Trump Tariffs Spark Market Frenzy—Bitcoin’s ’Digital Gold’ Narrative Gains Unlikely Validation

When markets flinch at political volatility, Bitcoin just yawns and ticks higher. The latest Trump tariff threats sent traditional assets into a tailspin—while BTC barely blinked, cementing its role as the unshockable hedge in a world of central bank puppetry.

Gold 2.0? More like gold for people who remember 2008. The ’safe haven’ crowd—once the domain of Swiss bankers and goldbugs—now piles into BTC every time a politician utters ’trade war.’ Funny how crisis after crisis turns skeptics into bagholders.

Wall Street’s latest epiphany? Real ’store of value’ assets don’t crater when the Fed whispers about balance sheets. Meanwhile, Bitcoin’s 2025 rally makes you wonder: maybe the real tariff was the fiat inflation we ignored along the way.

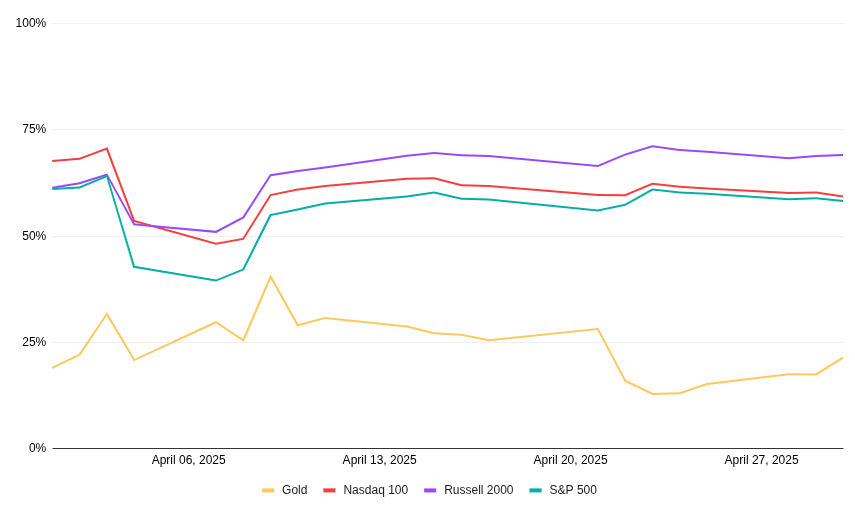

Source: Hashdex Research with data from CF Benchmarks and Bloomberg (April 01, 2025 to April 30, 2025). 30-day rolling correlations (considering only workdays) between bitcoin (represented by the Nasdaq Bitcoin Reference Price Index) and TradFi indices.

This short-term observation matters because it supports the changing nature of how investors perceive bitcoin. While some still categorize bitcoin as a high-beta “risk-on” asset, institutional sentiment is beginning to reflect a more nuanced understanding. Bitcoin recovered faster than the S&P 500 in the 60 days that followed the COVID outbreak, Russia’s invasion of Ukraine and the U.S. banking crisis in 2023, events in which it demonstrated resilience and a profile increasingly aligned with that of gold during stress.

These periods of decoupling establish a pattern where bitcoin displays its antifragile properties, allowing allocators to protect capital during systemic events, while still outpacing the performance of stocks, bonds and gold over the long haul.

Source: CaseBitcoin, Return data from May 1, 2020 to April 30, 2025 (CaseBitcoin.com)

Maybe more compelling than bitcoin’s longer-term returns are the long-term portfolio effects. Even a small allocation to bitcoin within a traditional 60% stock/40% bond portfolio would have improved risk-adjusted returns in 98% of rolling three-year periods over the last decade. And these risk-adjusted returns are markedly higher over longer time frames, suggesting that bitcoin’s volatility from positive returns more than counterbalances short-term drawdowns.

It might still be premature to claim that bitcoin has been universally accepted as “digital gold,” but that narrative, supported by its response to geopolitical events, is gaining momentum. The combination of bitcoin’s fixed supply, liquidity, accessibility and immunity to central bank interference gives it properties no traditional asset can replicate. This should be appealing to any investor, large or small, in search of portfolio diversification and long-term wealth preservation.