Bitcoin Flash Crash Erases Powell Gains as Options Market Flashes Warning Signs

Bitcoin just pulled a classic crypto move—skyrocketing on Fed chatter before imploding in a violent flash crash. The options market's pricing in serious turbulence ahead.

Powell's Pivot Pump

Jerome Powell's latest comments sent traders scrambling. Bitcoin ripped upward—another knee-jerk reaction to central bank semantics. Then came the rug pull.

Options Anxiety Spikes

Derivatives traders aren't buying the hype. Put options are stacking up, signaling big money expects more downside. The smart money's hedging while retail chases pumps.

Same Old Story

Digital gold? More like digital whiplash. Bitcoin's still dancing to the Fed's tune—just with more leverage and bigger crashes. Some things never change, even in decentralized finance. Traders might want to buckle up—this ride's getting bumpy.

Powel spike reversed

The price drop has erased gains seen after Friday, after the Fed Chair Jerome Powell appeared to support the idea of rate cuts, while playing down the long-term inflationary impact of President Trump's tariffs during his annual speech at Jackson Hole.

The so-called dovish speech saw BTC rally nearly 4% from $112,500 to $116,900 alongside a risk-on rally in U.S. stocks and the decline in the dollar index.

Over the weekend, the analyst community expressed confidence that a rate cut would occur in September, potentially leading to new all-time highs in Bitcoin and ether.

Options disagree

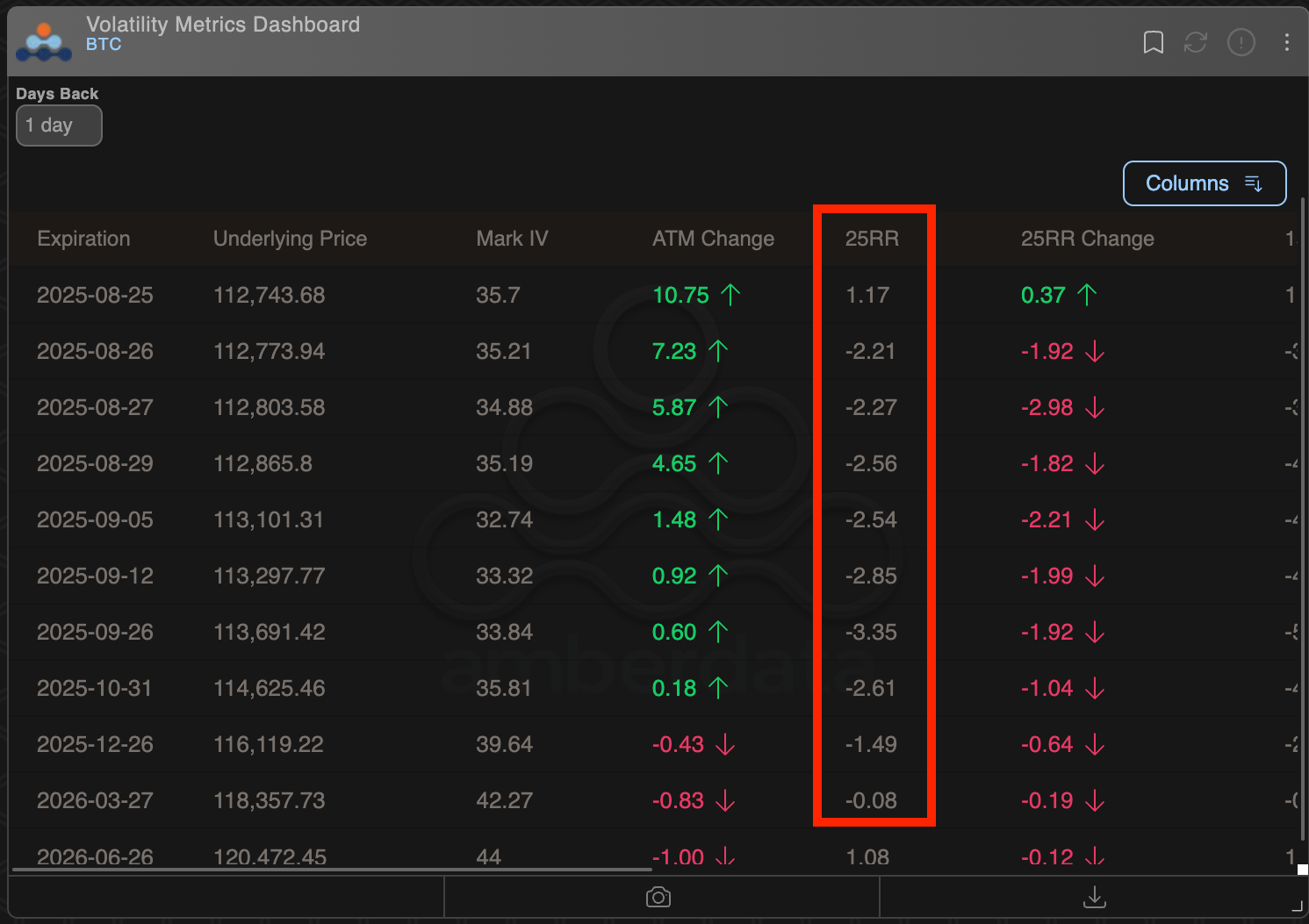

The Deribit-listed bitcoin options reveal a lingering risk aversion, according to data tracked by Amberdata.

Specifically, the 25-delta risk reversals, a measure of investor sentiment comparing calls to puts, continue to trade in the negative territory through the December expiry, reflecting hedging activity and a bearish title.

A negative risk reversal means that put options, which offer insurance against price declines, are more expensive than call options.

In other words, despite the so-called dovish pivot by Powell, BTC options traders continue to price in uncertainty, bracing for a potential downside volatility.