Clearpool Disrupts Payments Financing with Game-Changing Stablecoin Yield Token Launch

DeFi's institutional darling just rewrote the rulebook—again.

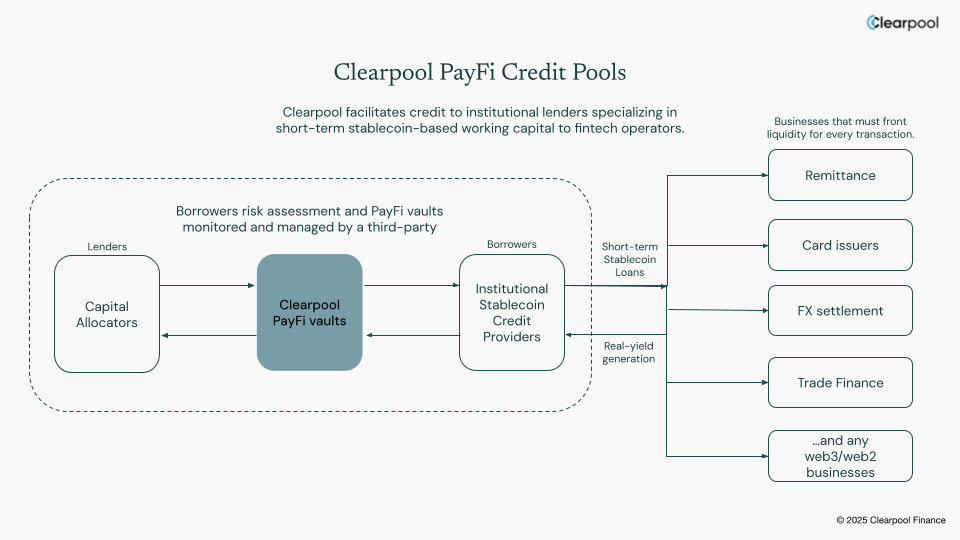

Clearpool storms into payments financing with a yield-bearing stablecoin play that could finally bridge TradFi's liquidity moat. The protocol's new token turns idle corporate cash flows into DeFi yield engines, slicing through legacy settlement delays like a hot knife through bureaucratic butter.

Because nothing motivates bankers like seeing their lunch get eaten by code.

The cpUSD token, backed by PayFi vaults and liquid, yield-bearing stablecoin, aims to deliver returns tied to real-world payment flows rather than speculative crypto activity.

Clearpool's expansion underscores the broader trend of stablecoins becoming Core infrastructure in global payments, particularly in emerging markets where traditional banking rails remain slow or costly. The protocol said it has already originated more than $800 million in stablecoin credit to institutional borrowers, including Jane Street and Banxa.