Litecoin Defies Market Downturn as ETF Speculation Heats Up During Global Uncertainty

Litecoin's surprising resilience shines as traditional markets wobble.

While Bitcoin and Ethereum struggle with bearish pressure, LTC charts its own course—fueled by growing whispers of a potential ETF launch. Here's why the 'silver to Bitcoin's gold' is stealing the spotlight.

ETF Dreams Meet Geopolitical Reality

Institutional interest spikes as global tensions escalate—because nothing drives crypto demand like the threat of conventional financial systems collapsing. Analysts note unusual options activity in LTC derivatives, suggesting big players are positioning for a volatility surge.

The Contrarian Play

Retail traders pile into meme coins while hedge funds quietly accumulate Litecoin. The 14-year-old blockchain suddenly looks attractive with its battle-tested network and (relatively) sane transaction fees. 'Digital silver' might finally have its moment as gold 2.0 stumbles.

Regulators Hate This One Trick

SEC chair's latest anti-crypto rant conspicuously omits Litecoin—fueling speculation that Wall Street's backdoor into crypto won't face the same resistance as Bitcoin ETFs. Meanwhile, traditional finance dinosaurs still can't decide if blockchain is a threat or just misunderstood Excel.

Whether this is Litecoin's long-awaited breakout or just another dead cat bounce, one thing's clear: in crypto, hope springs eternal—especially when there's money to be made off that hope.

Technical Analysis Overview

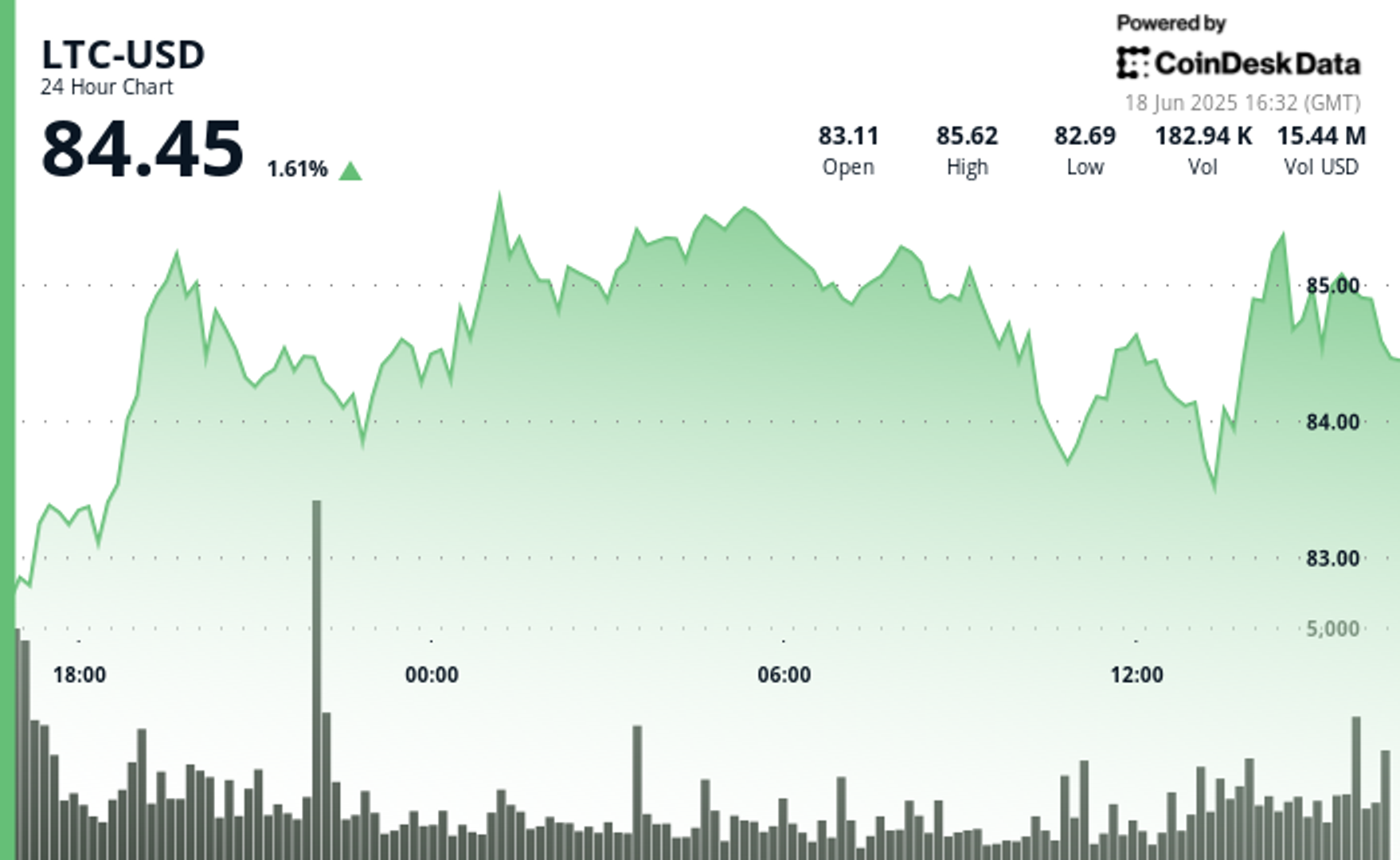

- Litecoin posted a 1.6% gain over the 24-hour period, climbing from a low of $82.69 to close at $84.88. The broader market, as measured by the CoinDesk 20 (CD20) index, dropped 0.5% over the same period.

- Support solidified in the $83.48–$83.57 range, according to CoinDesk Research's technical analysis data model, where buyers stepped in with above-average volume.

- This buying interest established a floor that helped LTC climb back despite intraday volatility. Resistance emerged at $85.60–$85.67, a zone that was tested twice but not breached.

- The price action developed an ascending channel, marked by higher lows, a sign of steady bullish momentum even as sellers capped gains.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk's full AI Policy.