Bitcoin Pushes Higher While ETH Surges Past $4k as Market Sentiment Plunges into ’Fear’ Zone

Crypto markets defy gravity as Bitcoin climbs and Ethereum smashes through psychological barrier.

The Fear Gauge Awakens

Market sentiment tanks into fear territory while digital assets stage a counterintuitive rally. Bitcoin edges upward as Ethereum rockets back above the $4,000 threshold—creating the kind of market dislocation that makes traditional finance guys check their Bloomberg terminals twice.

Contrarian Signals Flash

Fear metrics spike just as major cryptocurrencies post gains. The divergence between sentiment indicators and price action suggests either impending correction or one of those beautiful moments when crypto reminds everyone it plays by its own rules.

Wall Street's Nightmare Scenario

Nothing terrifies institutional investors more than assets that refuse to follow predictable patterns. While traditional markets obsess over fear indices, crypto assets demonstrate their signature volatility—proving once again that decentralized markets operate on a different emotional frequency than their centralized counterparts.

Sometimes the market needs to feel fear just to remember what real opportunity tastes like.

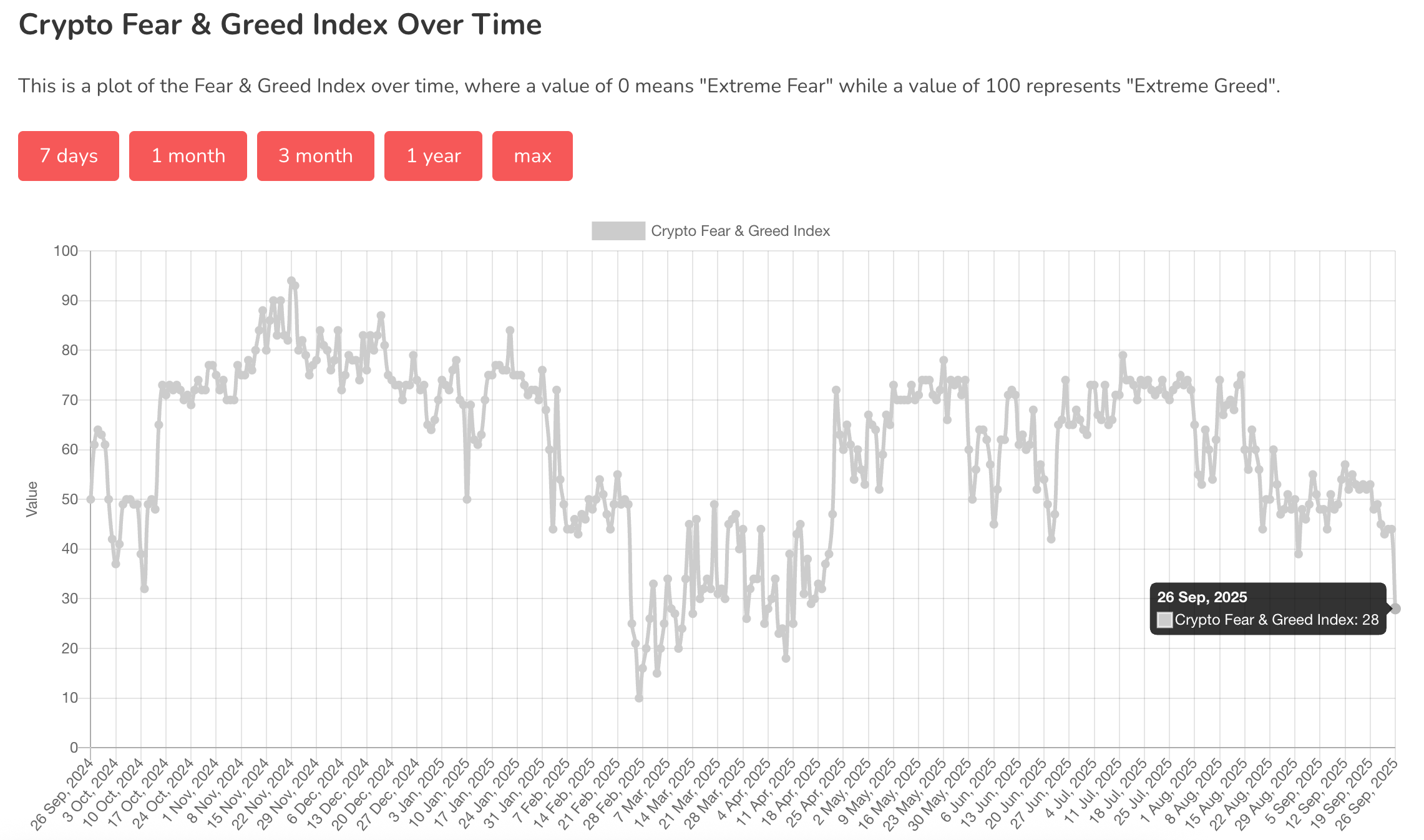

Crypto sentiment turns fearful

Meanwhile, sentiment in crypto remained fragile. The Fear & Greed Index, a well-followed sentiment indicator, plummeted to 28 on Friday, its most depressed level since mid-April signaling "fear" among traders. That reflected recent volatility after Thursday's $1.1 billion liquidation wave wiped out Leveraged long positions.

"In recent days, roughly $3 billion of levered longs have been liquidated," noted Matt Mena, strategist at digital asset manager 21Shares. With excess leverage largely flushed out, he said positioning has swung to an extreme bearish, Mena noted: popular tokens such as BTC, SOL, and Doge now show a long-to-short ratio of just one-to-nine.

That, combined with the Fear & Greed Index at NEAR extremes lows, "sets the stage for a potential short squeeze," Mena argued.

Paul Howard, senior director at trading firm Wincent, didn't share to positive outlook and warned that the market could drift lower before stabilizing. He pointed to BTC dipping below its 100-day moving average under $110,000 and the total crypto market cap sliding under $4 trillion as signs of weakness.

"The market is in a healthy correction without panic or significant uptick in volatility," he said. "It is likely that we grind lower the coming weeks,” adding he is beginning to question whether crypto revisits record highs in 2025.