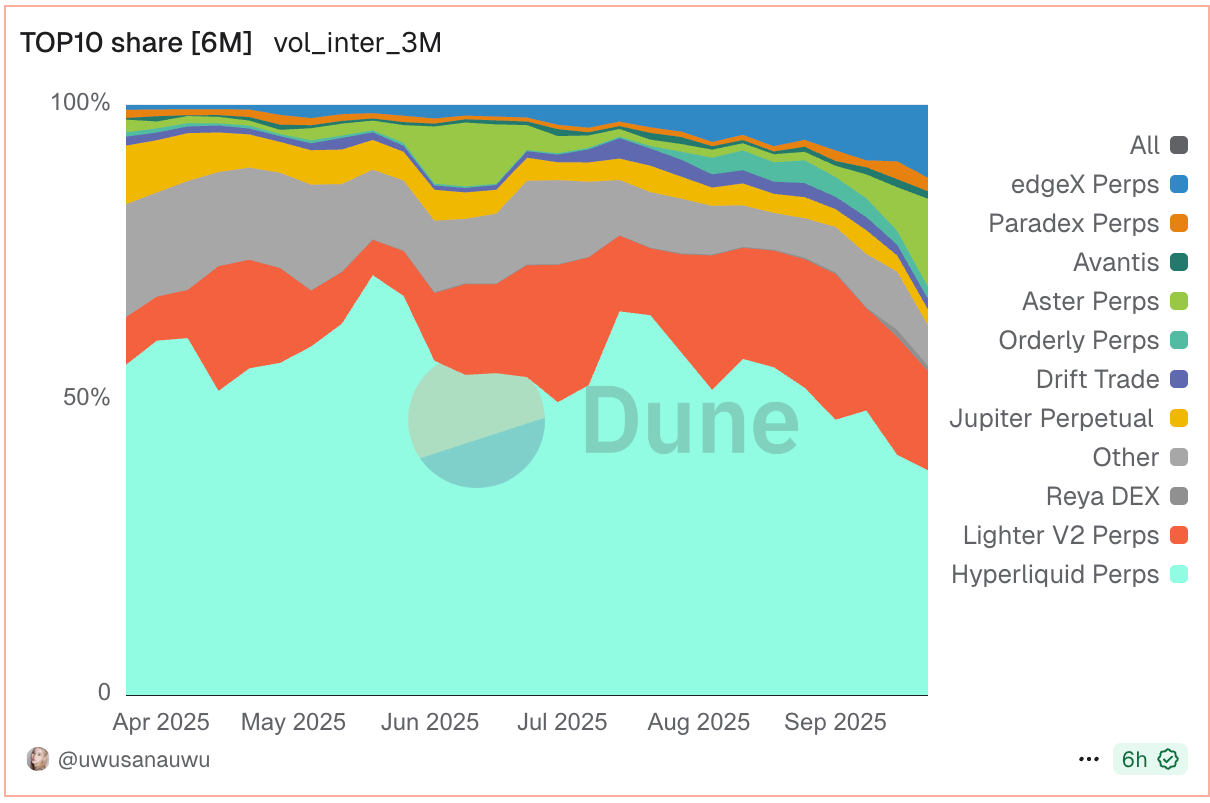

Hyperliquid’s Perpetual Share Plummets to 38% as Aster and Lighter Seize Market Momentum

Hyperliquid's dominance in perpetual trading faces brutal reckoning as competitors carve up the derivatives landscape.

Market Share Erosion Accelerates

Aster and Lighter aren't just gaining ground—they're rewriting the rulebook. Hyperliquid watches its perpetual share collapse to 38% while newcomers demonstrate what traders actually want: faster execution, lower fees, and interfaces that don't require a finance degree to navigate.

The Shifting Derivatives Battlefield

Perpetual contracts become the new battleground as protocols fight for liquidity. Aster's innovative risk engine and Lighter's simplified trading experience expose the vulnerabilities in legacy infrastructure. Turns out building a better mousetrap actually works—even in crypto.

Wake-Up Call for Established Players

When your market share drops to 38% in a space that moves at light speed, it's not a dip—it's a trend. The perpetual wars just entered their most brutal phase yet. Maybe traditional finance's 'too big to fail' mentality doesn't translate well to decentralized markets after all.

The on-chain perpetual market has experienced rapid growth. All platforms combined have registered a cumulative trading volume of nearly $700 billion over the past four weeks, with activity reaching $42 billion in the last 24 hours alone.

The number of protocols has grown significantly from just two in 2022 to over 80 as of today. This expansion perfectly exemplifies capitalism at work: a thriving market attracts a flood of new entrants, increasing competition and eroding the market share and profitability of early pioneers.

The absence of traditional barriers to entry or exit, a key feature of the crypto market, allows anyone with the technical know-how to launch new protocols and compete.

Lately, a war of sorts has been unfolding between Hyperliquid and Aster. Last week, Hyperliquid listed Aster's native token ASTR, allowing users to long or short the token with 3x leverage. On Monday, Aster responded by offering Hyperliquid's HYPE perpetuals with 300x leverage.