XRP Slams Into $3.09 Wall – Bears Now Eyeing $2.96 Lifeline

XRP hits a brick wall at $3.09 as resistance holds firm—now the battleground shifts to the $2.96 demand zone. Will buyers step in or let the bears run wild?

### The Rejection That Stings

Another day, another crypto rejection. XRP's rally got smacked down hard at $3.09—classic 'buy the rumor, sell the news' behavior from traders who still think 10% swings are 'stable.'

### Bears on the Prowl

With the $3.09 level holding like a boomer clinging to gold, shorts are now licking their chops at the $2.96 demand zone. A breakdown here could trigger a cascade—because nothing says 'market health' like panic selling.

### The Bigger Picture

Meanwhile, institutional analysts are probably drafting another 'XRP to $10' report—just in time for the next rejection. Stay nimble, folks.

Technical Analysis Shows Mixed Signals

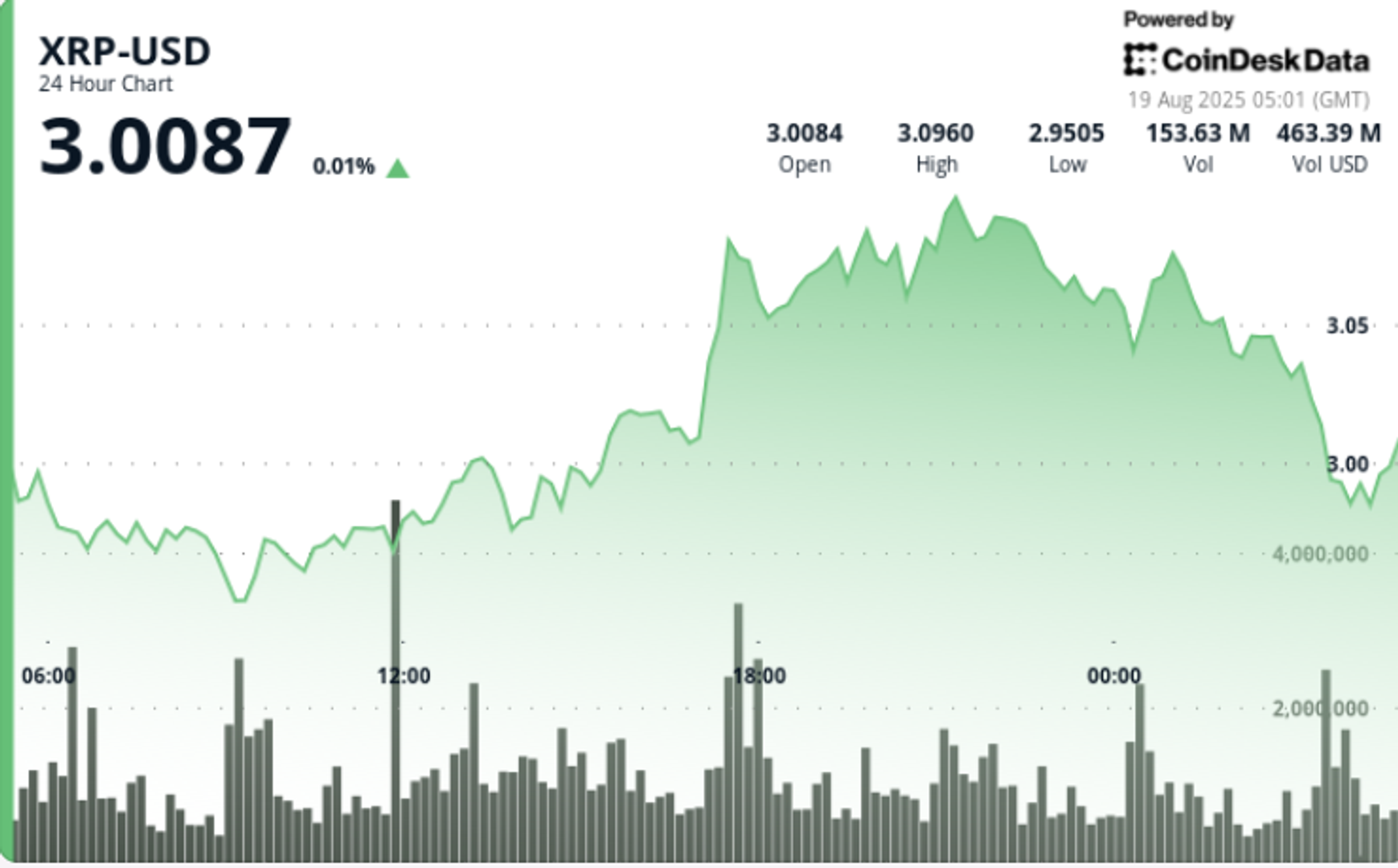

XRP traded within a $0.11 range between $2.94 and $3.10 across the 24-hour session from August 18 05:00 to August 19 04:00, representing nearly 4% intraday volatility. A bullish breakout during the 17:00 trading hour on August 18 pushed prices from $2.97 to $3.10, supported by heavy volume of 131 million—double the 24-hour average of 66.8 million. This established short-term support near $3.00.

Momentum faded quickly, however. The token rejected multiple times at $3.09, sliding into consolidation around $2.99. An aggressive pullback unfolded during the 03:00 hour on August 19, when XRP dropped from $3.04 to $2.99.

Key Market Movements

• XRP declined 1% in the final 60 minutes, sliding from $3.03 to $2.99 as volumes spiked to 5.26 million—five times the hourly average

• Distribution pressure accelerated around the $3.00 psychological threshold, triggering stop-loss liquidations during the 03:43–03:46 interval

• A bullish surge earlier in the session (August 18 17:00) lifted XRP from $2.97 to $3.10 on 131 million volume, far above average activity

Market Dynamics Drive Sharp Reversal

The late-session breakdown confirmed institutional selling near $3.00, erasing the earlier breakout’s momentum. While $2.99 provided intraday stabilization, the volume-backed rejection at $3.09 highlights growing resistance pressure.

XRP now sits at a crossroads: holding above $2.99 could allow bulls to retest the $3.08–$3.09 cluster, while failure risks a deeper correction toward the $2.96 demand zone.

Technical Indicators Summary

• Range: $0.11 (3.8%) between $3.10 peak and $2.94 trough

• Resistance: $3.09, rejected repeatedly through evening sessions

• Support: $3.00 psychological level, tested under high-volume distribution

• Risk: Breakdown toward $2.96 demand zone if $2.99 fails

• Signal: Bullish triangle structure intact, but momentum fading under profit-taking