circulating supply worth $42.84 million.

- Token Launches

- May 15: RIZE (RIZE) to list on Kraken.

- May 16: Galxe (GAL), Litentry (LIT), Mines of Dalarnia (DAR), Orion Protocol (ORN), and PARSIQ (PRQ) to be delisted from Coinbase.

Conferences

CoinDesk’s Consensus is taking place in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

- Day 2 of 3: CoinDesk’s Consensus 2025 (Toronto)

- May 19-25: Dutch Blockchain Week (Amsterdam, Netherlands)

- May 20-22: Avalanche Summit London

- May 20-22: Seamless Middle East Fintech 2025 (Dubai)

- May 21-22: Crypto Expo Dubai

- May 21-22: Cryptoverse Conference (Warsaw, Poland)

- May 27-29: Bitcoin 2025 (Las Vegas)

- May 27-30: Web Summit Vancouver

- May 29: Stablecon (New York)

- May 29-30: Litecoin Summit 2025 (Las Vegas)

Derivatives Positioning

- BTC and ETH perpetual futures open interest ticked up alongside an overnight spot price pullback, but funding rates remain positive. Perhaps traders are buying the dip.

- Open interest in XRP perpetual futures has dropped, signaling an unwinding of longs.

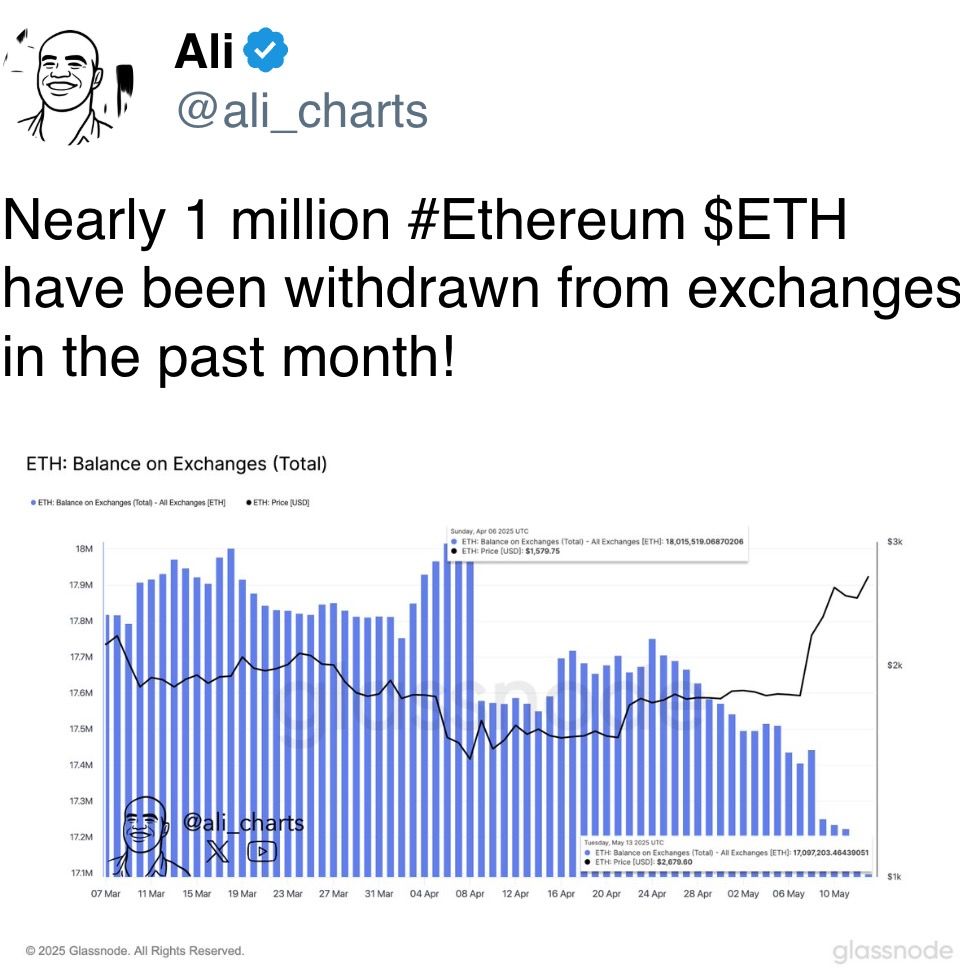

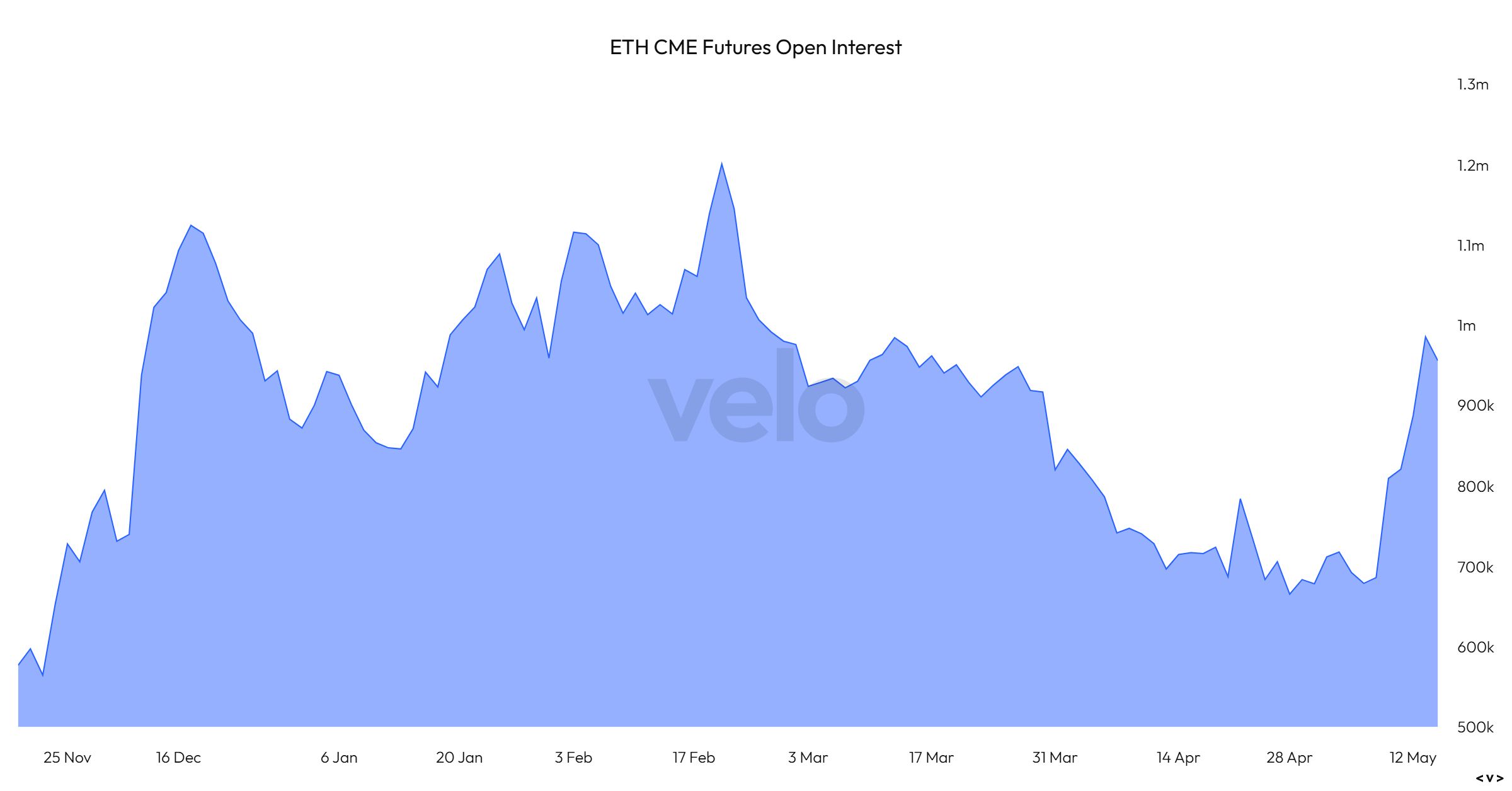

- Ether futures open interest on the CME has increased from roughly 685K ETH to 955K ETH in a week, reaching the highest since March 11. BTC CME futures have yet to see a similar uptick.

- On Deribit, ETH risk reversals at the front-end have flipped negative to show bias for puts, or downside protection. BTC calls continue to trade at a premium.

- OTC tech platform Paradigm noted mixed flows, with OTM BTC put spreads both bought and sold, while ETH OTM call spreads continued to be lifted.

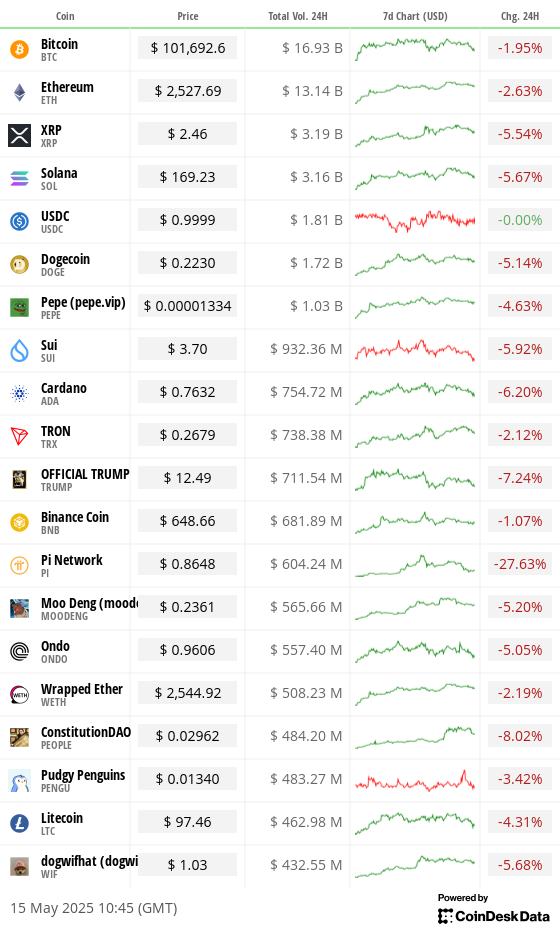

Market Movements

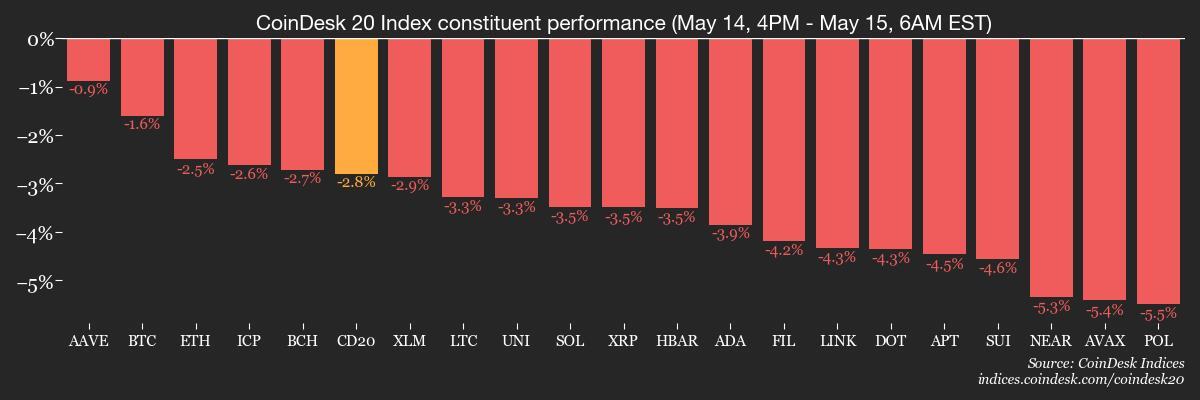

- BTC is down 1.49% from 4 p.m. ET Wednesday at $101,906.02 (24hrs: -1.52%)

- ETH is down 2.54% at $2,540.80 (24hrs: -2.58%)

- CoinDesk 20 is down 2.79% at 3,204.04 (24hrs: -3.66%)

- Ether CESR Composite Staking Rate is down 1 bps at 3.11%

- BTC funding rate is at 0.0045% (4.8968% annualized) on Binance

- DXY is down 0.29% at 100.75

- Gold is down 0.59% at $3,168.30/oz

- Silver is down 0.85% at $32/oz

- Nikkei 225 closed -0.98% at 37,755.51

- Hang Seng closed -0.79% at 23,453.16

- FTSE is up 0.14% at 8,596.60

- Euro Stoxx 50 is down 0.54% at 5,374.02

- DJIA closed on Wednesday -0.21% at 42,051.06

- S&P 500 closed +0.1% at 5,892.58

- Nasdaq closed +0.72% at 19,146.81

- S&P/TSX Composite Index closed +0.3% at 25,692.45

- S&P 40 Latin America closed +0.18% at 2,645.42

- U.S. 10-year Treasury rate is down 3 bps at 4.51%

- E-mini S&P 500 futures are down 0.51% at 5,878.25

- E-mini Nasdaq-100 futures are down 0.72% at 21,239.50

- E-mini Dow Jones Industrial Average Index futures are down 0.32% at 41,982.00

Bitcoin Stats

- BTC Dominance: 62.77 (+0.31%)

- Ethereum to bitcoin ratio: 0.02490 (-1.23%)

- Hashrate (seven-day moving average): 861 EH/s

- Hashprice (spot): $54.63

- Total Fees: 7.21 BTC / $747,357.79

- CME Futures Open Interest: 149,720 BTC

- BTC priced in gold: 31.9 oz

- BTC vs gold market cap: 9.04%

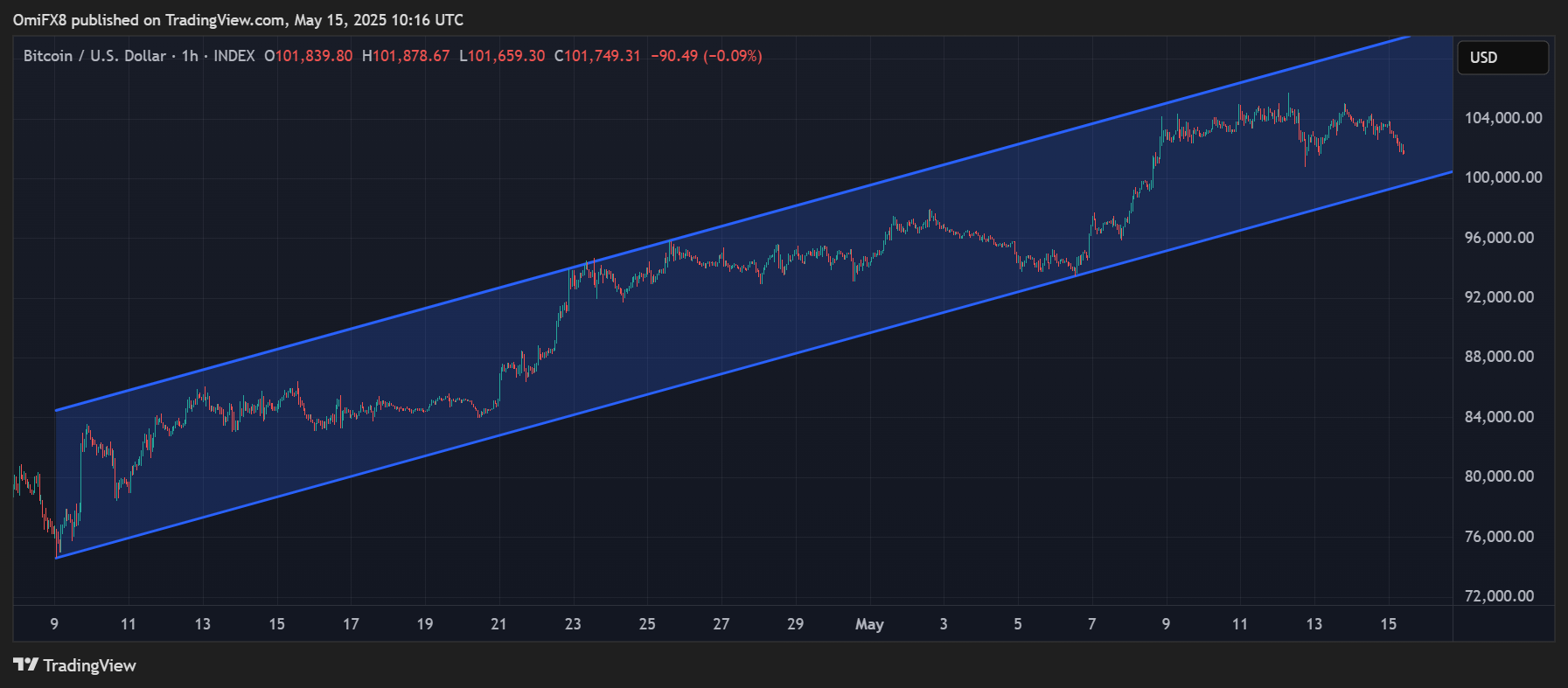

Technical Analysis

- While BTC has pulled back from the recent high of $105,700 to under $102,000, it’s broader upward trajectory remains intact.

- A break below $100,000 would invalidate the trend channel from April 9 lows, potentially leading to a deeper pullback.

Crypto Equities

- Strategy (MSTR): closed on Wednesday at $416.75 (-1.15%), down 2.35% at $406.95 in pre-market

- Coinbase Global (COIN): closed at $263.41 (+2.53%), down 3.39% at $254.48

- Galaxy Digital Holdings (GLXY): closed at $31.96 (+8.74%)

- MARA Holdings (MARA): closed at $15.87 (-3.05%), down 2.52% at $15.47

- Riot Platforms (RIOT): closed at $8.91 (-1.66%), down 2.24% at $8.71

- Core Scientific (CORZ): closed at $10.32 (+0.78%), down 1.55% at $10.16

- CleanSpark (CLSK): closed at $9.61 (-3.9%), down 2.29% at $9.39

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $16.95 (-1.45%), down 1.71% at $16.66

- Semler Scientific (SMLR): closed at $32.54 (-11.34%), down 1.72% at $31.98

- Exodus Movement (EXOD): closed at $34.88 (-17.03%), unchanged in pre-market

ETF Flows

- Daily net flow: $319.5 million

- Cumulative net flows: $41.37 billion

- Total BTC holdings ~ 1.17 million

- Daily net flow: $63.5 million

- Cumulative net flows: $2.55 billion

- Total ETH holdings ~ 3.44 million

Source: Farside Investors

Overnight Flows

Chart of the Day

- The chart shows a sharp rise in the number of open ETH futures bets on the Chicago Mercantile Exchange.

- The surge indicates growing institutional participation in the second-largest cryptocurrency.

While You Were Sleeping

- CFTC’s Pham Said to Plot Exit, Agency May Be Left Without a Party Majority (CoinDesk): If Brian Quintenz is confirmed as CFTC chair, he would replace a departing Democrat, while two Republicans also plan to leave, potentially reducing the five-member agency to just two commissioners.

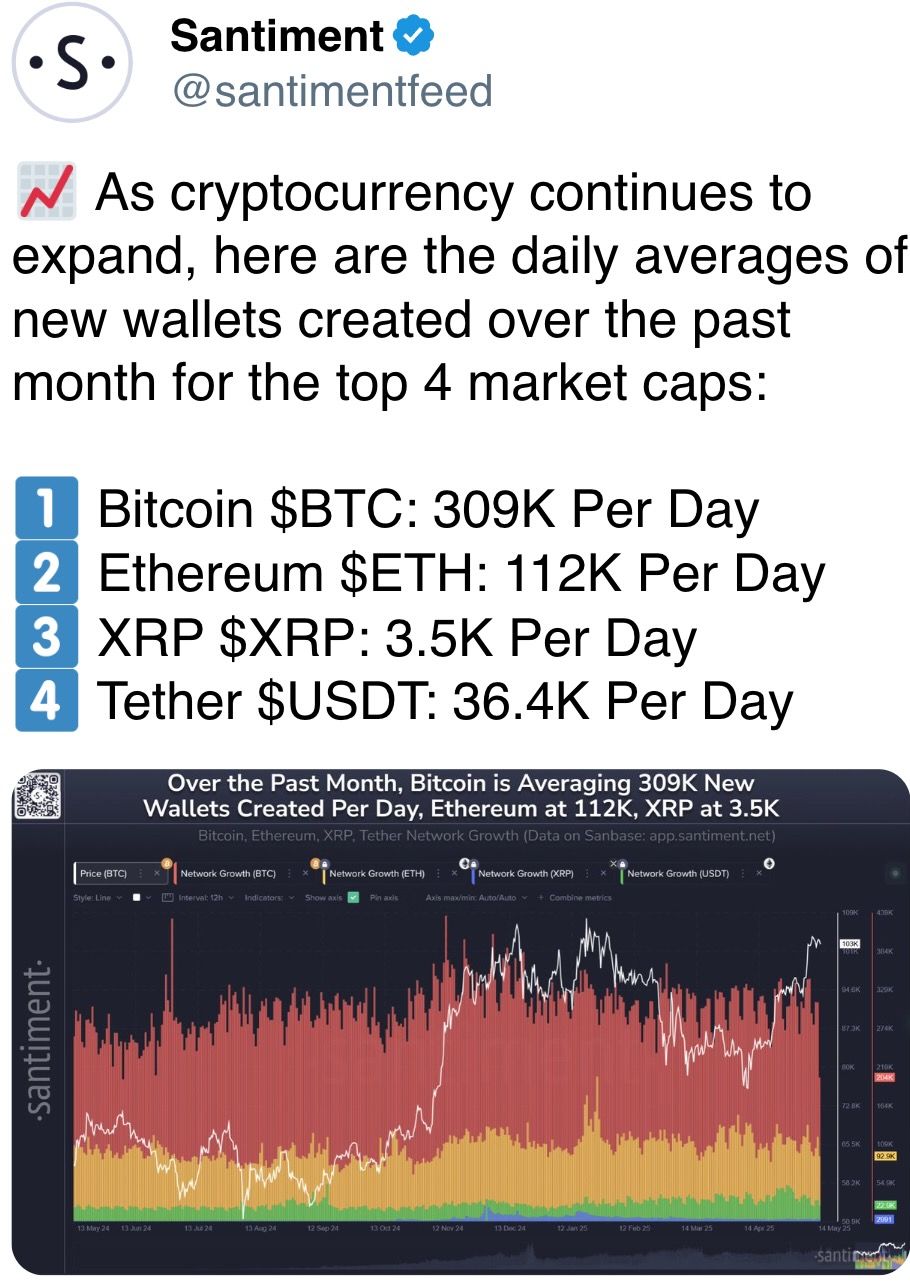

- Altcoin Season Could Heat Up in June and Drain Part of Bitcoin’s $2T Market Cap, Analyst Says (CoinDesk): Bitcoin’s dominance rate fell from 65% to 62% in a week, signaling a shift toward altcoins. Analyst Joao Wedson says dominance will drop further.

- Trump Says U.S. Close to a Nuclear Deal With Iran (Reuters): Talks remain complicated by sharp disagreements and Tehran’s continued uranium enrichment.

- Group of 21 Economies — Including U.S. and China — Warns of Growth Slowdown Over Trade Tensions (CNBC): The Asia Pacific Economic Cooperation (APEC) forecasts growth will slow to 2.6% this year from 3.6% in 2024, citing tariffs and non-tariff barriers as factors undermining business confidence.

- ARK Invest Bought $9.4M Worth of eToro Shares on Trading Platform’s Debut (CoinDesk): Cathie Wood’s firm bought 140,000 ETOR shares as the stock jumped 29% from its $52 open on stronger-than-expected demand.

- U.K. Economy Raced at Start of Year but Slowdown Looms (The Wall Street Journal): Despite outpacing the U.S. and eurozone with 0.7% first-quarter growth, rising employer taxes and wage costs have dented business confidence, pointing to weaker performance later this year and in 2026.

In the Ether