Gold Stalls—Now Bitcoin’s Moment? Traders Target $95K as Make-or-Break Level

As gold flatlines, crypto eyes a breakout. The magic number? $95K—clear that, and the bulls start salivating. (Another day, another ‘key level’ in an asset class that laughs at fundamentals.)

Crypto stocks, which opened strong, saw their performance dampen as the day unfolded. Miners such as Bitdeer (BTDR) and CORE Scientific (CORZ) fell back from double-digit gains, closing the day up roughly 4%. Coinbase (COIN) and Strategy (MSTR) are up 2.1% and 1.4%, respectively.

U.S. President Donald Trump seemed to be dialing down the pressure on China in the last few days, saying that tariffs on the Middle Kingdom would “come down substantially” on Tuesday. Bessent, however, said on Wednesday that the White House had not made a unilateral offer to cut tariffs on China, and that a deal between the two nations would take two to three years to achieve.

"A meaningful thaw in relations may not materialize until substantive news emerges from the upcoming Xi-Trump meeting," said Paul Howard, director at crypto trading firm Wincent. Markets priced in the initial tough stances and tariff threats, which kept a lid on risk appetite over the past two months, he said.

"History suggests that once the opening volleys pass, more constructive developments and easing volatility typically follow," Howard said, which could support risk assets such as crypto.

BTC ETF flows return

In a sign of renewed investor demand, U.S.-listed spot BTC exchange-traded funds (ETFs) have recorded nearly $1.3 billion in net inflows this week so far, according to SoSoValue data. The funds booked their strongest day on Tuesday since mid-January.

"This [crypto] rally isn’t retail-driven hype—it’s institutional capital positioning ahead of what many see as a new monetary and political regime," said Matt Mena, crypto research strategist at digital asset manager 21Shares. "More investors are turning to it not just as a speculative asset, but as a flight to safety amid rising uncertainty across traditional markets."

Despite the strong price action, Mena added that BTC is facing resistance at around the $95,000 level in the short term and could pull back.

Bitcoin to catch up to gold

Gold, meanwhile, is down 2.5% today, trading at $3,290 per ounce after a run that saw the precious metal rise 35% to $3,500 in the span of four months, possibly hinting that the market could be moving past peak uncertainty.

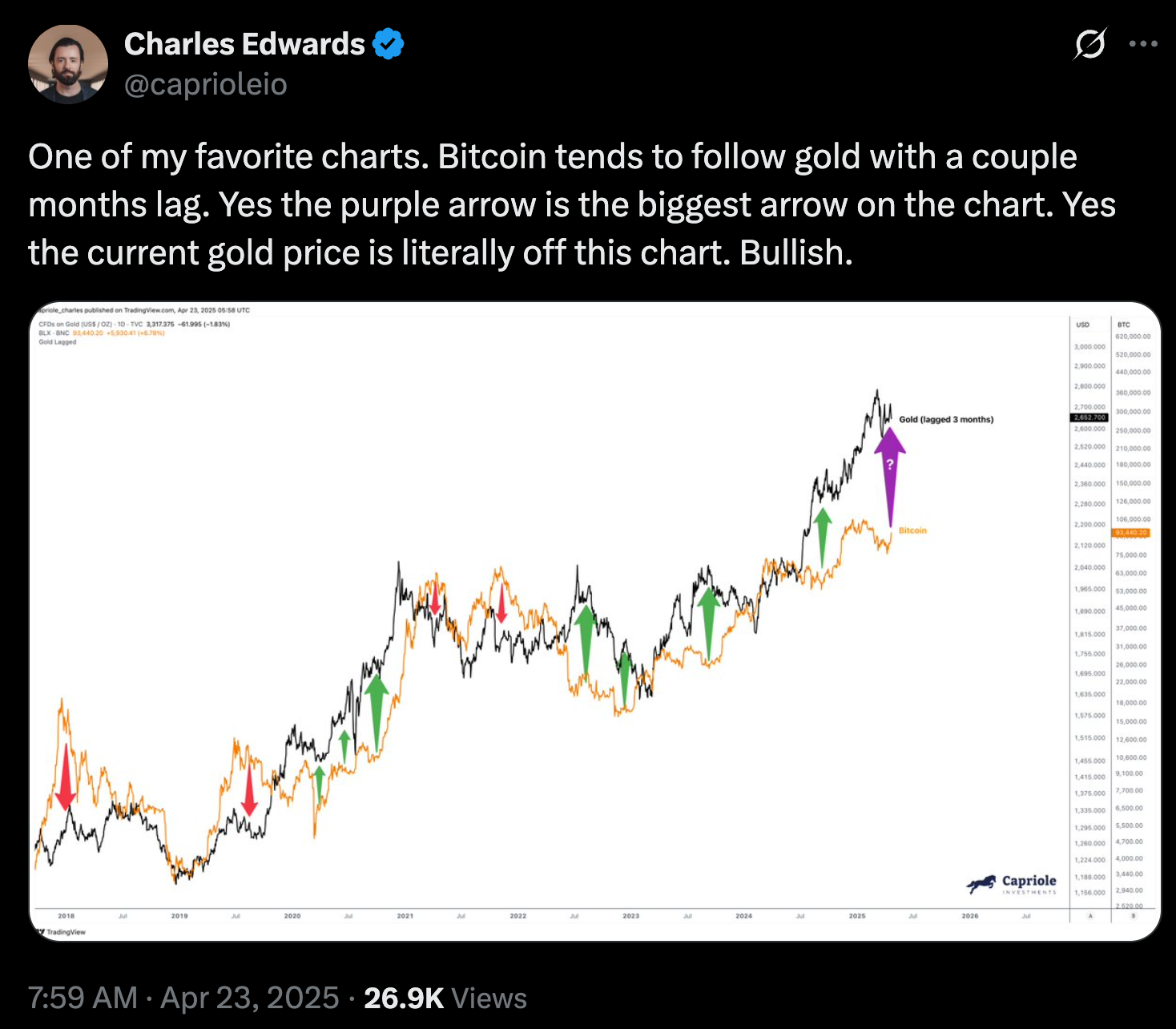

Gold stalling after a massive rally could bode well for bitcoin, said Charles Edwards, founder of bitcoin-focused hedge fund Capriole Investments. Posting a chart on X on Wednesday, he noted that BTC historically followed gold’s gains with a few-month lag.

"Bitcoin is showing significant strength," Edwards said in an X post. "We have decoupled from risk assets and the market is now starting to front-run the fact that Bitcoin is digital gold. If risk assets were to decay further from here, BTC is the ultimate QE [quantitative easing] hedge."