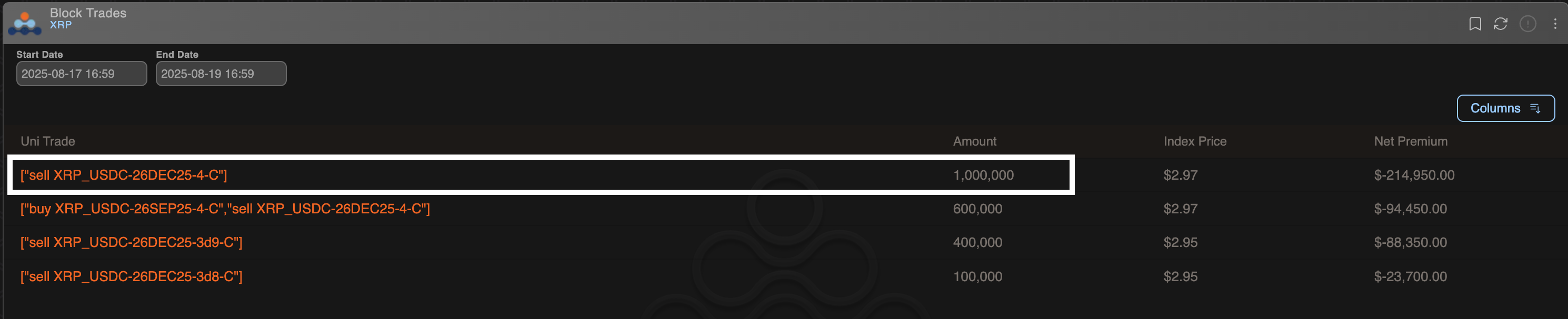

Massive 1M Block Trade of $4 XRP Calls Hits the Tape Amid Falling Prices

Whale alert just got real—someone's placing a million-dollar bet against the tide.

While retail panics, the big players are loading up on XRP calls like there's no tomorrow. That $4 strike price? Pure conviction play.

Block trades don't lie—they scream opportunity when everyone else hears alarm bells. Smart money's stacking contracts while weak hands fold.

Remember: the market always rewards those who buy when there's blood in the streets—even if it's mostly from paper cuts.

The covered call strategy involves writing higher strike out-of-the-money call options against a long position in the spot market. This helps the investor earn an extra yield on top of the coin stash, which comes from the premium received for selling the call option. The setup, however, limits the potential upside gains.

The covered call strategy is popular among BTC holders, and its increasing adoption has contributed to a steady decline in implied volatility over the past two years.

XRP's price briefly fell to $2.94 on Monday, tracking the broader market swoon and has since stabilized just above $3. Prices hit a record high of over $2.6 last month, CoinDesk data show.