Conflux’s CFX Skyrockets on China Hype—But Is the Rally Built on Hot Air?

China's crypto darling Conflux is making headlines again as CFX pumps on bullish sentiment—but dig deeper, and the fundamentals might leave you wanting.

The China Factor: Smoke or Fire?

Rumors of regulatory easing and institutional interest sent CFX soaring, proving once again that nothing moves markets faster than whispers in Beijing's halls. Yet analysts warn the project's tech adoption still trails rivals.

The Fundamentals Gap

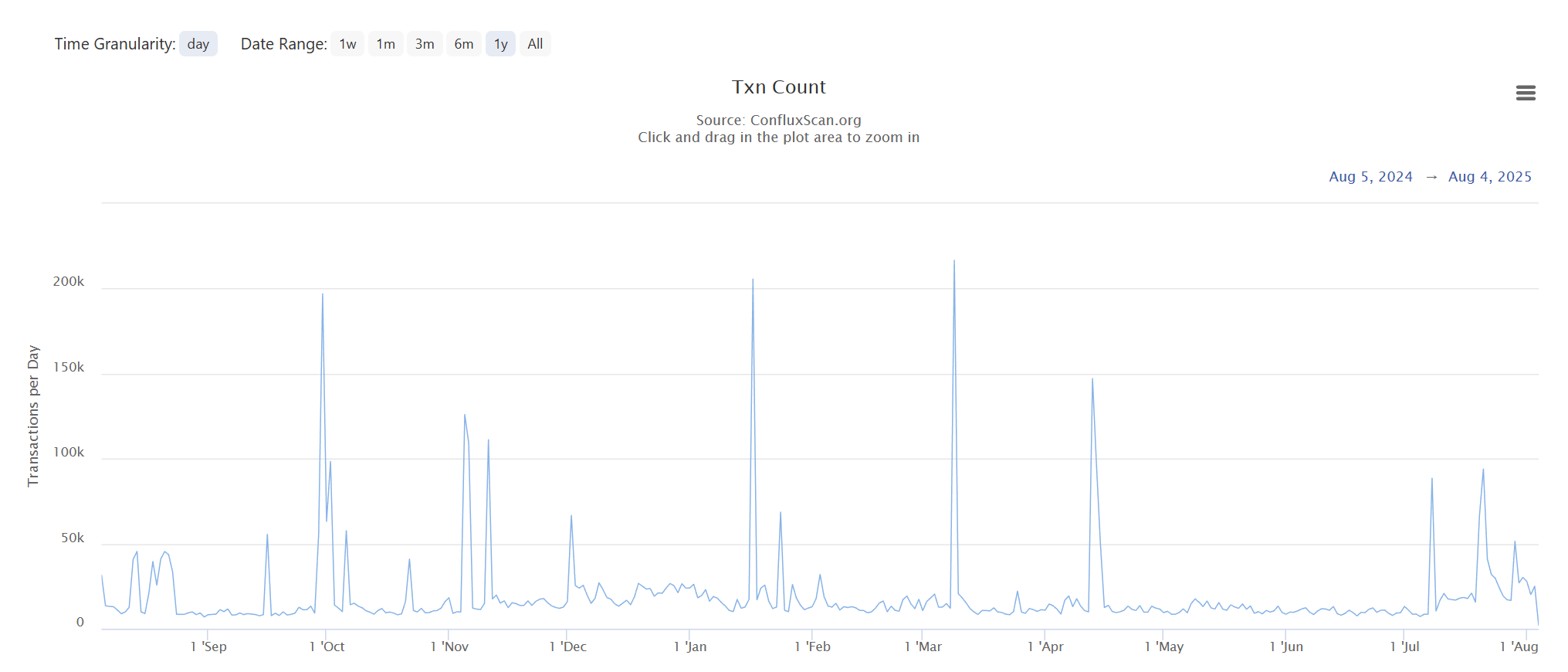

While the token rides the hype wave, questions linger about real-world usage. 'Show me the transactions,' quips one skeptical trader—because in crypto, nothing kills a rally faster than cold, hard metrics.

The Bottom Line

Another day, another 'China narrative' propping up prices. Will Conflux deliver? Only time—and maybe the next Politburo meeting—will tell.

In fact, it's still down from 2022 daily averages.

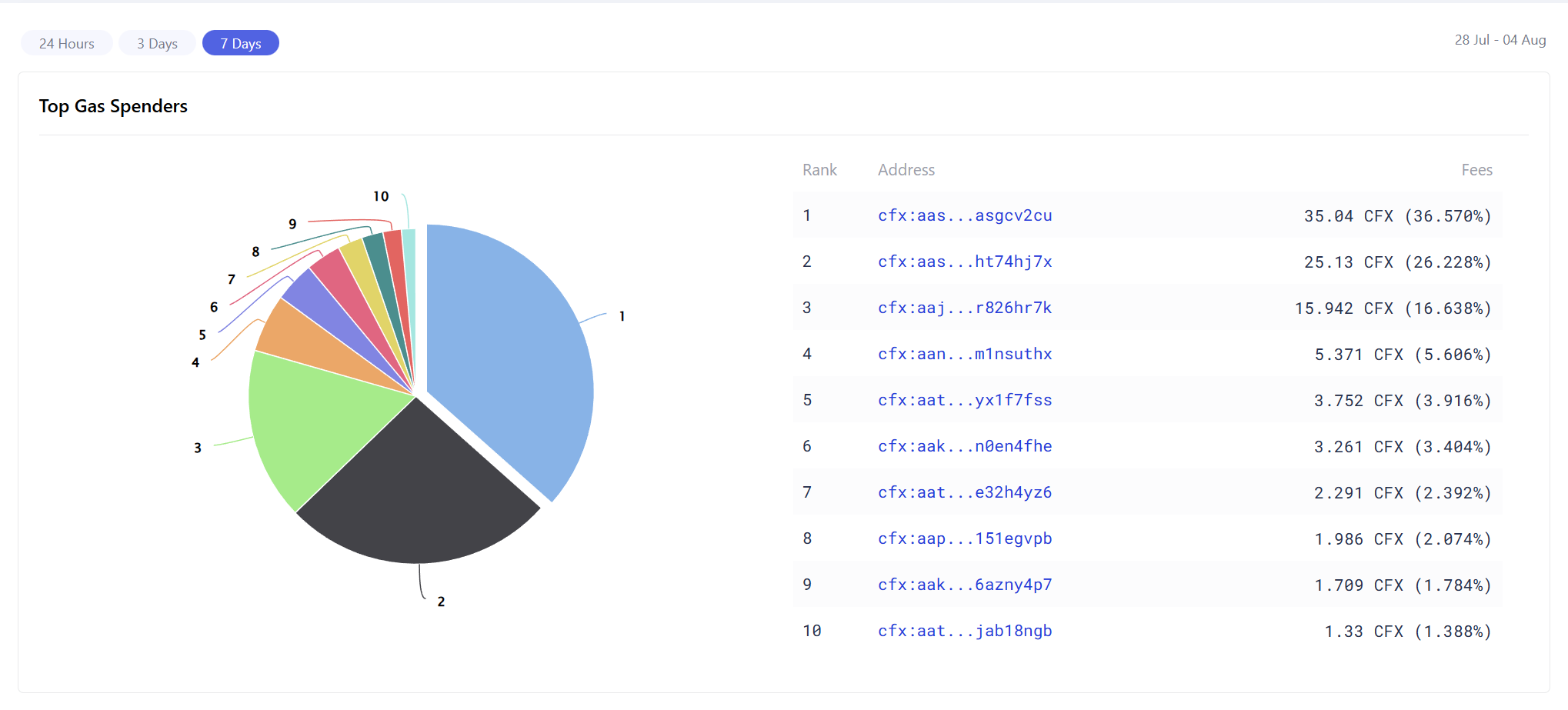

Other on-chain data shows that nearly 80% of the total gas spent in the protocol comes from three accounts, creating a concerning level of centralization.

In contrast, with Ethereum, the largest gas spender accounts for less than 10% of total gas spent on the network.

There certainly is a growing China narrative at the moment. Any sort of rumor that mainland China has banned crypto outright is demonstrably false. Hong Kong's embrace of crypto mirrors how equity markets in Shanghai learned from their counterparts in the city before opening mainland China's stock markets in the 1990s.

However, the question remains: Is Conflux the best proxy for this narrative? On-chain data WOULD suggest otherwise.