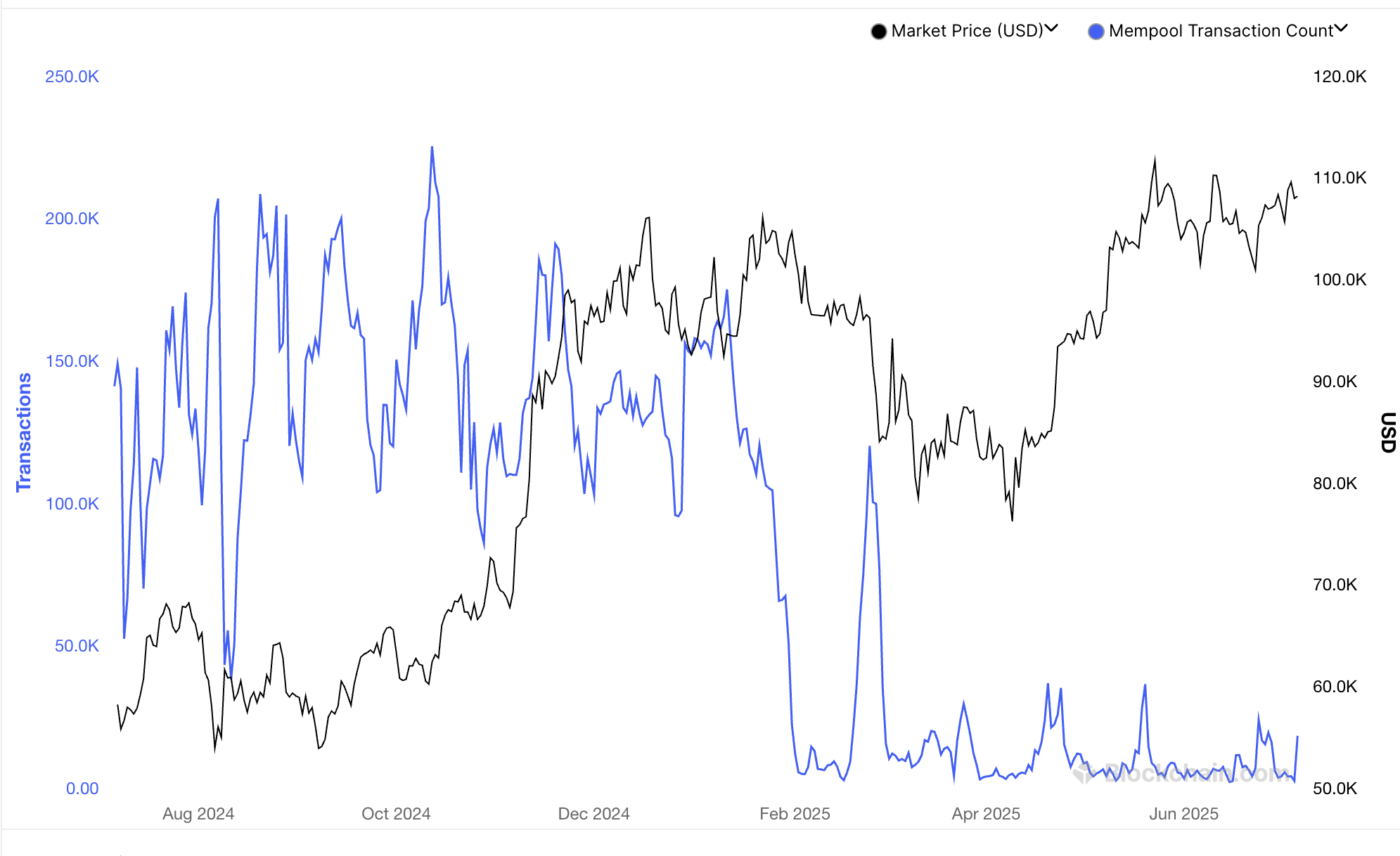

Bitcoin’s Mempool Hits Record Lows as Price Flirts With All-Time Highs—What’s Brewing?

Bitcoin's transaction backlog just pulled a disappearing act. The mempool—crypto's waiting room for unconfirmed transactions—is nearly empty while BTC dances within striking distance of its lifetime peaks. Strange bedfellows? Not for those who understand the mechanics of a maturing asset.

Fee Market Freefall: Where Did All the Transactions Go?

Miners are scraping the bottom of the fee barrel as block space demand evaporates. Either adoption's hit a wall (unlikely) or layer-2 solutions are eating Bitcoin's lunch (hello, Lightning Network). Meanwhile, Wall Street's algo-trading desks will surely spin this as 'efficiency' while quietly pocketing the spread.

Pricey Silence: The Calm Before the Volatility Storm?

Historically, mempool droughts precede seismic price movements. With open interest swelling and leverage creeping up, this eerie quiet feels like a coiled spring. Retail's distracted by meme coins again—classic 'weak hands' behavior while the smart money positions.

Closing Thought: Nothing terrifies TradFi dinosaurs quite like Bitcoin functioning exactly as designed—even when it contradicts their doom narratives. The mempool's emptiness isn't a bug; it's a feature that'll make more sense after the next halving. Now if only we could clear out the legacy finance backlog this efficiently.

According to Joao Wedson, CEO and founder of crypto data analysis platform Alphractal, the idle mempool is a sign of missing retail participation in the market.

"When Mempool transactions begin to rise again, it's a clear sign that retail is back — because the growing backlog reflects increased demand for using the network," Wedson said.