Ether Losing Its Edge? Options Market Signals Higher Risk for ETH Over BTC

Ether's risk premium just flipped Bitcoin's—and traders aren't blinking. The options market now prices ETH as the more volatile asset, a stark reversal from its 'safer altcoin' status. What's rattling confidence in the second-largest crypto?

The Volatility Tug-of-War

BTC's implied volatility has trailed ETH's since mid-July, with the gap widening this week. Market makers are demanding higher premiums to hedge Ether positions—a bet that its price swings will dwarf Bitcoin's. Never mind that both assets still move in near-lockstep with macro risk sentiment.

DeFi's Double-Edged Sword

Ethereum's sprawling ecosystem cuts both ways. While its DeFi and NFT dominance drives utility, regulatory overhang and upgrade risks pile on unique pressure. Meanwhile, Bitcoin's 'digital gold' narrative keeps its volatility in check—even when gold itself gets trampled by Fed speeches.

One cynical take? Traders finally noticed that 'ultrasound money' still trades like a meme stock when liquidity dries up. The smart money's hedging accordingly.

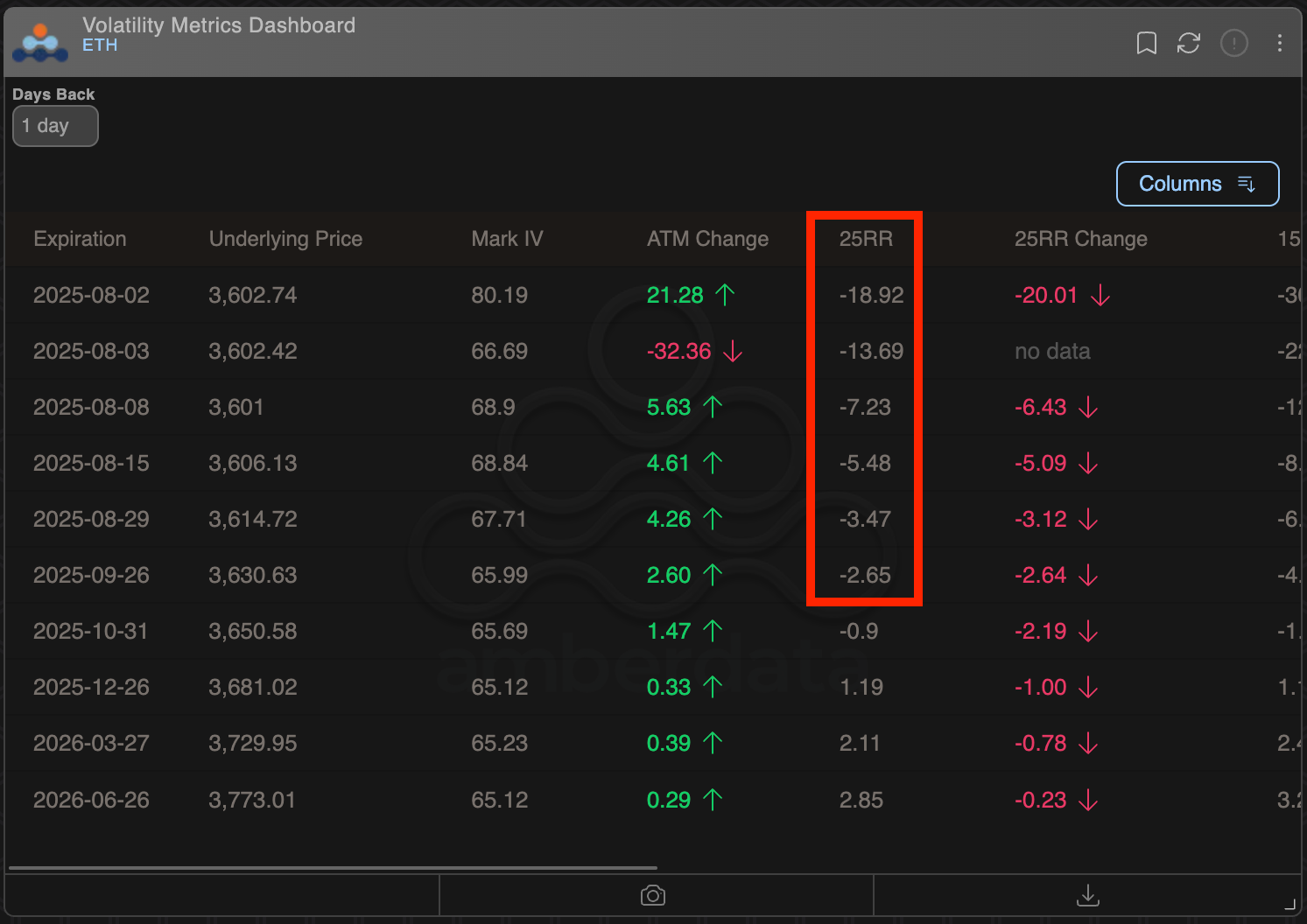

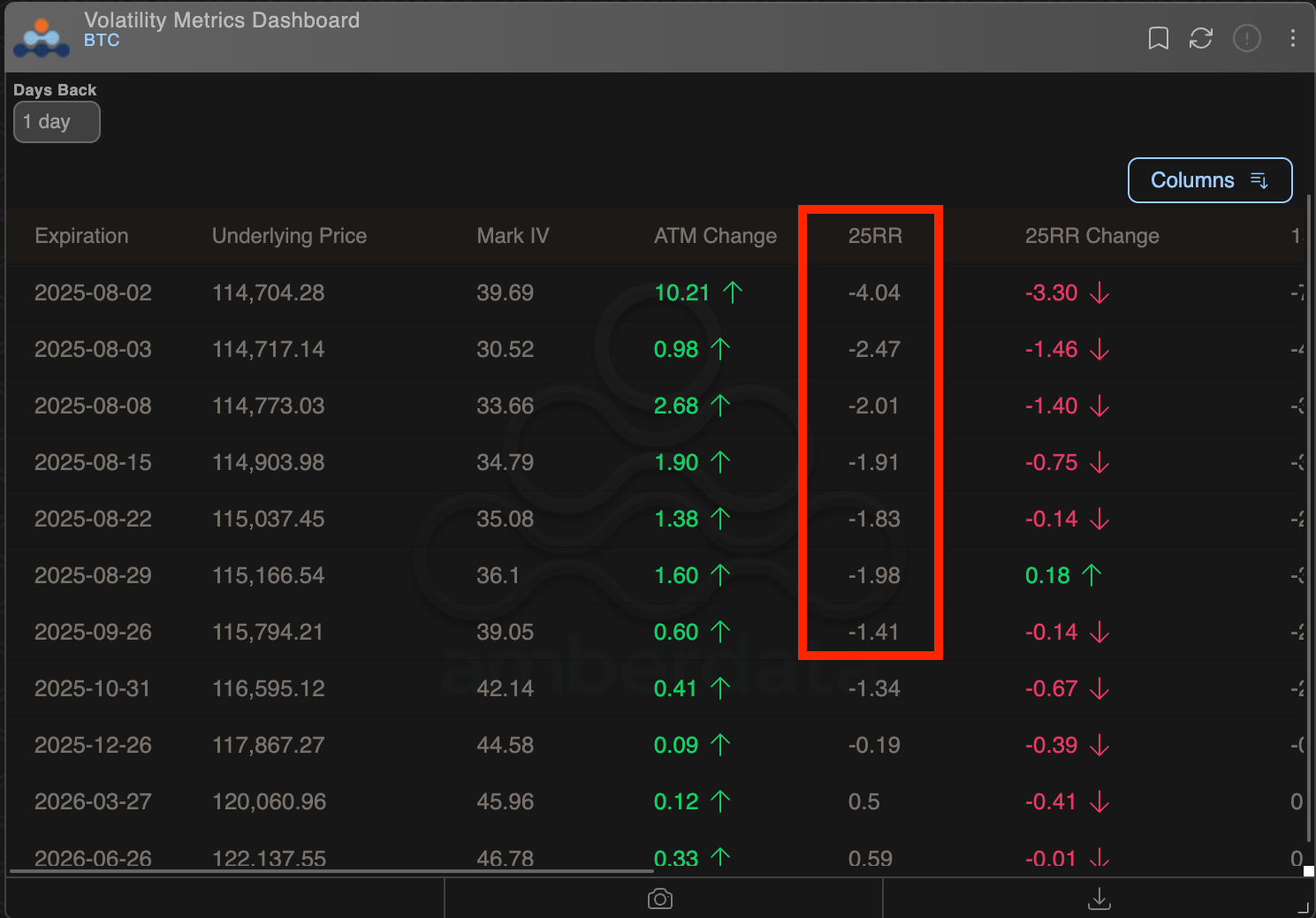

In comparison, bitcoin's short-term put options traded at 1%-2.5% premium to calls, suggesting relatively restrained downside fears.

A put option gives the purchaser the right to sell the underlying asset at a predetermined price on or before a specified future date. A put buyer is implicitly bearish on the market, seeking to hedge spot market holdings or profit from a price decline. A call buyer is implicitly bullish on the market.

The 25-delta risk reversal is an options strategy that comprises a long put position and a short call option (or vice versa) with a 25% delta, meaning the strike price for both options is relatively far from the underlying asset's market rate.

Risk reversals are widely tracked in the FX markets to gauge sentiment across time frames. Positive values represent bullish sentiment, while negative values suggest the reverse.

Ether, the native token of the ethereum blockchain surged 48% in July, reaching a seven-month high of $3,941 and outperforming BTC's 8% gain by a wide margin. Most of the advance, however, occurred in the first half of the month, with the rally losing steam on concerns it stemmed purely from corporate adoption and lacked support from on-chain activity.

Ether was recently trading at $3,600, down more than 6% over 24 hours, while Bitcoin had lost 3% to $114,380, according to CoinDesk data.