Bitcoin CME Futures Premium Craters—Are Big Money Players Losing Conviction?

Wall Street's crypto love affair hits a rough patch as Bitcoin's CME futures premium tanks. Institutional FOMO fading—or just profit-taking before the next leg up?

The 'smart money' indicator flashes yellow. When CME's Bitcoin futures trade at a discount to spot, hedge funds typically start sweating. But let's not confuse a cooling-off period with a full-blown exodus.

Meanwhile, crypto natives shrug. Retail traders never needed CME's approval to stack sats—another reminder that Wall Street's late to every party it eventually crashes.

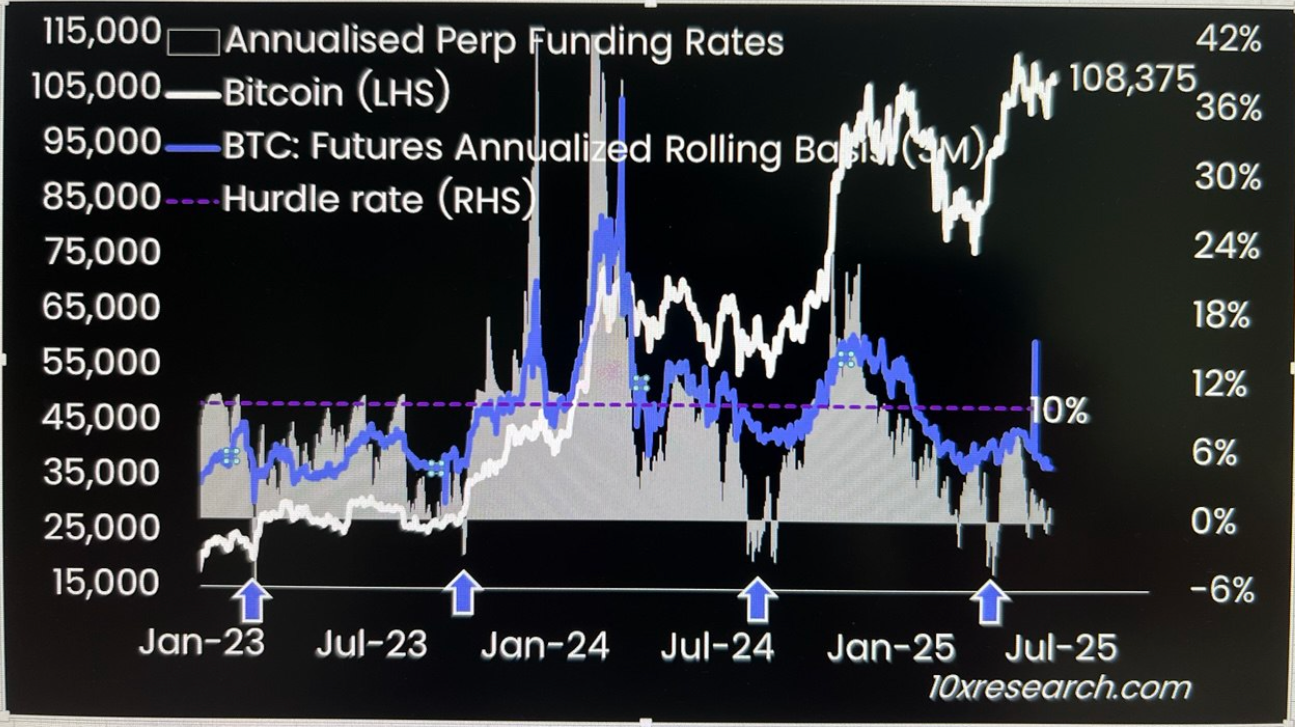

Thielen added that the drop-off coincides with muted retail participation, as indicated by depressed perpetual funding rates and low spot market volumes.

Padalan Capital voiced a similar opinion in a weekly update, calling the decline in funding rates a sign of retrenchment in speculative interest.

"A more acute signal of risk-off positioning comes from regulated venues, where the CME-to-spot basis for both Bitcoin and ethereum has inverted into deeply negative territory, indicating aggressive institutional hedging or a substantial unwind of cash-and-carry structures.," Padalan Capital noted.