Ethereum, Cardano, Dogecoin Rocket—$800M in Shorts Obliterated in Biggest Crypto Squeeze Since 2023

Crypto markets just delivered a brutal lesson to overleveraged bears. ETH, ADA, and DOGE ripped upwards so violently that $800 million worth of short positions got liquidated in 24 hours—the highest since Bitcoin’s last bull cycle.

The Domino Effect:

When majors move, altcoins follow. Ethereum’s 12% surge triggered cascading liquidations, while Dogecoin’s meme-powered 25% pump turned into a wrecking ball for skeptics.

Wall Street’s Take:

’Risk management? What’s that?’ joked one trader, as hedge funds—yet again—underestimated retail’s ability to move markets. Meanwhile, exchanges quietly collected liquidation fees like a casino rigging the roulette wheel.

Ether led the charge with a 20% rise, pushing past $2,000 for the first time since early March. Doge and Cardano’s ADA zoomed more than 10%, fueled by bullish sentiment and momentum trading, with Solana’s SOL, BNB and xrp (XRP) up at least 7%.

Liquidations occur when an exchange forcibly closes a trader’s Leveraged position due to insufficient margin. It happens when a trader cannot meet the margin requirements for a leveraged position, that is, when they don’t have sufficient funds to keep the trade open.

Large-scale liquidations can indicate market extremes, like panic selling or buying. A cascade of liquidations might suggest a market turning point, where a price reversal could be imminent due to an overreaction in market sentiment.

As such, the uptick in crypto markets came as bitcoin surged above $100,000 on Thursday, with sentiment buoyed on a trade deal between the U.S. and the UK.

The late Thursday wipeout ranks among the most severe since Bitcoin’s run to $93,000 in March, which saw bears lose over $550 million in a weekend squeeze.

In April, a similar rally in ETH and DOGE erased $500 million in shorts — but this move surpassed both, showing renewed risk appetite and a crowded short trade setup.

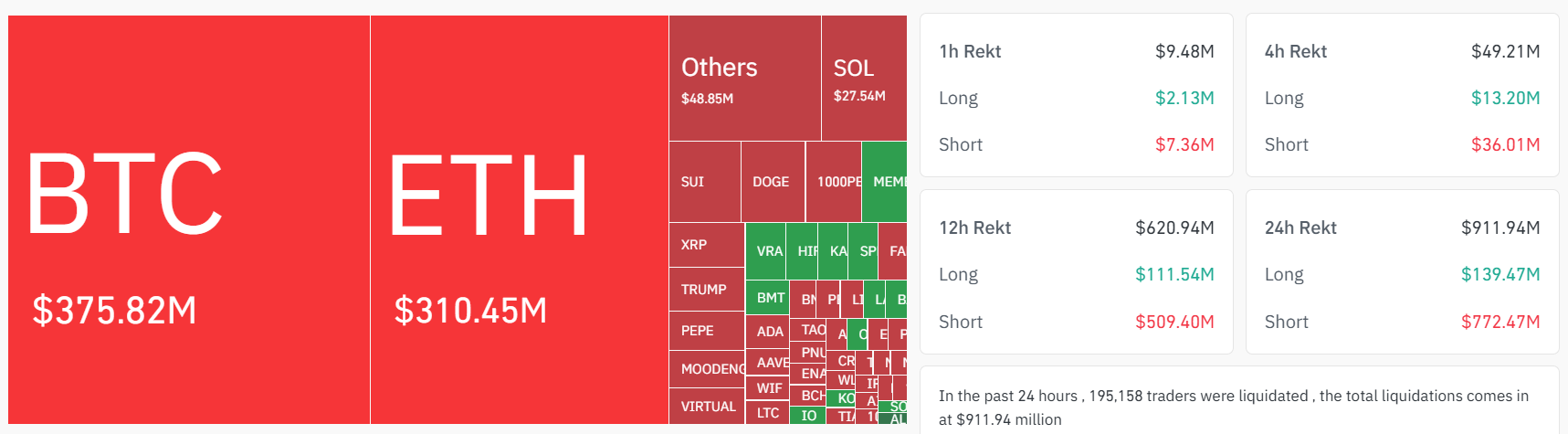

Coinglass data shows that the largest share of losses came from Binance and OKX, which accounted for more than $500 million in liquidations. ETH alone was responsible for over $310 million, while bitcoin-tracked futures led at $375 million.

The short squeeze on ETH came as the asset had been rangebound for a few weeks amid falling institutional interest and retail sentiment. But Ethereum’s recent Pectra upgrade may be giving traders a reason to bet on the asset, some say.