Stablecoins Poised to Trigger Blockchain’s ’ChatGPT Moment’—Citi Predicts $3.7T Boom by 2030

Wall Street’s latest crypto epiphany? Stablecoins might actually be useful. Citi analysts claim these dollar-pegged tokens could spark mass blockchain adoption—cutting through volatility like a hot knife through regulatory loopholes.

The $3.7 trillion projection by 2030 suggests stablecoins will outgrow some national economies. Funny how banks suddenly care about crypto when there’s a way to pretend it’s just digital dollars.

This isn’t your 2017 hype cycle. Real-world payments, remittances, and—let’s be honest—capital flight are driving demand. The tech works. The market’s ready. Now watch traditional finance ’discover’ what crypto natives knew years ago.

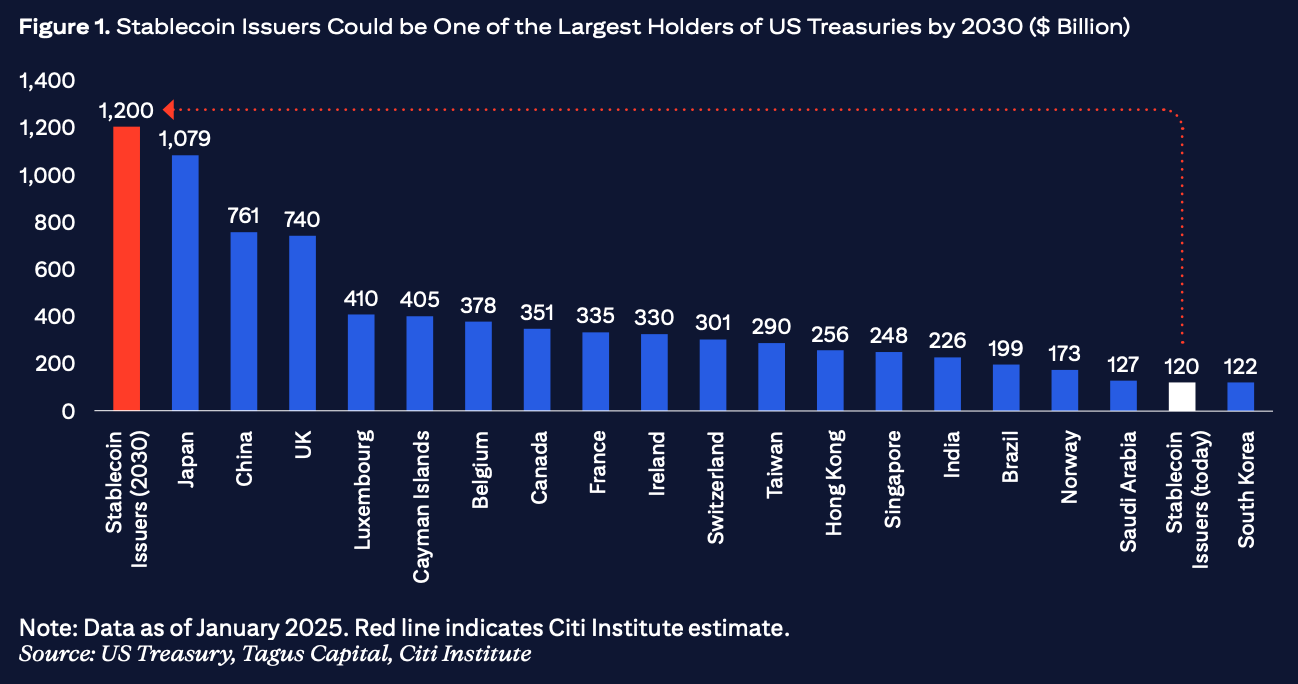

Stablecoin issuers to become major U.S. Treasury holders

Stablecoins are expected to remain heavily dollar-denominated in the future. The report anticipates that around 90% of stablecoins in circulation in 2030 will still be tied to the U.S. dollar, cementing its dominance.

This has major implications for the global financial system. Dollar stablecoin issuers could become one of the largest buyers of U.S. Treasuries, assuming that regulations push toward backing tokens with low-risk, highly liquid traditional financial assets like government bonds. Citibank estimated issuers could hold $1.2 trillion in U.S. government debt by the end of the decade, potentially surpassing all major foreign sovereign holders.

Meanwhile, the central banks of countries in Europe and Asia will likely promote their own digital currencies, or CBDCs, the report noted.

The report pointed to several risks that could hamper the growth. Stablecoins de-pegged nearly 1,900 times in 2023 alone, including more than 600 instances involving major tokens, the report’s authors wrote, citing Moody’s data.

In extreme cases, mass redemptions—like those following the collapse of Silicon Valley Bank (SVB) that consequently hit USDC—can disrupt crypto liquidity, force automated selloffs and Ripple through financial markets, the authors added.