DOGE Futures Open Interest Drops 8% Despite Golden Cross Holding Strong on Higher Timeframes

Dogecoin's futures market shows cracks as open interest tumbles—yet the technical setup refuses to break.

Open Interest Takes a Hit

DOGE futures open interest slid 8% this week, signaling cooling leverage among traders even as the meme coin's longer-term charts flash bullish. The drop hints at profit-taking or risk-off moves despite the so-called 'golden cross' pattern staying intact on daily and weekly frames.

Golden Cross: Still in Play?

That golden cross—where the 50-day moving average climbs above the 200-day—hasn't budged. Higher timeframes suggest underlying strength, even if short-term speculators are pulling back. Classic crypto behavior: the charts look good until someone remembers this was all started as a joke.

Market Mood vs. Technical Reality

Traders love a narrative, but sometimes the numbers tell a messier story. DOGE's holding key levels, but fading futures interest could foreshadow volatility. Remember: in crypto, 'technical strength' often just means 'not crashing yet.'

News Background

Market attention turned to Doge after a 900 million token transfer (valued at over $200 million) was tracked moving to Binance wallets. The move raised concerns about short-term sell pressure just as the token’s rally toward $0.25 ran into resistance. Meanwhile, on-chain data showed whales accumulated over 680 million DOGE in August—suggesting deeper-pocketed investors remain positioned for long-term upside even as near-term technicals weaken.

Macroeconomic context also weighed on sentiment. Risk assets pulled back following fresh trade policy headlines and hawkish central bank commentary. Futures open interest in DOGE dipped 8%, reflecting lighter speculative positioning despite the month’s whale activity.

Price Action Summary

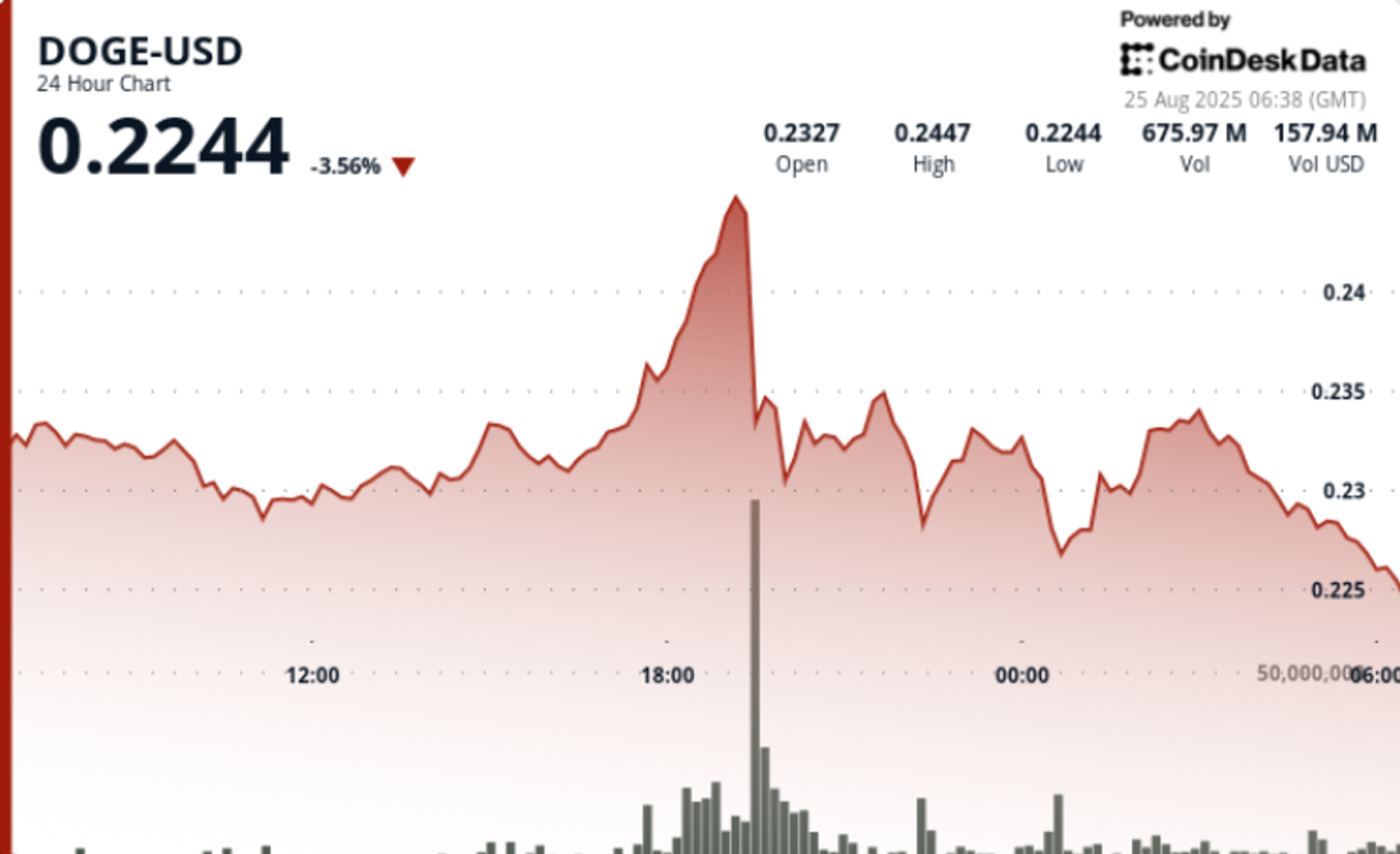

• DOGE traded in a wide $0.02 range (8%) between $0.23 lows and $0.25 highs in the 24-hour period from August 24 at 06:00 to August 25 at 05:00.

• The key breakout occurred at 19:00 UTC on August 24, when DOGE spiked to $0.25 on 2.29 billion volume—multiple times the daily average.

• The move quickly reversed, with prices sliding to $0.23 and settling at $0.23 by session close, down 3% from the open.

• In the final hour (04:44–05:43), DOGE fell another 0.4% as heavy volume broke through $0.229 intraday support, hitting lows NEAR $0.228 before closing at $0.228.

Technical Analysis

•: Heavy rejection at $0.25 confirmed strong overhead supply, with 2.29 billion tokens traded at the peak.

•: Multiple retests anchored support near $0.23, though pressure persisted through late-session deterioration.

•: Range-bound consolidation ($0.228–$0.233) suggests buyers defending support but momentum favoring sellers.

•: Spikes of 10–12 million per minute during the 05:07–05:08 window signal institutional distribution.

•: A golden cross remains intact on higher timeframes, but immediate momentum skews bearish without a reclaim of $0.24.

What Traders Are Watching

• Whether $0.23 holds as durable support—loss of this level could open downside toward $0.21 psychological zone.

• Follow-through on whale transfers: more Binance inflows could intensify sell pressure, while further accumulation WOULD counterbalance.

• Futures positioning: OI contraction suggests sidelined leverage, but a rebound could fuel the next move.

• Macro backdrop: risk assets remain sensitive to central bank policy; dovish turns could provide relief rallies.

• Broader meme coin flows: correlation with SHIB and PEPE rallies remains a secondary driver of speculative flows into DOGE.