Traders Ramp Up Nine-Figure Bullish Bitcoin Bets—Liquidation Risks Soar

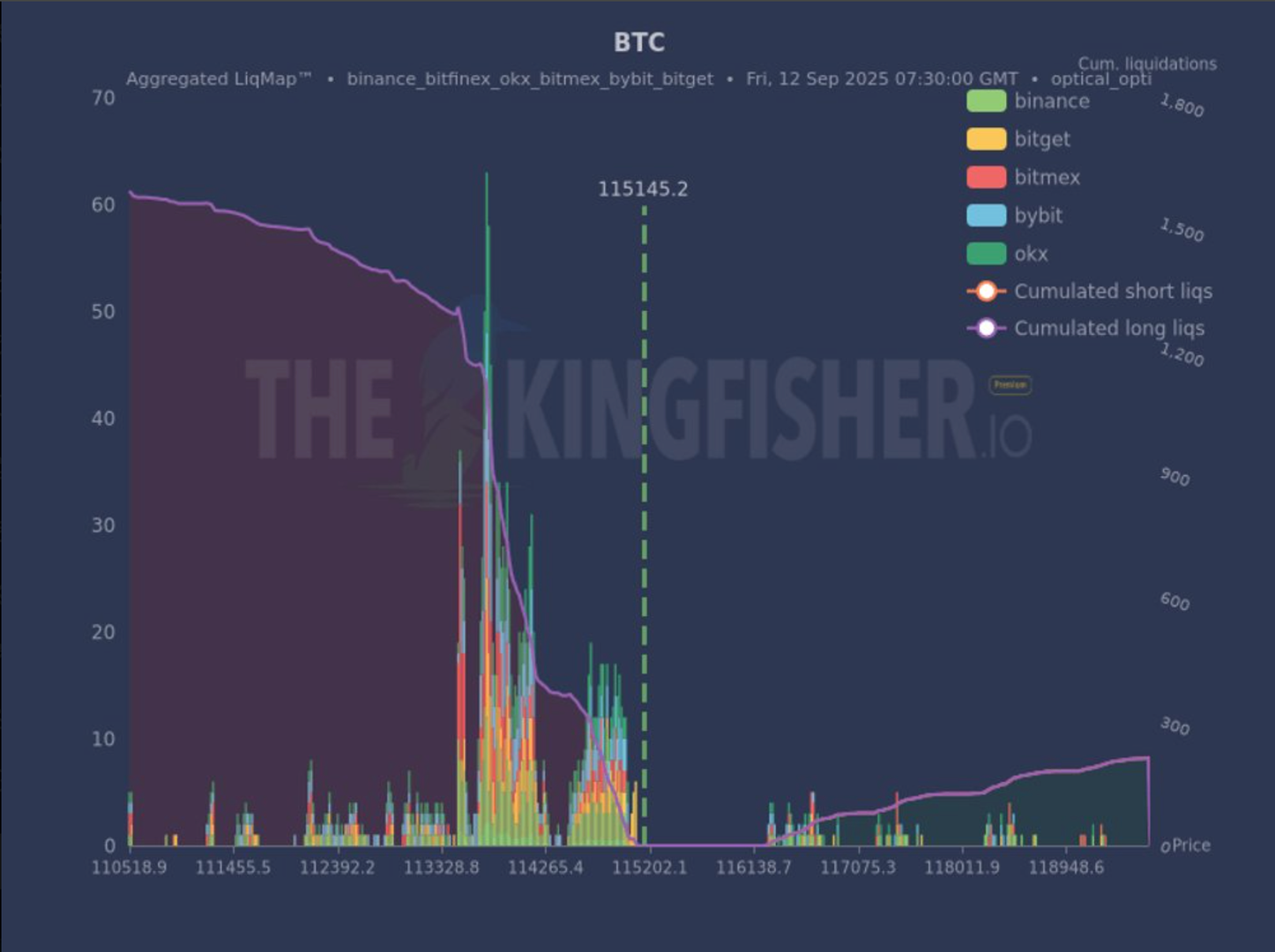

Massive long positions hit the Bitcoin market as institutional players place nine-figure bullish bets—setting the stage for potential liquidation cascades.

The Leverage Gamble

Futures markets show traders stacking aggressive long positions at current levels. These aren't retail punts—these are institutional-sized moves betting big on continued upside.

Liquidation Triggers Loom

Such concentrated positioning creates fragility. Any sudden downside move could trigger automated liquidations—forcing sells that accelerate price declines. It's a high-stakes game of chicken with volatility.

Market Mechanics Under Stress

Derivatives exchanges face mounting pressure as open interest swells. The system handles it—until it doesn't. Remember—liquidity often vanishes exactly when you need it most.

Because nothing says 'prudent risk management' like betting nine figures on an asset that once dropped 80% in three weeks. The crypto casino remains open for business.