Analysts: Bitcoin’s Market Top ’Nowhere Near’ as Price Holds Steady at $120K

Bitcoin's bull run still has legs—plenty of them. Despite pausing at $120K, analysts insist the market top isn't even on the horizon.

The calm before the next storm?

While traders sweat over short-term consolidation, macro indicators scream accumulation. Institutional inflows, ETF approvals, and that halving glow haven't even hit full stride yet.

Wall Street's FOMO meets crypto's patience

Traditional finance is finally catching up—only to realize crypto markets operate on geological time. By the time banks finish their risk assessments, retail will have mooned and memed their way to new ATHs.

Remember: markets climb a wall of worry... and this one's got hedge funds writing 50-page reports on whether to buy the dip.

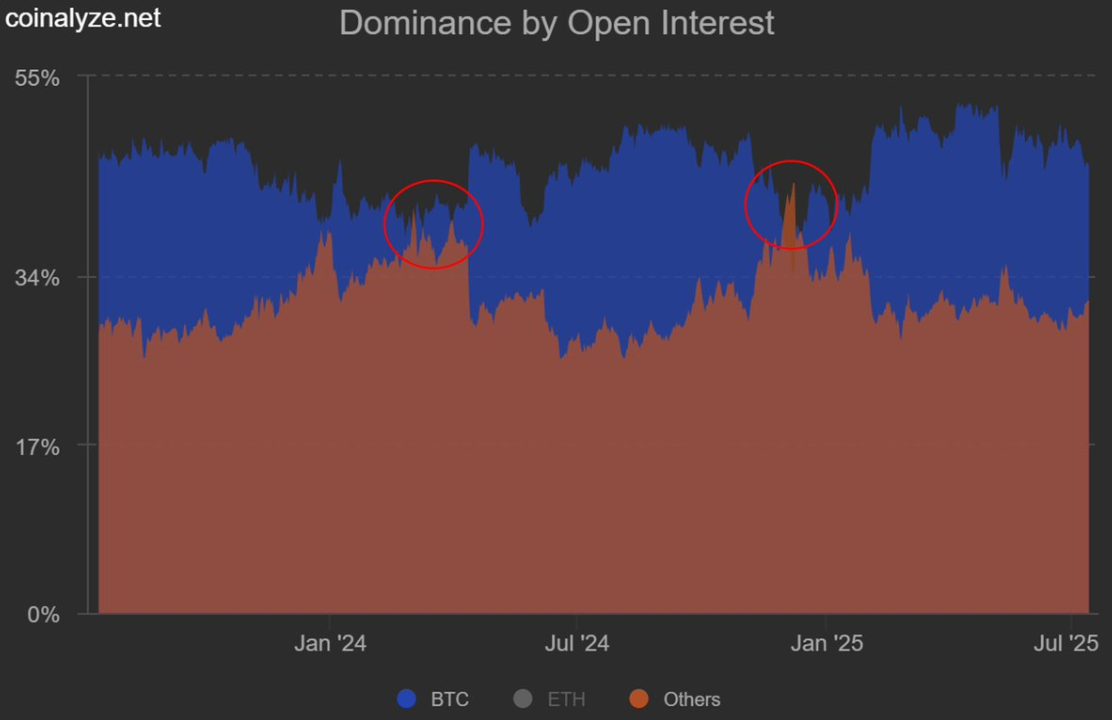

Volumes on both centralized and decentralized exchanges ROSE 23% week-over-week, but still aren’t near to the levels during other broad-market rallies in the past, Dorman added.

Looking at the big picture, bitcoin is being propelled higher by excessive sovereign debt and investors seeking refuge from monetary inflation, said Eric Demuth, CEO of Europe-based crypto exchange Bitpanda.

He said BTC rising to €200,000 ($233,000), is "certainly a possibility," but the underlying adoption of the asset carries more importance than price targets.

"What happens when bitcoin becomes permanently embedded in the portfolios of major investors, in the reserves of sovereign states, and in the infrastructure of global banks?," he said. "Because that’s exactly what’s happening right now."

In the next years, Dermuth expect bitcoin's market capitalization to gradually converge to gold's, currently sitting at over $22 trillion, nine times larger than BTC.