Powell’s Speech Looms Over Crypto as Asia’s Market Battles Heat Up

All eyes on the Fed chair today—whatever he says will ripple through Bitcoin and altcoins faster than a meme coin pump-and-dump. Meanwhile, Asian markets are playing high-stakes poker with crypto regulations (spoiler: house usually wins).

Traders are glued to two fronts: Powell’s monetary policy hints and whether Asia’s love-hate relationship with digital assets swings toward adoption or another crackdown. Brace for volatility—the only ‘stable’ thing in crypto remains the Tether printer.

Bonus jab: Wall Street still can’t decide if crypto is a hedge against inflation or just a hedge fund liquidity trap. Place your bets.

What to Watch

- Crypto:

- May 8: Judge John G. Koeltl will sentence Alex Mashinsky, the founder and former CEO of the now-defunct crypto lending firm Celsius Network, at the U.S. District Court for the Southern District of New York.

- May 12, 1 p.m. to 5:30 p.m.: A U.S. SEC Crypto Task Force Roundtable on "Tokenization: Moving Assets Onchain: Where TradFi and DeFi Meet" will be held at the SEC’s headquarters in Washington.

- Macro

- May 7, 2 p.m.: The Federal Reserve announces its interest-rate decision. The FOMC press conference is livestreamed 30 minutes later.

- Federal Funds Rate Target Range Est. 4.25%-4.5% vs. Prev. 4.25%-4.5%

- May 8, 7 a.m.: The Bank of England announces its interest-rate decision. The Monetary Policy Report Press Conference is livestreamed 30 minutes later.

- Bank Rate Est. 4.25% vs. Prev. 4.5%

- May 8, 8:30 a.m.: The U.S. Department of Labor releases unemployment insurance data for the week ended May 3.

- Initial Jobless Claims Est. 230K vs. Prev. 241K

- May 9-12: Chinese Vice Premier He Lifeng will hold trade talks with U.S. Treasury Secretary Scott Bessent during his visit to Switzerland.

- May 7, 2 p.m.: The Federal Reserve announces its interest-rate decision. The FOMC press conference is livestreamed 30 minutes later.

- Earnings (Estimates based on FactSet data)

- May 8: CleanSpark (CLSK), post-market, $-0.11

- May 8: Coinbase Global (COIN), post-market, $1.88

- May 8: Hut 8 (HUT), pre-market, $-0.10

- May 8: MARA Holdings (MARA), post-market, $-0.52

- May 13: Semler Scientific (SMLR), post-market

Token Events

- Governance votes & calls

- Arbitrum DAO is voting on whether to put the last $10.7 million from its 35 million ARB diversification plan into three low‑risk, dollar‑based funds from WisdomTree, Spiko, and Franklin Templeton. Voting ends on May 8.

- Compound DAO is voting on which new collateral type to prioritize on Compound V3. Voting ends May 8.

- May 7, 7:30 a.m.: PancakeSwap to host an X Spaces Ask Me Anything (AMA) session on the future of trading.

- May 7, 9 a.m.: Binance to host an AMA on its Binance Seeds program.

- May 7, 11 a.m.: Pendle to host a Pendle Yield Talk: Stablecoin Alpha X Spaces session.

- May 8, 10 a.m.: Balancer and Euler to host an Ask Me Anything (AMA) session.

- Unlocks

- May 9: Movement (MOVE) to unlock 2.04% of its circulating supply worth $7.75 million.

- May 11: Solayer (LAYER) to unlock 12.87% of its circulating supply worth $47.82 million.

- May 12: Aptos (APT) to unlock 1.82% of its circulating supply worth $54.17 million.

- May 13: WhiteBIT Coin (WBT) to unlock 27.41% of its circulating supply worth $1.13 billion.

- May 15: Starknet (STRK) to unlock 4.09% of its circulating supply worth $16.74 million.

- Token Launches

- May 7: Obol (OBOL) to be listed on Binance, Bitget, Bybit, Gate.io, MEXC and others.

- May 8: Space and Time (SXT) to be listed on Binance, MEXC, BingX, KuCoin, Bitget and others.

- May 16: Galxe (GAL), Litentry (LIT), Mines of Dalarnia (DAR), Orion Protocol (ORN) and PARSIQ (PRQ) to be delisted from Coinbase.

Conferences

CoinDesk’s Consensus is taking place in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

- Day 2 of 2: Financial Times Digital Assets Summit (London)

- Day 2 of 3: Stripe Sessions (San Francisco)

- Day 1 of 3: SALT’s Bermuda Digital Finance Forum 2025 (Hamilton, Bermuda)

- May 9-10: Stanford Blockchain Governance Summit (San Francisco)

- May 11-17: Canada Crypto Week (Toronto)

- May 12-13: Dubai FinTech Summit

- May 12-13: Filecoin (FIL) Developer Summit (Toronto)

- May 12-13: Latest in DeFi Research (TLDR) Conference (New York)

- May 12-14: ACI’s 9th Annual Legal, Regulatory, and Compliance Forum on Fintech & Emerging Payment Systems (New York)

- May 13: Blockchain Futurist Conference (Toronto)

- May 13: ETHWomen (Toronto)

- May 14-16: CoinDesk’s Consensus 2025 (Toronto)

Token Talk

By Shaurya Malwa

- MOG Coin, an Ethereum and Base-based memecoin, is gaining traction on tech Twitter by fusing "mogging" (being better) with accelerationism (tech progress at all costs), birthing an internet-native ideology of mog/acc.

- Technology entrepreneurs and investors such as Elon Musk and Garry Tan have joined the trend, switching their profile pics to Pit Viper sunglasses — a symbol of the mog/acc ideology — and Solana firms like Jupiter and Raydium have followed suit.

- The mog/acc aesthetic is spreading fast thanks to viral tools like an auto-Pit Viper bot that converts profile pictures to the signature look of the movement.

- Mog/acc differs from e/acc or d/acc by skipping intellectual or moral discourse and leaning into meme culture, performance and raw ambition as a form of techno-optimism.

- Widespread adoption of mog/acc and the signature Pit Viper sunglasses could lead to increased mindshare for the MOG Coin token, which could boost demand and prices.

Derivatives Positioning

- BTC and ETH annualized CME futures basis has retreated to 6% from 8%.

- On offshore exchanges, BTC perpetual funding rates hold marginally positive while ETH’s funding rates have risen to near 10%, indicating renewed interest in taking bullish long bets.

- On Deribit, BTC front-end skew flipped negative to suggest a bias for short-term puts. A block trade involved a large long position in the $90K put expiring on May 16.

Market Movements

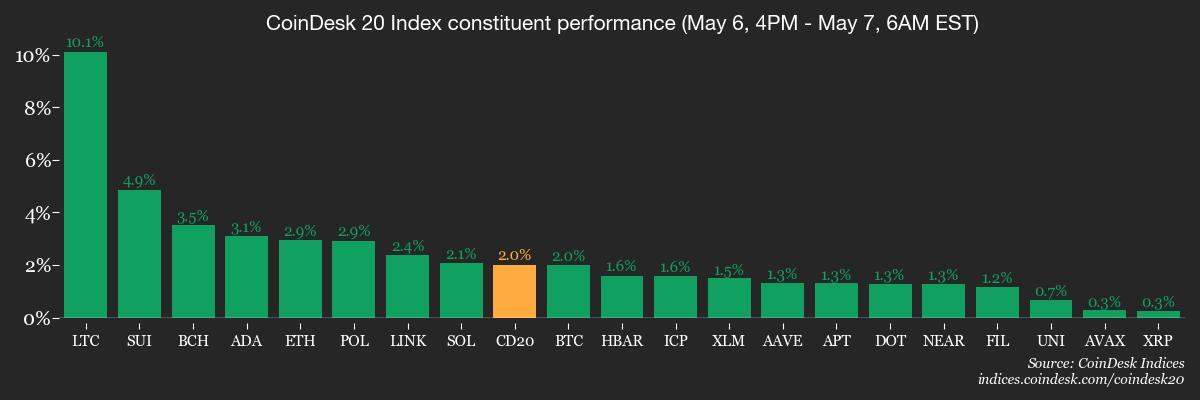

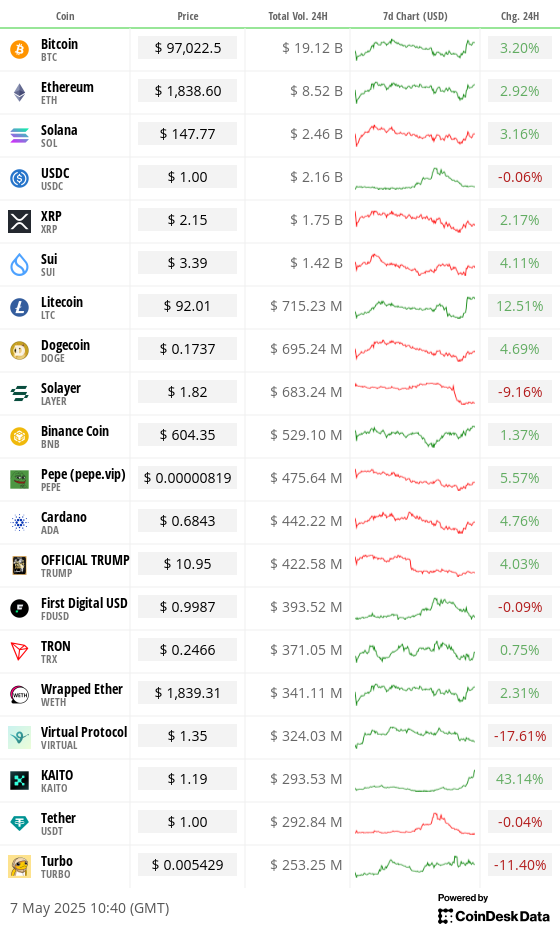

- BTC is up 2.11% from 4 p.m. ET Tuesday at $96.997.82 (24hrs: +2.88%)

- ETH is up 3.31% at $1,844.39 (24hrs: +2.51%)

- CoinDesk 20 is up 2.18% at 2,749.824 (24hrs: +3.35%)

- Ether CESR Composite Staking Rate is down 1 bp at 2.955%

- BTC funding rate is at -0.0006% (-0.6406% annualized) on Binance

- DXY is up 0.31% at 99.54

- Gold is down 1.2% at $3,374.49/oz

- Silver is down 1.29% at $32.76/oz

- Nikkei 225 closed -0.14% at 36,779.66

- Hang Seng closed +0.13% at 22,691.88

- FTSE is down 0.32% at 8,569.76

- Euro Stoxx 50 is down 0.2% at 5,252.95

- DJIA closed on Tuesday -0.95% at 40,829.00

- S&P 500 closed -0.77% at 5,606.91

- Nasdaq closed -0.87% at 17,689.66

- S&P/TSX Composite Index closed unchanged at 24,974.72

- S&P 40 Latin America closed -2.94% at 2,517.04

- U.S. 10-year Treasury rate is up 2 bps at 4.325%

- E-mini S&P 500 futures are up 0.53% at 5,657.00

- E-mini Nasdaq-100 futures are up 0.54% at 19,984.75

- E-mini Dow Jones Industrial Average Index futures are up 0.5% at 41,123.00

Bitcoin Stats

- BTC Dominance: 65.19 (-0.12%)

- Ethereum to bitcoin ratio: 0.0190 (+1.28%)

- Hashrate (seven-day moving average): 897 EH/s

- Hashprice (spot): $51.79

- Total Fees: 5.23 BTC / $494,601

- CME Futures Open Interest: 142,100 BTC

- BTC priced in gold: 28.3 oz

- BTC vs gold market cap: 8.04%

Technical Analysis

- ETH’s daily chart shows the cryptocurrency has exited the prolonged downtrend.

- However, the sideways move past the trendline doesn’t quality as a bullish breakout and the lower high of $2,104 created on March 24 is the new level to beat for the bulls.

Crypto Equities

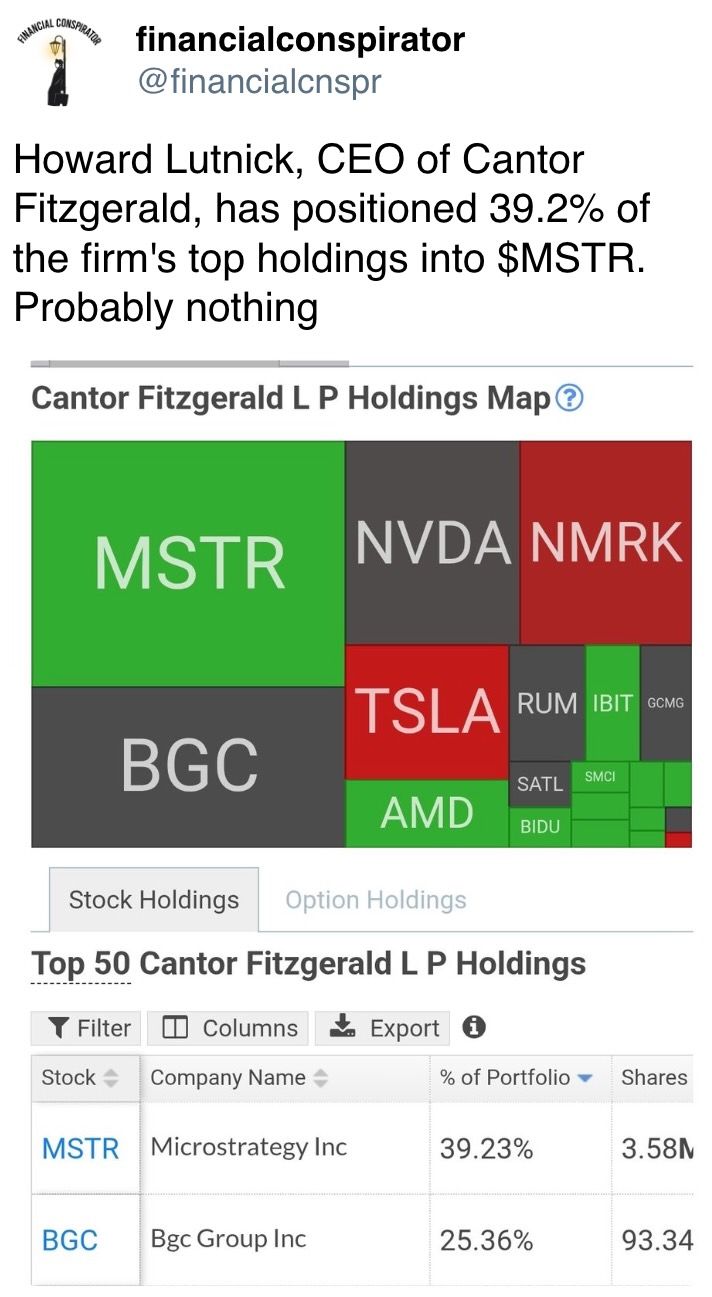

- Strategy (MSTR): closed on Tuesday at $385.60 (-0.24%), up 2.7% at $396 in pre-market

- Coinbase Global (COIN): closed at $196.89 (-1.26%), up 1.88% at $200.60

- Galaxy Digital Holdings (GLXY): closed at C$25.90 (-2.3%)

- MARA Holdings (MARA): closed at $13.15 (+0.46%), up 2.74% at $13.51

- Riot Platforms (RIOT): closed at $7.86 (-0.51%), up 3.05% at $8.10

- Core Scientific (CORZ): closed at $8.99 (+2.74%), up 2.22% at $9.19

- CleanSpark (CLSK): closed at $8.09 (+0.0%), up 2.6% at $8.30

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $14.54 (+1.96%)

- Semler Scientific (SMLR): closed at $33.09 (-1.46%), up 4.2% at $34.48

- Exodus Movement (EXOD): closed at $39.48 (-4.36%), unchanged in pre-market

ETF Flows

- Daily net flow: -$85.7 million

- Cumulative net flows: $40.54 billion

- Total BTC holdings ~ 1.17 million

- Daily net flow: -$17.9 million

- Cumulative net flows: $2.50 billion

- Total ETH holdings ~ 3.46 million

Source: Farside Investors

Overnight Flows

Chart of the Day

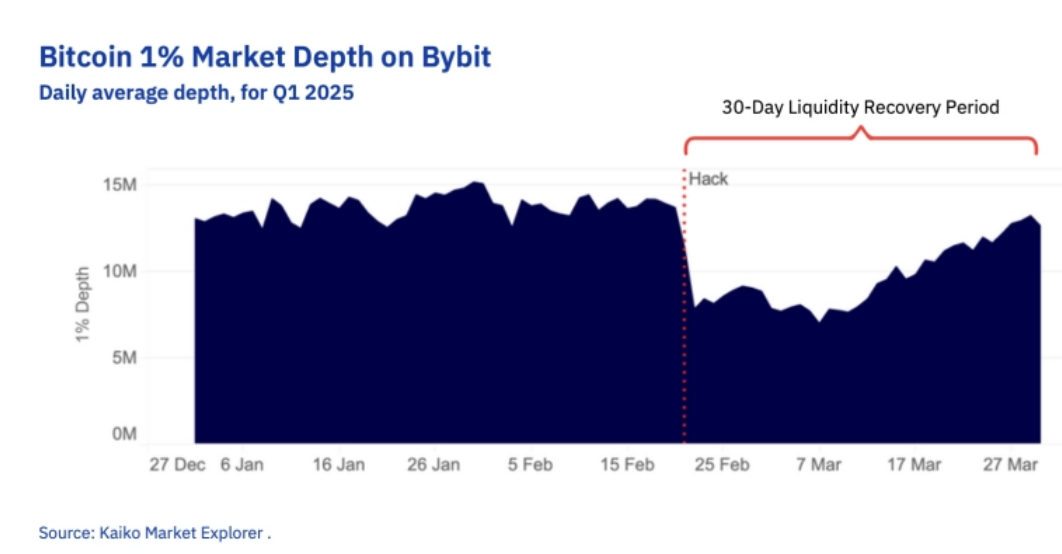

- BTC’s 1% market depth on Bybit, the collection of buy and sell orders within 1% from the going price, has recovered to levels last seen before the exchange was hacked in February.

- The recovery represents an improvement in the order book liquidity.

While You Were Sleeping

- India Strikes Pakistan Over Tourist Killings, Pakistan Says Indian Jets Downed (Reuters): India launched its heaviest strikes on Pakistan in over 20 years, prompting Islamabad to call the action a blatant act of war and vow retaliation amid global calls for restraint.

- U.S. and Chinese Officials to Meet for Trade Talks (Wall Street Journal): U.S. Treasury Secretary Scott Bessent said his weekend talks with Chinese Vice Premier He Lifeng in Switzerland will focus on easing tensions, not securing a major trade deal.

- Ethereum Activates ‘Pectra’ Upgrade, Raising Max Stake to 2,048 ETH (CoinDesk): The long-awaited “Pectra” upgrade went live, marking the blockchain’s most significant overhaul since the Merge in 2022.

- BlackRock’s Spot Bitcoin ETF Tops World’s Largest Gold Fund in Inflows This Year (CoinDesk): IBIT’s outperformance signals institutional confidence in bitcoin’s long-term outlook, even as the cryptocurrency lags in recent price performance.

- Forecasting Fed-Induced Price Swings in Bitcoin, Ether, Solana and XRP (CoinDesk): On Fed day, Volmex’s implied volatility indices suggest modest moves following the interest-rate decision, with bitcoin’s 24-hour swing at 2.56% and ether’s at 3.45%.

- Dollar Faces $2.5 Trillion ‘Avalanche’ of Asian Sales, Jen Says (Bloomberg): Eurizon SLJ Capital analysts said rising trade tensions could prompt Asian investors to repatriate funds or hedge against a weaker dollar, risking a major sell-off.

- China Keeps Adding Gold to Reserves as Challenges Stack Up (Bloomberg): The People’s Bank of China added 70,000 ounces of gold in April, lifting its six-month total to nearly 1 million, while futures trading volumes recently reached all-time highs in Shanghai.

In the Ether