Ether ETFs Hit Wall Street—Now Institutions Want to Stake Your ETH for Profit

BlackRock and friends just flipped the switch on Ether ETFs—but the real play isn’t trading, it’s staking. Here’s why Wall Street’s suddenly obsessed with your yield.

### The Institutional Staking Gold Rush

Forget ’number go up.’ TradFi giants now see ETH as a cashflow asset—one they can borrow, lend, and stake while you hold the bag. The 4-6% APY beats Treasury bonds... if you ignore the smart contract risk.

### Regulatory Jiu-Jitsu

SEC Chair Gary Gensler hates crypto but loves ETFs. Now institutions get exposure without touching the ’unregistered security’—while quietly farming rewards through third-party validators. Classic loophole exploitation.

### The Fine Print Trap

That 0.75% management fee? It covers custody—not the 15-25% staking cut middlemen take. Plus, your ETH gets locked while whales unstake anytime. But hey, at least it’s ’regulated.’

Wall Street always finds a way to monetize decentralization—while keeping the actual decentralization at arm’s length. The more crypto changes, the more it becomes... well, finance.

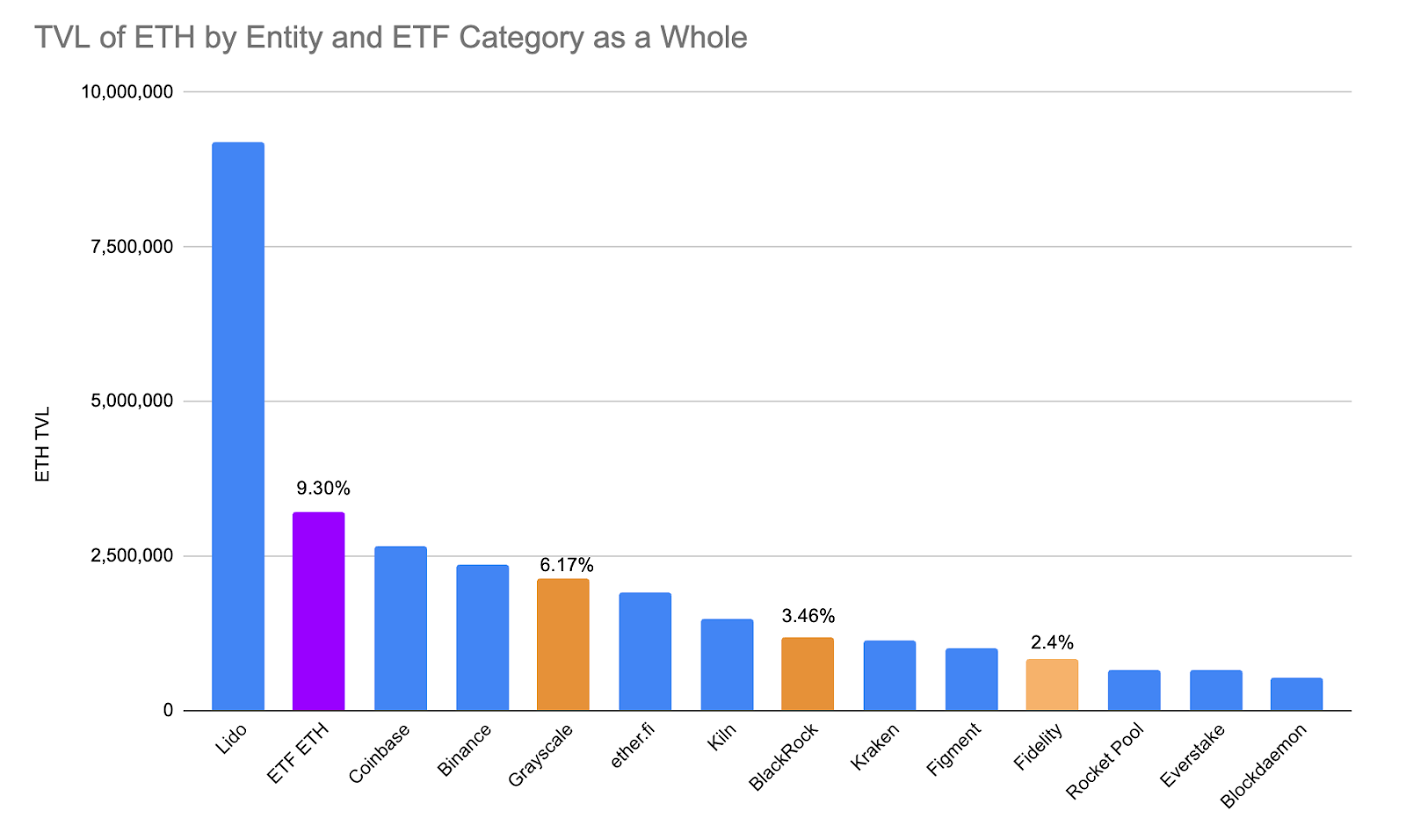

This chart shows the total ETH held by ETFs in purple, which would be the second largest staker as a category, and in orange the top three ETFs holding ETH. TVL= total value locked.

On the flip side, there’s a rare opportunity forrunning their own nodes.

Vertical integration into staking infrastructure allows issuers to both decentralize the network and unlock economic upside. The standard validator fee — typically 5–15% of staking rewards — is currently captured by operators and the liquid staking protocol managing the staking pools, such as Lido, RocketPool and even the centralized wallet exchanges pools.

However, if ETF managers run their own nodes or partner with independent providers, they can reclaim that margin and boost fund performance. In an industry competing on basis points, that edge matters. We’re already seeing an M&A trend underway. Bitwise’s acquisition of a staking operator is no coincidence: it’s a signal that smart asset managers are positioning for a future where staking isn’t just a back-end service but a CORE part of the fund’s value chain.

This development represents Ethereum’s fork in the road, in which institutions can either treat staking as a plug-and-play checkbox, reinforcing centralization and systemic risk, or they can help build a more credibly neutral protocol by distributing operations across validators.

With a short queue, an expanding set of validators and billions of ETH sitting idle, the timing couldn’t be better. So as the institutionalization of staking looks increasingly likely, let’s make sure it’s done right, reinforcing the foundations of what blockchain is all about.