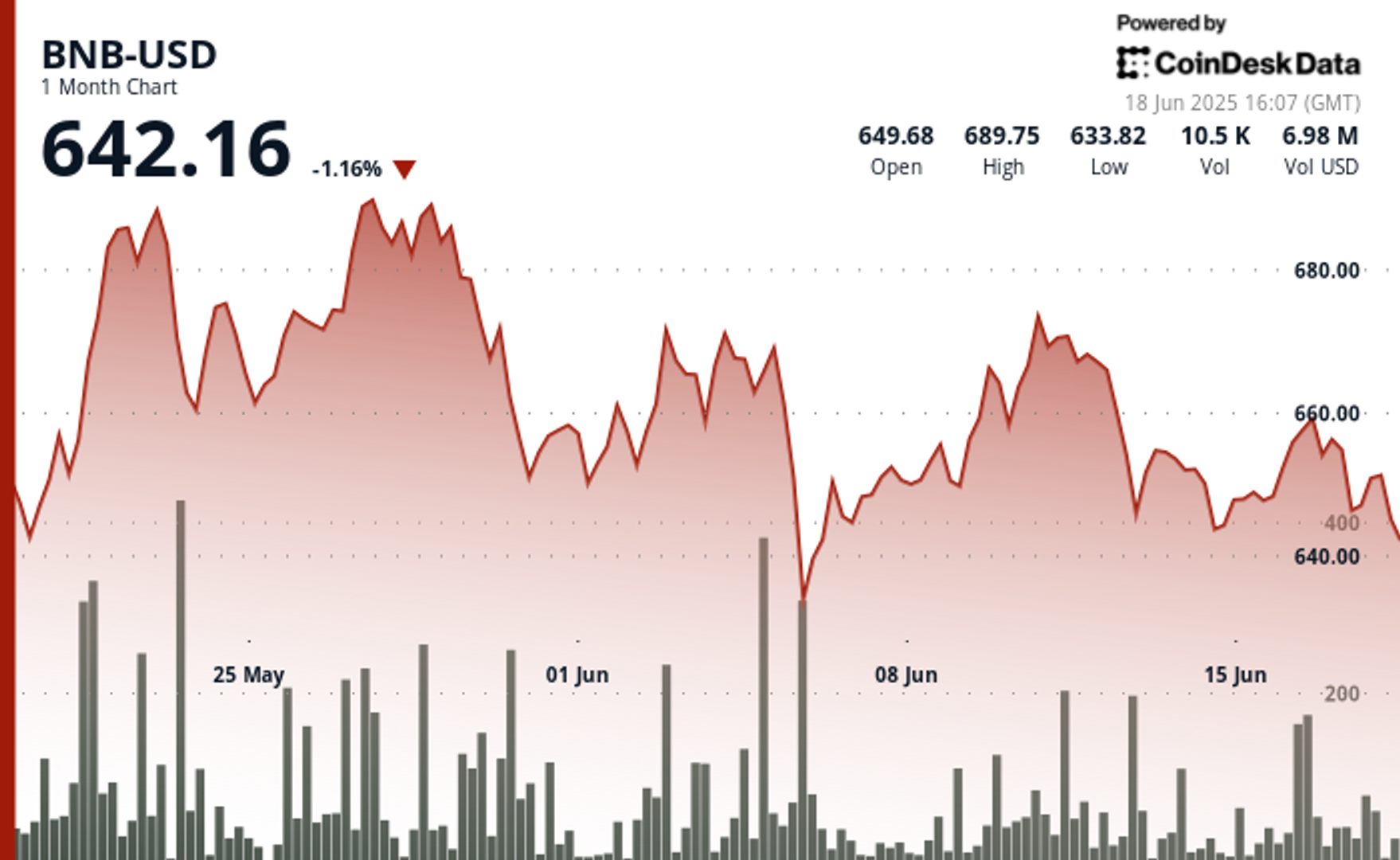

BNB Slams Into $654 Wall as Israel-Iran Tensions Spook Crypto Markets

BNB's rally hits a brick wall at $654—just as geopolitical shudders send traders scrambling for cover.

Here's why crypto's playing defense today:

• Resistance level holds firm as Middle East tensions trigger risk-off mood

• Trading volumes spike amid flight to stablecoins (because nothing says 'safe haven' like algorithmic dollar-pegged tokens)

• Macro fears override bullish technicals—for now

Smart money's watching whether BNB can consolidate above $600 support. Break that, and we're in for a proper crypto tantrum.

Meanwhile, traditional markets pretend they're not equally rattled—gold up, oil volatile, but sure, it's just a 'crypto thing.'

Technical Analysis Overview

BNB is currently consolidating in a volatile range, showing signs of both accumulation and hesitation among traders.

- The asset traded within a 24-hour range of 2.53%, climbing from $641 to a session high of $654 before facing rejection.

- A potential resistance zone has formed near $653.5, confirmed by repeated failures to break higher and a spike in selling activity and volume around that area.

- A significant support level emerged at $638, marked by the day’s highest volume spike that points to strong buyer interest.

- The price touched a low of $637 before showing signs of stabilization. Since then, BNB has posted three consecutive higher lows, hinting at a potential double bottom and renewed buying interest.

- Market participants might be watching whether BNB can hold above the $640 support line.

- A sustained move higher may require clearing resistance at $654 with stronger conviction, while a break below $637 could trigger a deeper pullback.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk's full AI Policy.