Solana Skyrockets as Galaxy Digital Snatches $700M+ in Tokens From Exchanges

Massive institutional move sends SOL prices soaring—while exchanges watch their reserves drain.

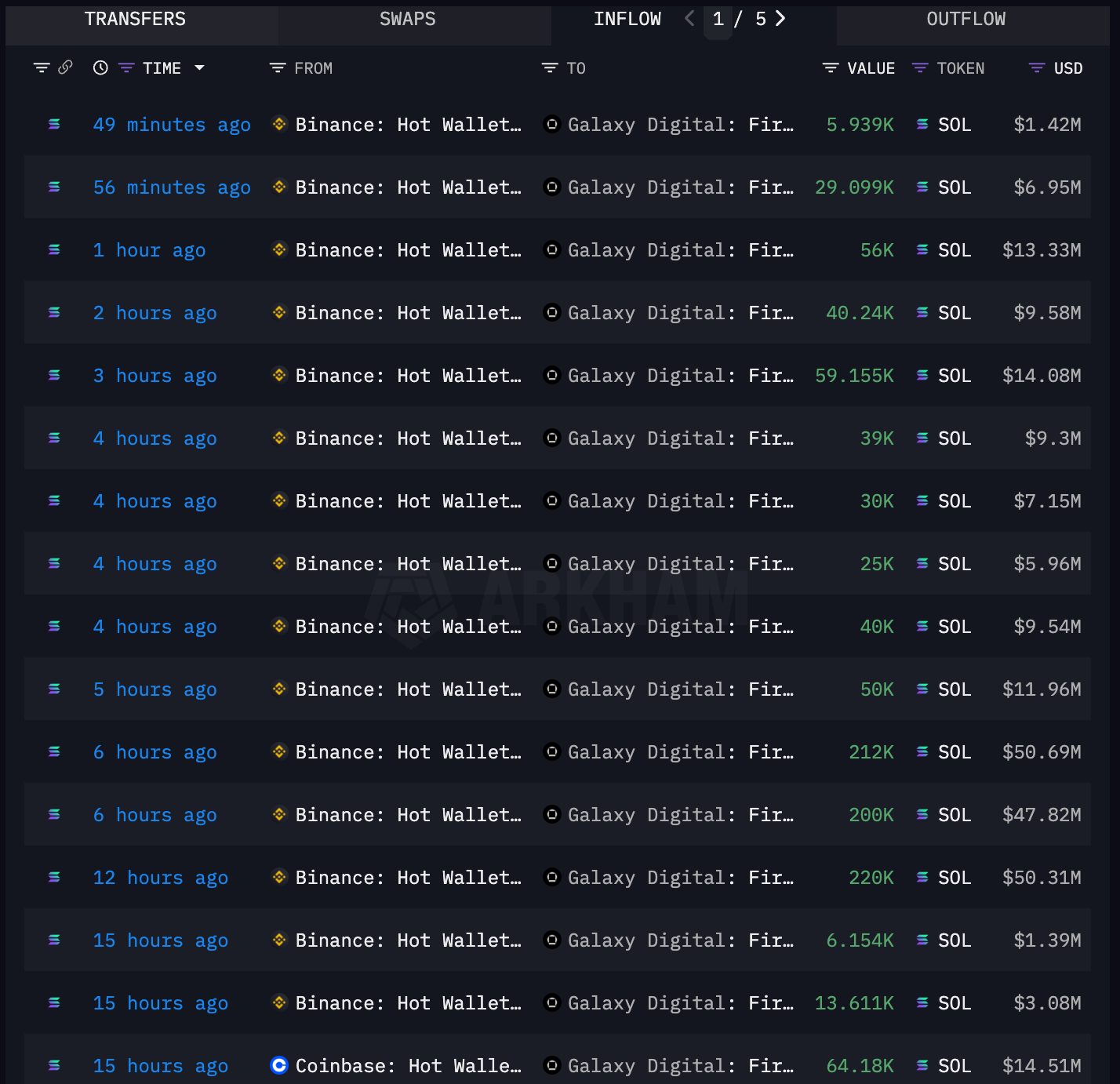

The Whale Movement

Galaxy Digital just pulled over $700 million worth of Solana tokens off major trading platforms. That’s not a casual buy—it’s a statement. One that’s lit a fire under SOL’s price and left traders scrambling.

Supply Shock in Motion

When this much liquidity vanishes from order books, volatility follows. Prices don’t just creep—they jump. And with fewer tokens available for trading, even modest demand can push valuations higher. Fast.

Institutions Aren’t Waiting

This isn’t retail FOMO. This is capital moving with purpose. Galaxy’s play signals deep conviction—not hopium. They see value. They execute. No committees. No memos. Just action.

Exchanges Left Holding Empty Bags

Crypto platforms love to talk liquidity—until a real player shows up and takes it. Suddenly, that deep order book looks… shallow. Almost like traditional finance, where the big boys eat first and everyone else gets crumbs.

The transactions may have to do with Forward Industries (FORD), the digital asset strategy company with a $1.65 billion cash pile to build a solana treasury. Galaxy was a lead investor in the fundraising round, while its asset management division was tasked to "actively manage" Forward's war chest, according to a press release.

Solana season

Solana's outperformance could continue, Bitwise CIO Matt Hougan forecasted earlier this week, as incoming demand from treasury companies and spot ETF anticipation could have an outsized impact and SOL, given its smaller market capitalization compared to bitcoin (BTC) and ether (ETH).

Mike Novogratz, CEO of Galaxy, echoed that view in a Thursday CNBC interview, saying that the market could be entering the "season of SOL." He pointed to crypto investment firm Pantera's upcoming Solana treasury company and the potential approval of SOL ETFs, bringing in fresh money for the crypto.

His firm also chose the Solana blockchain to tokenize its stock with Superstate earlier this month.