Bitcoin’s 2025 Second Half Outlook: Bullish Projections Signal Market Transformation

Bitcoin defies traditional finance once again—climbing toward unprecedented territory as institutional adoption accelerates.

The Halving Effect

Supply constraints from the 2024 halving event continue fueling upward momentum. Miners face squeezed margins while hodlers reap rewards—classic Bitcoin economics playing out exactly as Satoshi designed.

Institutional Tsunami

BlackRock's ETF dominance reshapes capital flows. Wall Street finally gets it—digital gold isn't going anywhere. Meanwhile, traditional banks scramble to offer crypto services while regulators play catch-up.

Technical Breakout Territory

Breaking past previous all-time highs wasn't a fluke. Sustained volume and growing network activity suggest this rally has legs. Retail FOMO hasn't even kicked in yet.

Global Macro Tailwinds

Currency debasement continues worldwide. Bitcoin's fixed supply looks increasingly attractive as central printers keep humming. Because nothing says 'sound money' like politicians promising fiscal responsibility.

The cynical take? Traditional finance will eventually co-opt and dilute crypto's revolutionary potential—but not before making early adopters filthy rich. The revolution will be monetized.

Price outlook

Our analysis for the remainder of 2025 forecasts Bitcoin reaching a target ofdriven by a Fed policy pivot and rate drop expectations in the United States, beneficial liquidity conditions and the increasingly positive crypto regulatory environment.

The latest announcement from the Trump administration allowing cryptos into 401(k)s adds an extra layer to the crypto adoption narrative, and a clear pathway to expanding the existing crypto market cap via the estimated 9 trillion USD retirement market in the United States.

Unknown block type "divider", specify a component for it in the `components.types` optionOn September 9 at 11:00am ET join Michelle Noyes from AIMA and Andy Baehr from CoinDesk Indices as they discuss building a sustainable business in the cyclical markets of crypto. Register today. https://aima-org.zoom.us/webinar/register/4917558078322/WN_3jAGIrqMTK2z7e74q5bkWg#/registration

CoinDesk: Policy & Regulation in Washington D.C. on September 10th. The agenda includes senior officials from the SEC, Treasury, House, Senate and OCC, plus private roundtables and unparalleled networking opportunities. Use code COINDESK15 to save 15% on your registration. http://go.coindesk.com/4oV08AA.

Unknown block type "divider", specify a component for it in the `components.types` optionOngoing crypto catalysts

Quantitative models and risks

Our quantitative models remain positive and show significant scope for further upside in bitcoin and the broader market:

- Our Vanguard model, which is a trend detection system, continues to generate long conviction weekly signals.

- Weekly price closes above $119,000 will keep the bullish sentiment alive and cement the technical backdrop for further upside into uncharted waters for bitcoin.

Source: Biyond.co, August 2025

Risks

- An acceleration of negative data points in the United States, leading to stagflation fears and risk-off over fears of a global slowdown.

- A significant pullback in the S&P 500 in Q3, possibly from the 6,660 level, which remains a primary target.

- Negative tariff headlines, and more specifically, a breakdown in Sino-U.S. trade talks.

- Extensive profit taking from ETF holders if bitcoin crosses $150,000 or even $160,000

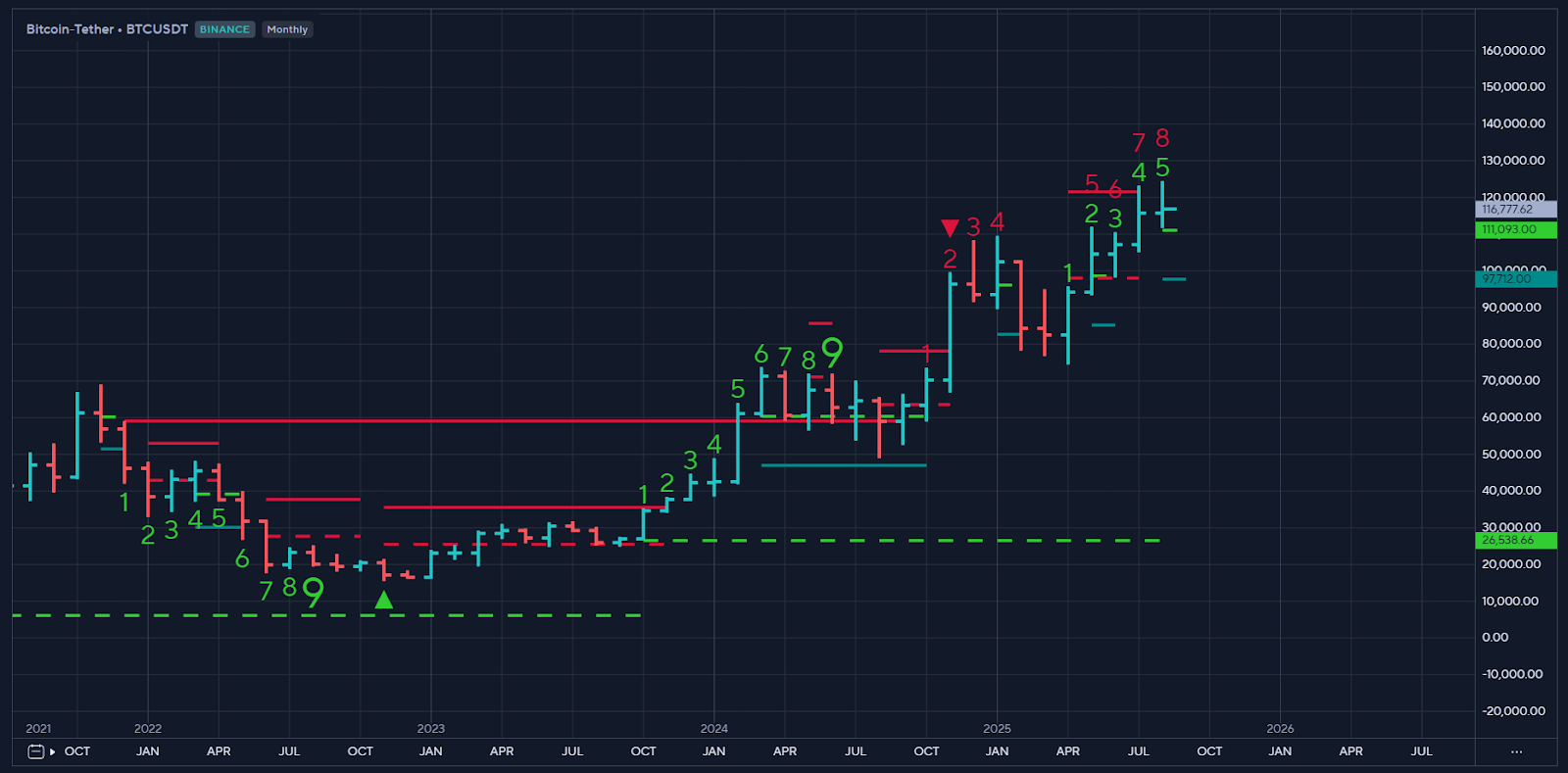

Insights from Demark indicator

Demark TD sequential monthly chart is pointing to a possible top at the end of the year with the index moving towards setup 9 and countdown 13. When the Demark indicator has approached 9 or 13 previously, it has signalled strong overbought exhaustion.

Source: Symbolik Demark TD Sequential

Crypto total market cap

The potential breakout of the crypto total market capitalization chart presents another dynamic to the ongoing and previously mentioned bullish catalyst for the crypto market. Namely:

- An initial Q3 target of five trillion USD.

- A broad-based crypto market rally encompassing the top 150 cryptos.

- Limited scope for downside under 4 trillion USD once a definitive chart breakout occurs.

Conclusion

Bitcoin and the cryptocurrency market are well-placed to explode to new trading highs, with projections expected to reach between, and a five trillion USD market capitalization.

Key upcoming risk events include higher CPI readings in the coming months and a halt in trade negotiations between the United States and China, although we feel it is far more likely a “kicking of the can” down the road and an extension of ongoing trade talks to appease markets.

Based on all the positive developments surrounding bitcoin and technical indicators, a strong case can be made for further strong price appreciation running into year-end.