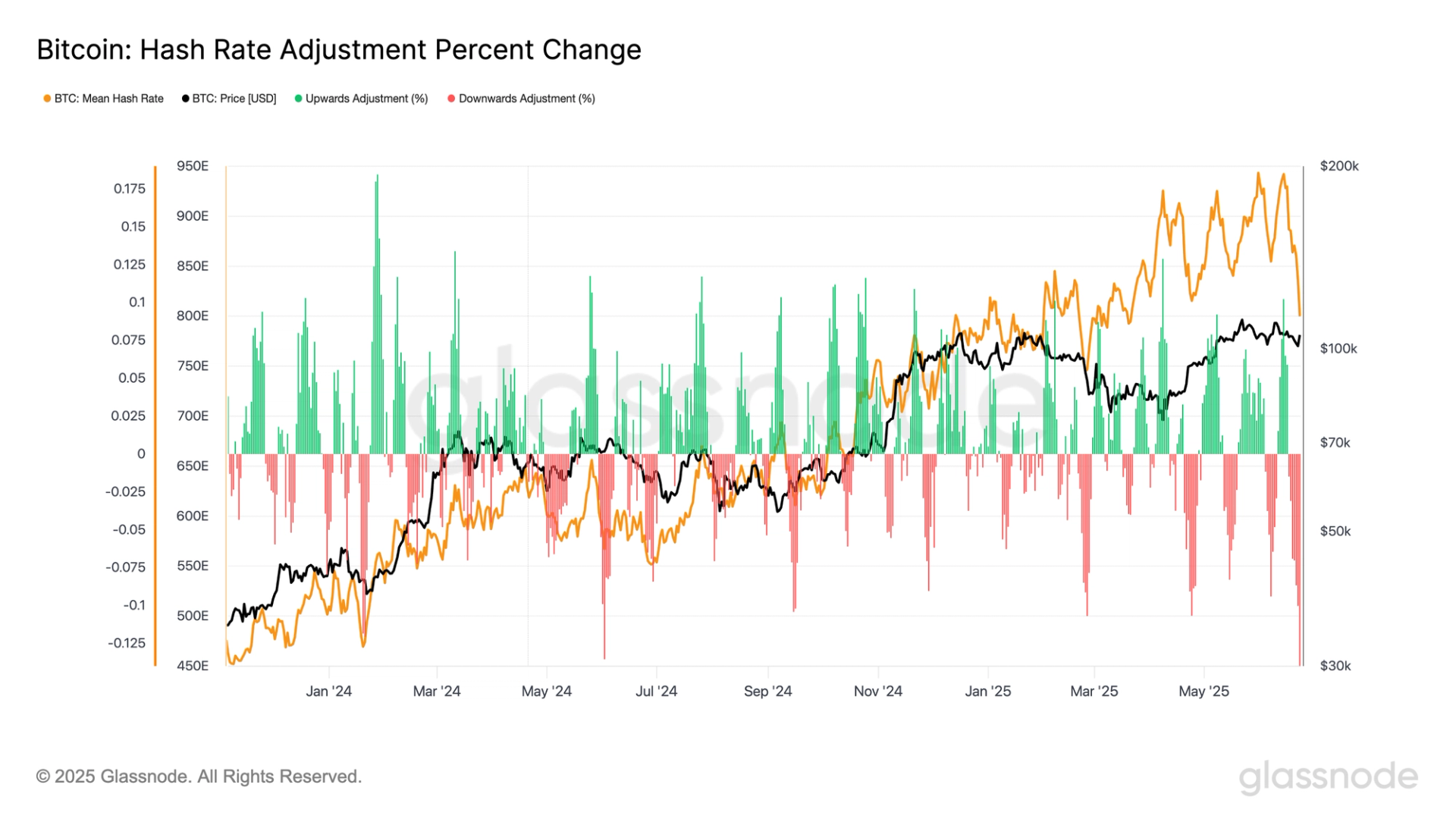

Bitcoin Braces for Steepest Mining Difficulty Plunge in 4 Years—What It Means for Your Stack

Hash rate headaches? Bitcoin's mining difficulty is about to take its sharpest nosedive since the China mining exodus of 2021. Here's why it matters—and why Wall Street still doesn't get it.

Miners catch a break (for once)

The network's self-correcting algorithm is slashing difficulty by double digits—a rare relief for rig operators after months of profit-crushing competition. Fewer miners chasing the block reward means surviving operations suddenly breathe easier.

Market implications beyond the memes

While traders obsess over price charts, this infrastructure shift quietly impacts everything from hardware ROI to regional hash rate redistribution. The last time we saw this scale of adjustment? When Beijing pulled the plug and triggered a 28% difficulty drop overnight.

Bonus cynicism: Goldman Sachs will probably spin this as 'proof of Bitcoin's instability' while quietly front-running the difficulty adjustment in their OTC desk. Stay paranoid, folks.