BNB Slips Below $860 as Traders Brace for U.S. Jobs Data

BNB breaks critical support level as macroeconomic anxiety grips crypto markets.

Traders dump positions ahead of key employment report—because nothing says 'digital asset revolution' like sweating over traditional economic indicators.

The $860 level collapses under selling pressure as risk-off sentiment dominates.

Market watches for Fed reaction function—because apparently decentralized finance still dances to central bankers' tune.

Next support awaits at $820, but don't tell the 'this time it's different' crowd.

Technical Analysis Overview

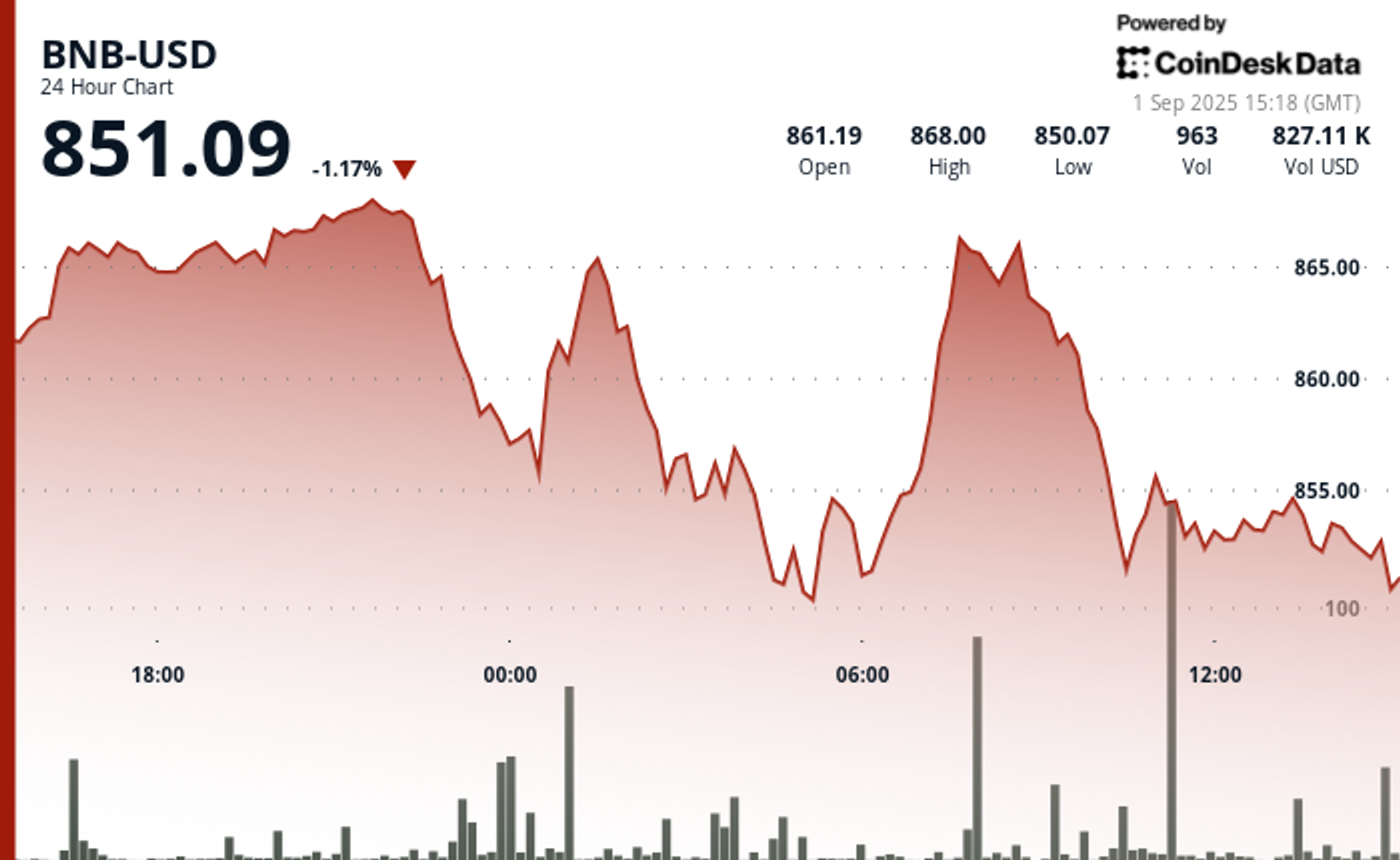

BNB entered the session with a surge from $860.30 to $868.08, but the rally quickly lost steam. Heavy selling pressure emerged around the $867–$868 level, a zone that has now established itself as a key resistance ceiling, according to CoinDesk Research's technical analysis model.

Volume surged during this attempt, peaking at 72,000 tokens, well above the average of 54,000, indicating a high level of participation during the failed breakout.

After the rejection, BNB retraced toward the $850–$855 range, where buying interest emerged. This was most visible as the token dipped to $851.40, triggering a volume spike. This response pointed to solid demand at these lower levels.

Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk's full AI Policy.