Ethena’s USDe Crushes BlackRock’s Bitcoin & Ether ETFs: $3.1B Floods In—Here’s Why

Move over, legacy finance—Ethena’s synthetic dollar USDe just lapped BlackRock’s crypto ETFs with a jaw-dropping $3.1B inflow surge. Who needs a spot ETF when DeFi’s serving yield on tap?

### The Numbers Don’t Lie

While Wall Street’s giants play catch-up with Bitcoin and Ether wrappers, USDe’s growth curve looks like a rocket trajectory. $3.1 billion in fresh capital? That’s not adoption—it’s a stampede.

### Why TradFi Should Sweat

BlackRock’s ETFs might have the ticker tape, but Ethena’s got the algo-stablecoin magic: collateralized shorts, staking yields, and zero custody battles. Guess which one investors are piling into?

### The Cynic’s Corner

Let’s be real—if BlackRock launched this, CNBC would call it ‘innovation.’ When DeFi does it? ‘Too risky.’ Meanwhile, the smart money’s already voting with its wallet.

According to on-chain data curated by the Ethena community, the supply increase since July 17 is the fastest period of growth since the protocol's inception in February 2024.

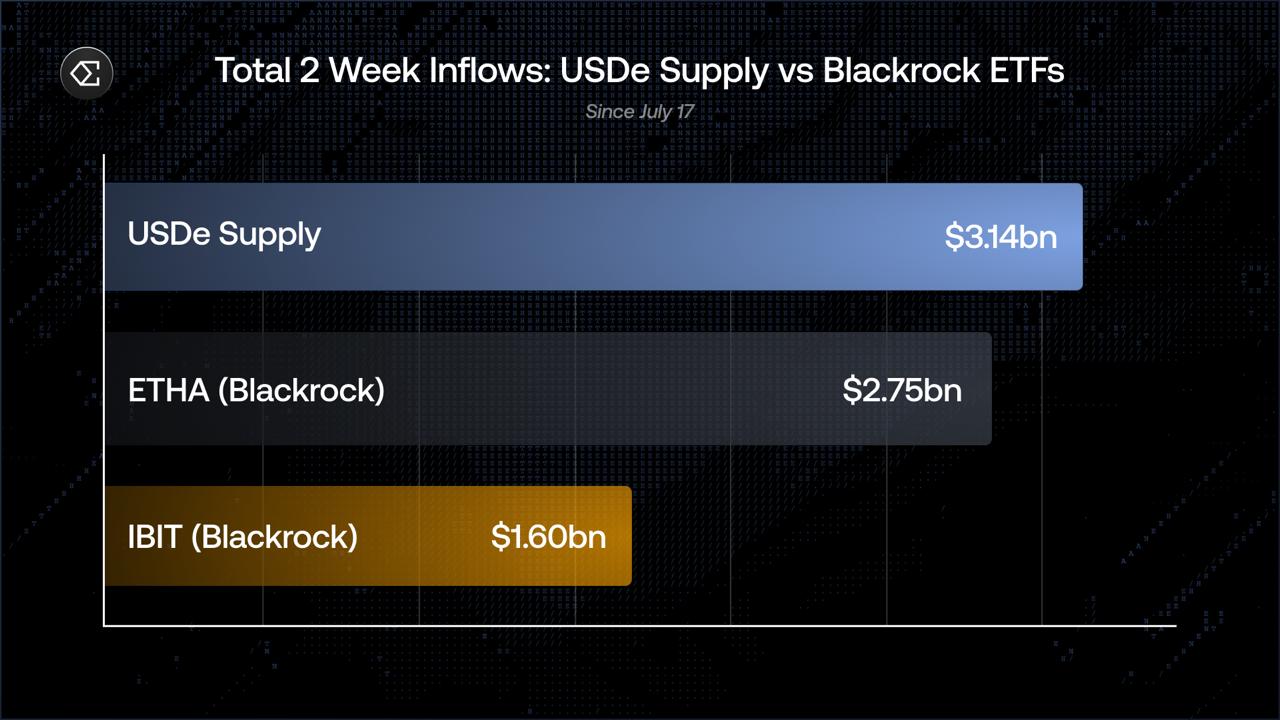

Inflow into the yield-bearing stablecoin exceeds the $2.75 billion added to BlackRock’s ether ETF (ETHA) and the $1.60 billion into its bitcoin ETF (IBIT) in the same period, making the DeFi-native stablecoin the biggest magnet for capital across both on- and off-chain markets in recent weeks.

The rally has spilled over into Ethena’s governance token ENA, which more than doubled in the past month, though it is down 12% in the past 24 hours as traders hope the long-awaited fee switch will soon activate.

The protocol has already surpassed most of the thresholds required to distribute revenue to staked ENA holders, with the final benchmark, a favorable yield spread versus rivals, expected to be met soon.

USDe’s recent growth reflects a powerful reflexive loop built into its Core design, as Nansen explained in a recent research report on the Ethena ecosystem.

As bitcoin and ether prices rally, perpetual funding rates in turn increasingly positive. Ethena captures this funding via delta-neutral hedges, and distributes it as real-time yield to sUSDe holders.

That higher yield then draws in more users, leading to greater USDe issuance, more hedging, and more protocol revenue.

In the last month, Ethena has brought in nearly $50 million in feed and $10 million in revenue, according to DeFiLlama data. This makes it the sixth best-performing protocol for monthly fee revenue according to the data aggregator.

ENA is currently trading for $0.58.