Bitcoin Smashes $2T Market Cap—FOMO Buying Surges While Whales Stay Wary

Bitcoin’s market cap just pierced the $2 trillion barrier—triggering a retail buying frenzy as on-chain data reveals institutional players are quietly taking profits. The crypto king’s latest milestone proves even Wall Street can’t ignore digital gold... though they’ll still charge you 2% to ’manage’ your exposure.

Retail traders pile in as whales cash out

On-chain analytics show new wallet addresses exploding while exchange inflows from known institutional cold wallets spike—classic ’weak hands meet strong hands’ behavior. The $2T psychological barrier has become a self-fulfilling prophecy, with algorithmic traders front-running the breakout.

When the suits start sweating

Watch for suppressed volatility as market makers hedge their bets. This isn’t 2021’s reckless bull run—today’s players are battle-hardened veterans who remember Celsius’ collapse. The real test comes when leveraged longs hit record highs... again.

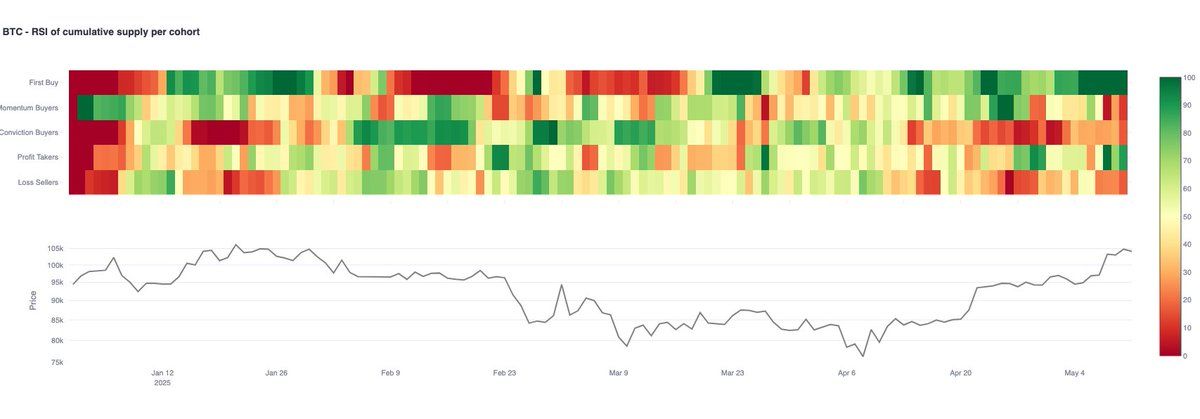

Glassnode’s supply-mapping tool represents granular segmentation of different investor cohorts based on their behavioral patterns.

First timers are defined as wallets engaging with the token for the first time. The 30-day relative strength index of the first-time buyers holding at 100 through the week indicates strong buying interest from these participants.

However, the activity of other investor cohorts isn’t as encouraging, raising the possibility of a BTC price consolidation or pullback.

Per Glassnode, demand from momentum buyers remains weak, with the 30-day RSI at 11. Momentum traders capitalize on an established uptrend or downtrend, betting it will continue.

"Momentum Buyers remain weak (RSI ~11), and Profit Takers are rising. If fresh inflows slow, lack of follow-through could lead to consolidation," Glassnode noted.