Crypto Leaders Clash With U.S. Senators in High-Stakes Market Structure Showdown

Crypto's biggest players just threw down the gauntlet in Washington—and Wall Street's watching closely.

The power play: Industry heavyweights pitched radical market reforms to skeptical senators, framing crypto as the inevitable future of finance (while conveniently ignoring last month's $200M exchange hack).

Key demands: Clearer regulations, tailored oversight frameworks, and—shocker—less interference from traditional finance gatekeepers. Because nothing says 'decentralization' like lobbying for preferential treatment.

The subtext: This is crypto's make-or-break moment to shape its own regulatory destiny before the SEC forces its hand. Meanwhile, Bitcoin barely blinked during the hearing—proving once again that digital assets care more about memes than macro.

One senator's parting shot: 'We'll consider your proposals right after we finish bailing out commercial real estate.'

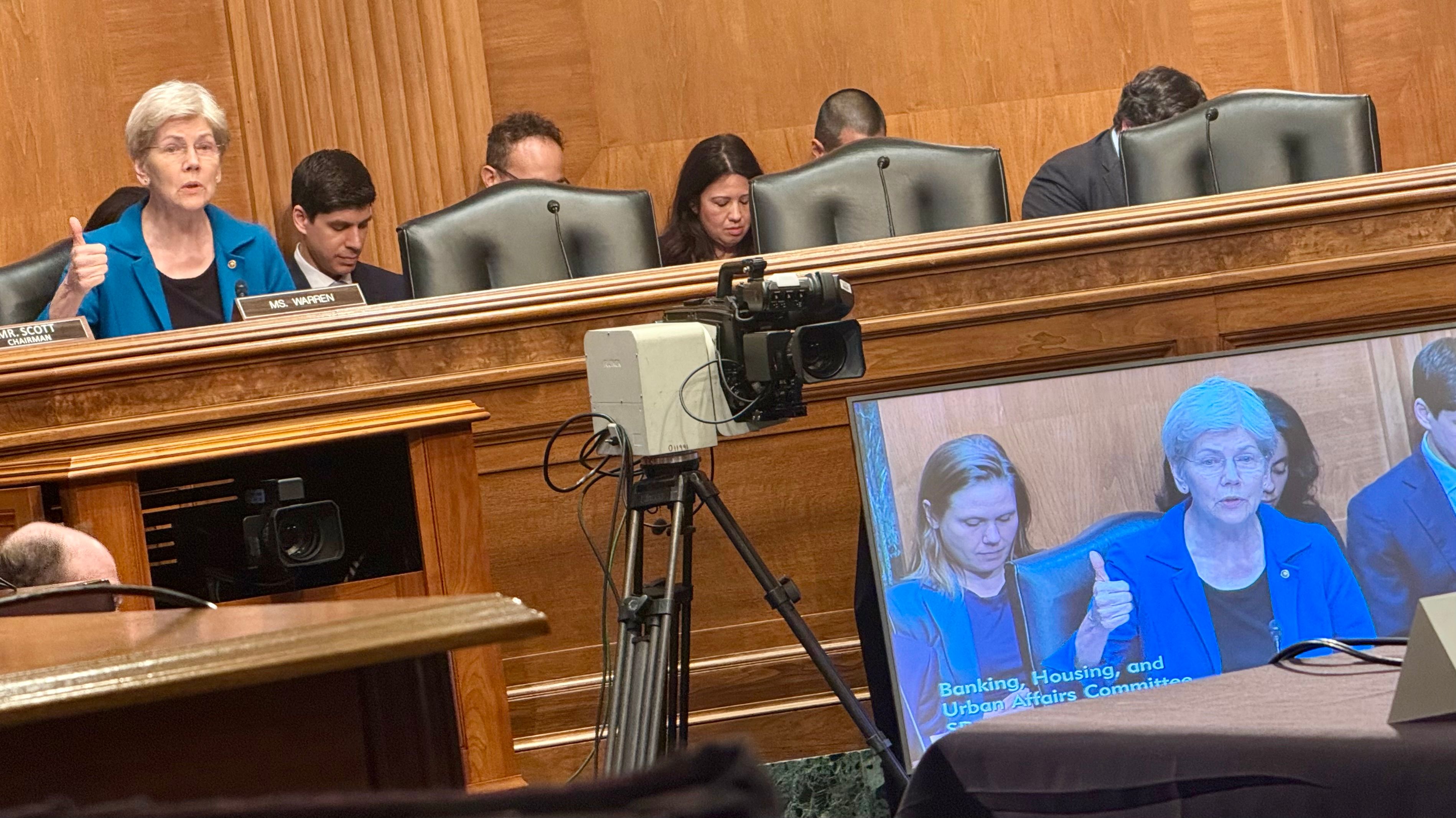

She also said that proposals including the House's Clarity Act "will allow noncrypto companies to tokenize their assets in order to evade" regulation from the Securities and Exchange Commission.

"Think for just a minute about what that means," Warren said. "Under the House bill, a publicly traded company like Meta or Tesla could simply decide to put its stock on the blockchain" to escape SEC scrutiny.

The House's Clarity Act has already cleared the relevant committees in that chamber, so it's the piece of legislation furthest along and has been suggested by Scott as a template for Senate work on market structure. One of the key provisions in the bill is to set up the Commodity Futures Trading Commission as a primary regulator of U.S. digital assets activity. A former chairman of that agency, Tim Massad, was among the witnesses on Wednesday and was asked about his thoughts on the act.

Massad responded, "I think it's got a lot of problems. I think it's 236 pages of regulatory arbitrage opportunities."

Scott's committee has previously set out a series of guidelines for its own work on market structure legislation that will "recognize the need to clearly define what is a commodity, what is a security, and how digital assets can trade and be custodied in a way that fosters innovation while protecting investors," he said at the hearing.

"We don’t need more roadblocks," he said. "We need rules that actually work."

Trump has added urgency to the crypto policy debate in Congress at the moment, because he'd set his own August deadline for the Senate and House to produce stablecoin and market structure bills. While it's possible the House signs off on the Senate's stablecoin bill next week and sends it to the president to be signed into law, the timeline for the more complex bill may be further out. Senator Scott has declared a September 30 deadline for the Senate to finish market structure legislation.