Ripple Ramps Up XRP Transparency Push as Wall Street Warms to Crypto Plumbing

Institutional adoption isn’t coming—it’s already here. Ripple’s doubling down on its quarterly XRP reports as big-money players finally discover what retail figured out years ago.

The crypto infrastructure firm plans to expand its market transparency efforts, adding deeper liquidity metrics and institutional use-case breakdowns. Because nothing says ’mature asset class’ like PowerPoint slides for hedge fund managers.

With cross-border payment volumes hitting record highs, Ripple’s betting that sunlight is the best disinfectant for lingering regulatory skepticism. The real question? Whether traditional finance will still call it ’risky’ while quietly routing settlements through XRP Ledger.

That strength was matched by growing institutional interest. XRP-based investment products recorded $37.7 million in net inflows during the quarter, pushing the year-to-date total to $214 million, just $1 million shy of surpassing ETH-focused funds.

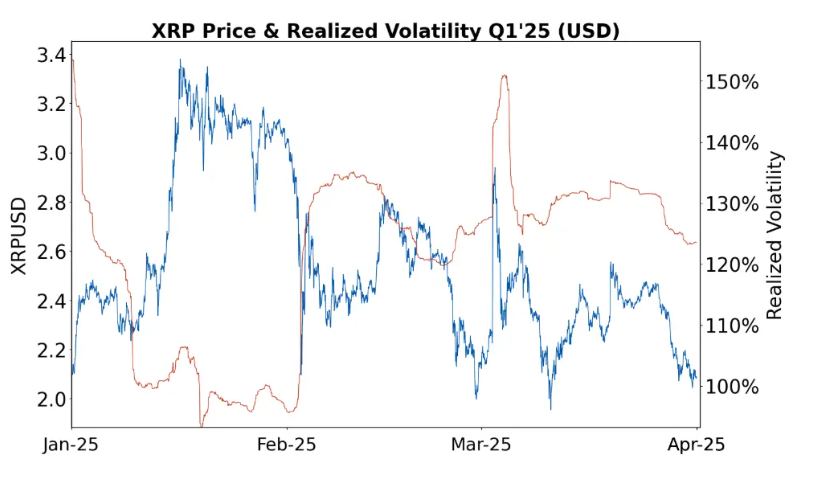

XRP spot market activity remained robust throughout the quarter. Average daily volumes hovered around $3.2 billion, with Binance maintaining a dominant share at 40%, followed by Upbit and Coinbase. Price volatility spiked in February, pushing realized volatility to around 130%, as XRP touched levels not seen since early 2018.

On-chain activity on the XRP Ledger moderated after a period of expansion in late 2024. Wallet creation and transaction volume dropped by 30–40%, in line with broader slowdowns across Layer 1 networks.

However, XRP DeFi activity showed resilience, with DEX volume slipping just 16% quarter-over-quarter. RLUSD was a key driver of activity, with its market cap surpassing $90 million and cumulative DEX trading volume crossing $300 million.