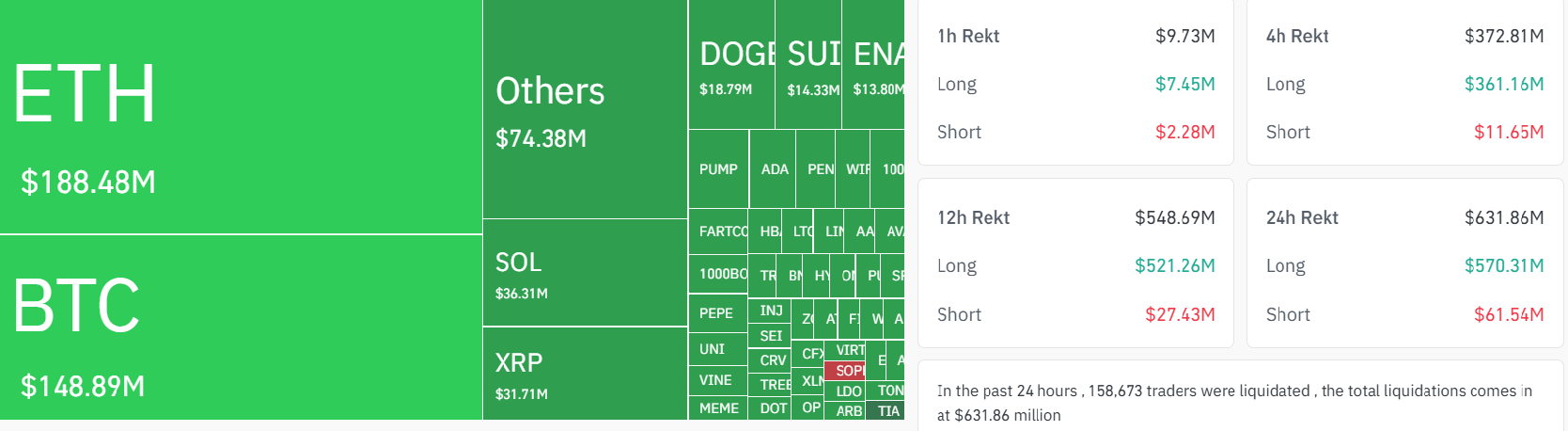

🚨 $600M Longs Wiped Out as Bitcoin Crashes to $115K – DOGE, SOL, XRP Plunge 6% in Market Carnage

Crypto markets got steamrolled today as Bitcoin nosedived to $115K—liquidating $600M worth of bullish bets in a brutal shakeout. Altcoins bled harder, with Dogecoin, Solana, and XRP each shedding 6% as traders scrambled for exits.

Leverage Wreckage:

The mass long liquidation suggests overeager traders got caught with their margin calls down—classic crypto Darwinism at work.

Altcoin Avalanche:

Meme coins and smart contract platforms tanked in unison, proving once again that when BTC sneezes, the whole market catches pneumonia.

Silver lining? At least the 'buy the dip' crowd now has fresh ammo—assuming they didn't just get margin-called into oblivion.

Ether (ETH) fell to $3,687, while XRP (XRP) retraced under $3 despite strong recent headlines. solana (SOL) pulled back to $170, and BNB (BNB) eased to $780 after a record run last week that punted it above $855.

Coinglass data shows the largest single liquidation was a $13.7 million ETH long on Binance.

Liquidations occur when traders using leverage (borrowed funds) are forcibly closed out of their positions because their collateral falls below required maintenance thresholds. This typically amplifies price volatility, especially in short timeframes, as liquidated positions create sudden selling or buying pressure depending on the side of the trade.

For traders, liquidation data provides insight into market sentiment and risk of positioning. High liquidation totals — particularly concentrated in one direction (e.g., longs) — often signal overextended positioning. This can indicate possible inflection points or impending reversals as the market resets.

Tracking real-time liquidation heatmaps and funding rates can help traders identify areas of forced selling or buying, often around key support/resistance levels, time entries or exits during high-volatility zones and gauge market leverage and risk-on/off behavior

Speculative altcoins were particularly affected. Solana-ecosystem tokens such as Fartcoin (FART), Pump.fun (PUMP) and Jupiter (JUP) all faced steep intraday corrections.

“We observe that tokens like FARTCOIN and Pump.fun are less aligned with broader market beta and more reflective of high-volatility, sentiment-driven microcycles,” said Ryan Lee, Chief Analyst at Bitget, said in a Telegram message.

“The recent corrections — FART dropping 14% to retest its 100-day EMA NEAR $1, JUP losing support at its 200-day EMA, and PUMP continuing its slide within a descending channel — appear to stem from profit-taking and waning short-term momentum, not from a systemic market shift.”

Lee added that Bitcoin’s relative strength, supported by ETF inflows and macroeconomic stability, reinforces the view that the pullback is isolated, not broad-based.

Bitcoin holding above $115,000 remains the market’s anchor. Unless that level breaks, the broader structure stays intact.