DOGE Battles at 22-Cent Line: $782M Trading Frenzy Triggers Stop-Loss Avalanche

Dogecoin's make-or-break moment hits as volatility spikes.

The meme coin's latest stress test comes with a side of liquidations.

When the 22-cent support wobbled under $782M in volume, the cascade began—a textbook case of overleveraged traders getting rekt while whales feast. Classic crypto.

Technical traders eye the next resistance level, but let's be real—this is DOGE we're talking about. Since when did fundamentals matter?

One thing's certain: when this much money moves this fast, someone's getting rich. And it's probably not you.

News Background

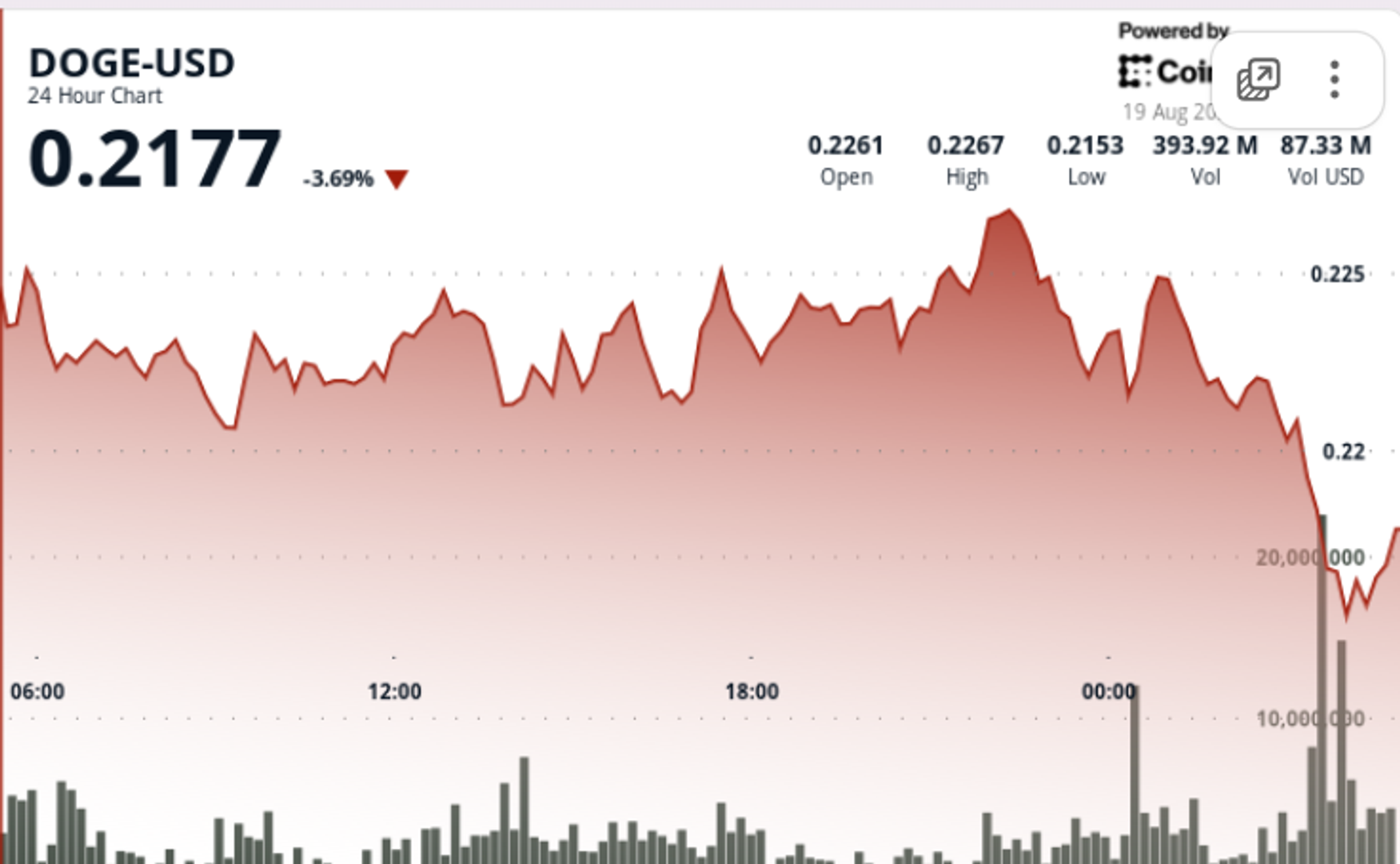

• Dogecoin dropped from $0.23 to $0.22 in a 24-hour window ending August 19 at 04:00, marking a 4% decline.

• A sharp liquidation wave hit between 03:00-04:00, where volumes spiked to 782 million DOGE — nearly double the daily average.

• The decline occurred as industry-wide liquidations topped $1 billion, triggered by U.S. inflation prints beating expectations and denting Fed rate-cut hopes.

• Despite the drop, institutional buyers have accumulated 2 billion DOGE worth about $500 million this week, bringing total reported holdings to 27.6 billion.

Price Action Summary

• DOGE traded within a $0.01 band, reflecting 5% intraday volatility.

• Overnight crash drove the token to test $0.22 support, now viewed as the key level to defend.

• A late-session rebound attempt lifted prices modestly back toward $0.22, signaling demand at the lows.

• Resistance is building NEAR $0.23, where profit-taking and heavy sell orders reappear.

Technical Analysis

• Breakdown from $0.23 invalidates prior bullish structure, with $0.22 emerging as new short-term floor.

• Volume surge of 782 million Doge validates capitulation selling — a potential precursor to bottom formation.

• Support: $0.22 (critical), followed by $0.21 if pressure persists.

• Resistance: $0.23 (immediate), $0.25 (major breakout threshold).

• Indicators suggest mixed signals: RSI approaching oversold, but momentum remains negative.

What Traders Are Watching

• Whether institutional accumulation continues if $0.22 cracks — signaling smart money conviction or retreat.

• Broader market risk sentiment: equity weakness and macro headwinds remain the dominant driver.

• $1 billion+ in crypto liquidations highlight fragility; another macro shock could deepen downside.

• A reclaim of $0.23 WOULD be seen as a short-term reversal trigger, otherwise $0.21 support test is likely.