Bitcoin Stalls Below $110K as QCP Warns of Market Squeeze—While Altcoins Steal the Show

Bitcoin''s price action hits a wall—QCP Capital flags a ''tight range'' as traders yawn and altcoins rally. The usual suspects (yes, Wall Street) still can''t decide if crypto''s a ''hedge'' or just their latest casino chip.

Meanwhile, ETH, SOL, and other alts surge past BTC''s lethargic performance. Guess the ''flippening'' crowd found fresh hopium.

Pro tip: When institutional analysts whisper ''consolidation,'' grab popcorn—it''s either a coiled spring or a slow-motion train wreck.

Token Events

- Governance votes & calls

- ApeCoin DAO is weighing scrapping the decentralized autonomous organization and launching ApeCo to “supercharge the APE ecosystem.”

- Optimism DAO is voting to approve eligibility criteria for the Milestones and Metrics (M&M) Council in Seasons 8 and 9, introducing a model where members are selected “based on competencies rather than elections.” Voting ends June 11.

- June 10, 10 a.m.: Ether.fi to host an analyst call followed by a Q&A session.

- June 11, 7 a.m.: Cronos Labs lead Mirko Zhao to participate in a community Ask Me Anything (AMA) session.

- Unlocks

- June 12: Aptos (APT) to unlock 1.79% of its circulating supply worth $53.61 million.

- June 13: Immutable (IMX) to unlock 1.33% of its circulating supply worth $12.82 million.

- June 15: Starknet (STRK) to unlock 3.79% of its circulating supply worth $16.90 million.

- June 15: Sei (SEI) to unlock 1.04% of its circulating supply worth $10.59 million.

- June 16: Arbitrum (ARB) to unlock 1.91% of its circulating supply worth $32.21 million.

- June 17: ZKsync (ZK) to unlock 20.91% of its circulating supply worth $41.25 million.

- June 17: ApeCoin (APE) to unlock 1.95% of its circulating supply worth $10.88 million.

- Token Launches

- June 16: Advised deadline to unstake stMATIC as part of Lido on Polygon’s sunsetting process ends

- June 26: Coinbase to delist Helium Mobile (MOBILE), Render (RNDR), Ribbon Finance (RBN) and Synapse (SYN).

Conferences

The CoinDesk Policy & Regulation conference (formerly known as State of Crypto) is a one-day boutique event held in Washington on Sept. 10 that allows general counsels, compliance officers and regulatory executives to meet with public officials responsible for crypto legislation and regulatory oversight.

- June 14: Incrypted Crypto Conference 2025 (Kyiv)

- June 18-19: Canadian Blockchain Consortium’s 2nd Annual Policy Summit (Ottawa)

- June 19-21: BTC Prague 2025

- June 25-26: Bitcoin Policy Institute’s Bitcoin Policy Summit 2025 (Washington)

- June 26: The Injective Summit (New York)

- June 26-27: Istanbul Blockchain Week

- June 30 to July 3: Ethereum Community Conference (Cannes, France)

Token Talk

By Oliver Knight

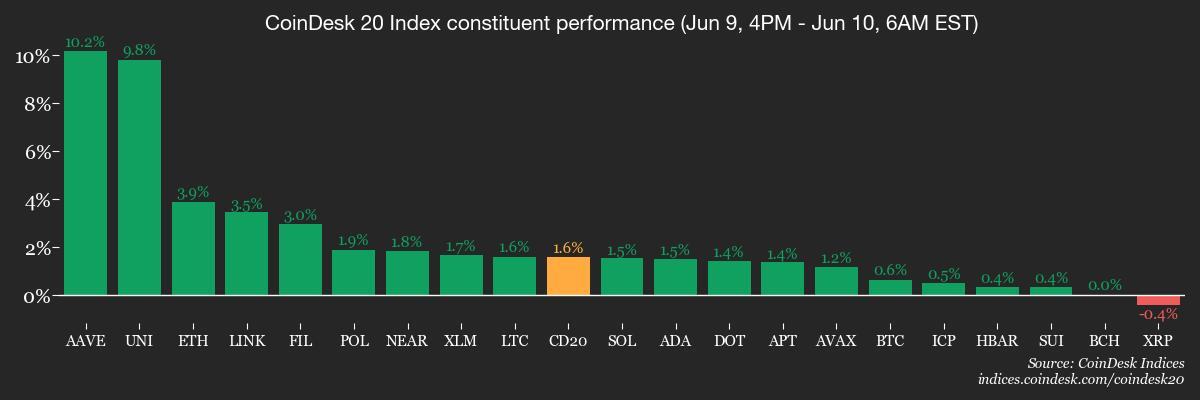

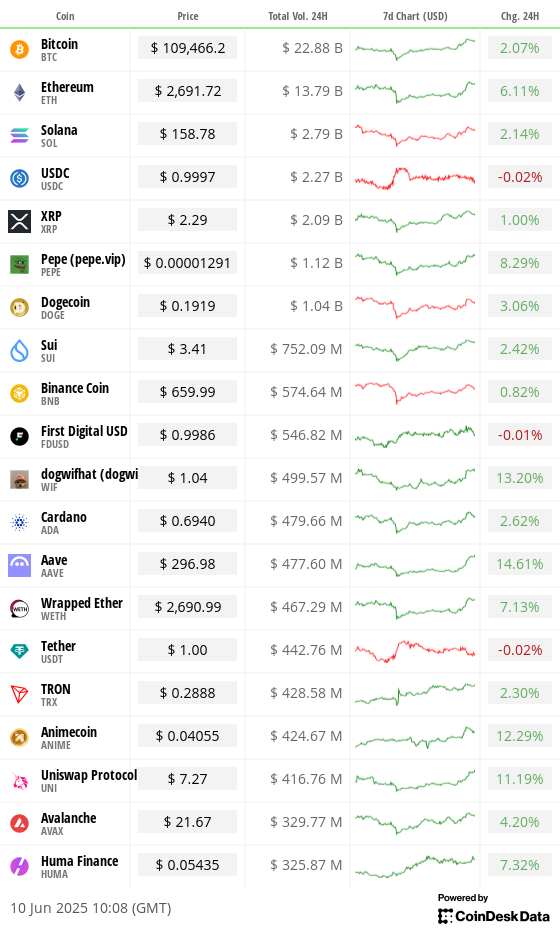

- The SEC announced special exemptions for DeFi projects on Monday, prompting the tokens of of aave (AAVE) and uniswap (UNI) to jump by around 16%.

- Ether (ETH), meanwhile, increased by 7.3% as daily trading volume more than doubled to $26.5 billion.

- A breakout for ETH above the $2,650 level of resistance would open a path towards $4,000, where it briefly traded in December before surrendering those gains in February.

- CoinMarketCap''s altcoin season index has ticked up from 18 to 29 out of a maximum 100 since the turn of the month, suggesting that traders are focusing on the altcoin market instead of bitcoion, even though BTC was dominant throughout the recent cycle.

- Bitcoin has risen by 32% since March, but has been outperformed by a large portion of altcoins including HYPE, SUI and ETH, which are up between 42% and 200% respectively over the same period.

Derivatives Positioning

- Bitcoin options open interest (OI) rose to a June high of $44.33B, led by Deribit at $35.24B, followed by CME ($3.5B) and OKX ($3.24B), according to Coinglass data.

- The BTC options-to-futures OI ratio stood at 57.6%, reflecting strong demand for optionality relative to directional exposure.

- Traders continue to lean bullish with a put/call ratio of 0.57 on Deribit.

- The 140K strike leads in notional terms with $1.79B, while the 27 June expiry dominates the curve with $13.7B in total notional value. The top traded instruments include 120K and 150K calls expiring June and August.

- Futures open interest momentum remains positive across BTC, AXL and altcoins.

- AXL’s OI has surged over 800% in the past 24 hours, Velo data shows.

- BTC funding rates on Deribit reached 36.1% APR, with similarly elevated levels on Hyperliquid (27.5%) and Bybit (11%), highlighting persistent long-side demand.

- On Binance, liquidation leverage rose sharply to $129.3M near the $106.6K price level, reflecting a cluster of open interest that could be wiped out if prices pull back to that zone, according to Coinglass.

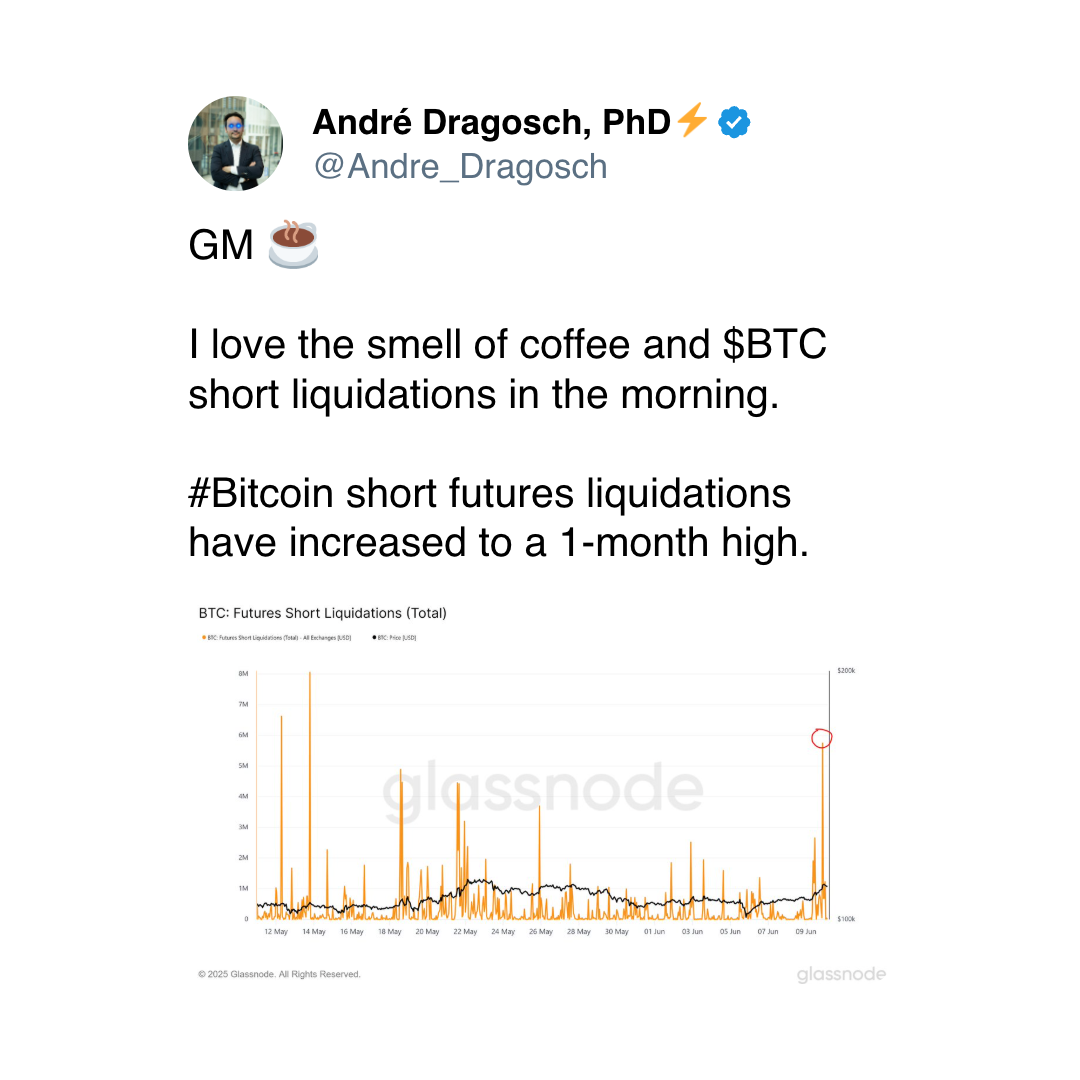

- Over the past 24 hours, actual BTC liquidations totalled $170.74M, dominated by short liquidations of $160.93M, signaling aggressive forced buying as the price surged through key levels.

Market Movements

- BTC is up 0.71% from 4 p.m. ET Monday at $109,535.95 (24hrs: +2.14%)

- ETH is up 3.92% at $2,692.82 (24hrs: +6.18%)

- CoinDesk 20 is up 1.52% at 3,210.97 (24hrs: +3.21%)

- Ether CESR Composite Staking Rate is up 14 bps at 3.08%

- BTC funding rate is at 0.01% (10.95% annualized) on Binance

- DXY is up 0.21% at 99.15

- Gold futures are down 0.13% at $3,350.60

- Silver futures are down 0.44% at $36.63

- Nikkei 225 closed up 0.32% at 38,211.51

- Hang Seng closed unchanged at 24,162.87

- FTSE is up 0.32% at 8,860.46

- Euro Stoxx 50 is down 0.32% at 5,404.14

- DJIA closed on Monday unchanged at 42,761.76

- S&P 500 closed unchanged at 6,005.88

- Nasdaq Composite closed up 0.31% at 19,591.24

- S&P/TSX Composite closed down 0.20% at 26,375.80

- S&P 40 Latin America closed down 0.38% at 2,574.85

- U.S. 10-Year Treasury rate is down 3 bps at 4.45%

- E-mini S&P 500 futures are unchanged at 6,006.50

- E-mini Nasdaq-100 futures are unchanged at 21,805.50

- E-mini Dow Jones Industrial Average Index are down 0.16% at 42,728.00

Bitcoin Stats

- BTC Dominance: 64.53 (-0.18%)

- Ethereum to bitcoin ratio: 0.02445 (+0.99%)

- Hashrate (seven-day moving average): 878 EH/s

- Hashprice (spot): $54.72

- Total Fees: 5.00 BTC / $535,990

- CME Futures Open Interest: 151,915

- BTC priced in gold: 32.7 oz

- BTC vs gold market cap: 9.27%

Technical Analysis

- After trading into the weekly orderblock, Solana has reclaimed the 50-day exponential moving average and 100-day EMA on the daily time frame.

- The price is currently capped by the 50-day measure on the weekly time frame. A decisive break and hold above this level could open the door for a move back toward the prior range highs between $170 and $180.

- In the event of a pullback, bulls will want to see a higher low form, with the weekly order block continuing to hold as a strong support zone.

Crypto Equities

- Strategy (MSTR): closed on Monday at $392.12 (+4.71%), +0.64% at $394.61 in pre-market

- Coinbase Global (COIN): closed at $256.63 (+2.13%), +0.34% at $257.49

- Circle (CRCL): closed at $115.25 (+7.01%), +3.44% at $119.27

- Galaxy Digital Holdings (GLXY): closed at C$28.58 (+4.31%)

- MARA Holdings (MARA): closed at $16.27 (+3.11%), unchanged in pre-market

- Riot Platforms (RIOT): closed at $10.12 (+2.74%), +0.3% at $10.15

- Core Scientific (CORZ): closed at $12.71 (+4.27%), +1.57% at $12.91

- CleanSpark (CLSK): closed at $10.12 (+3.37%), +0.2% at $10.14

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $20.16 (+3.01%)

- Semler Scientific (SMLR): closed at $33.99 (+3.06%)

- Exodus Movement (EXOD): closed at $29.01 (+0.52%), +0.24% at $29.08

ETF Flows

- Daily net flows: $386.2 million

- Cumulative net flows: $44.61 billion

- Total BTC holdings ~1.2 million

- Daily net flows: $52.7 million

- Cumulative net flows: $3.4 billion

- Total ETH holdings ~3.79 million

Source: Farside Investors

Overnight Flows

Chart of the Day

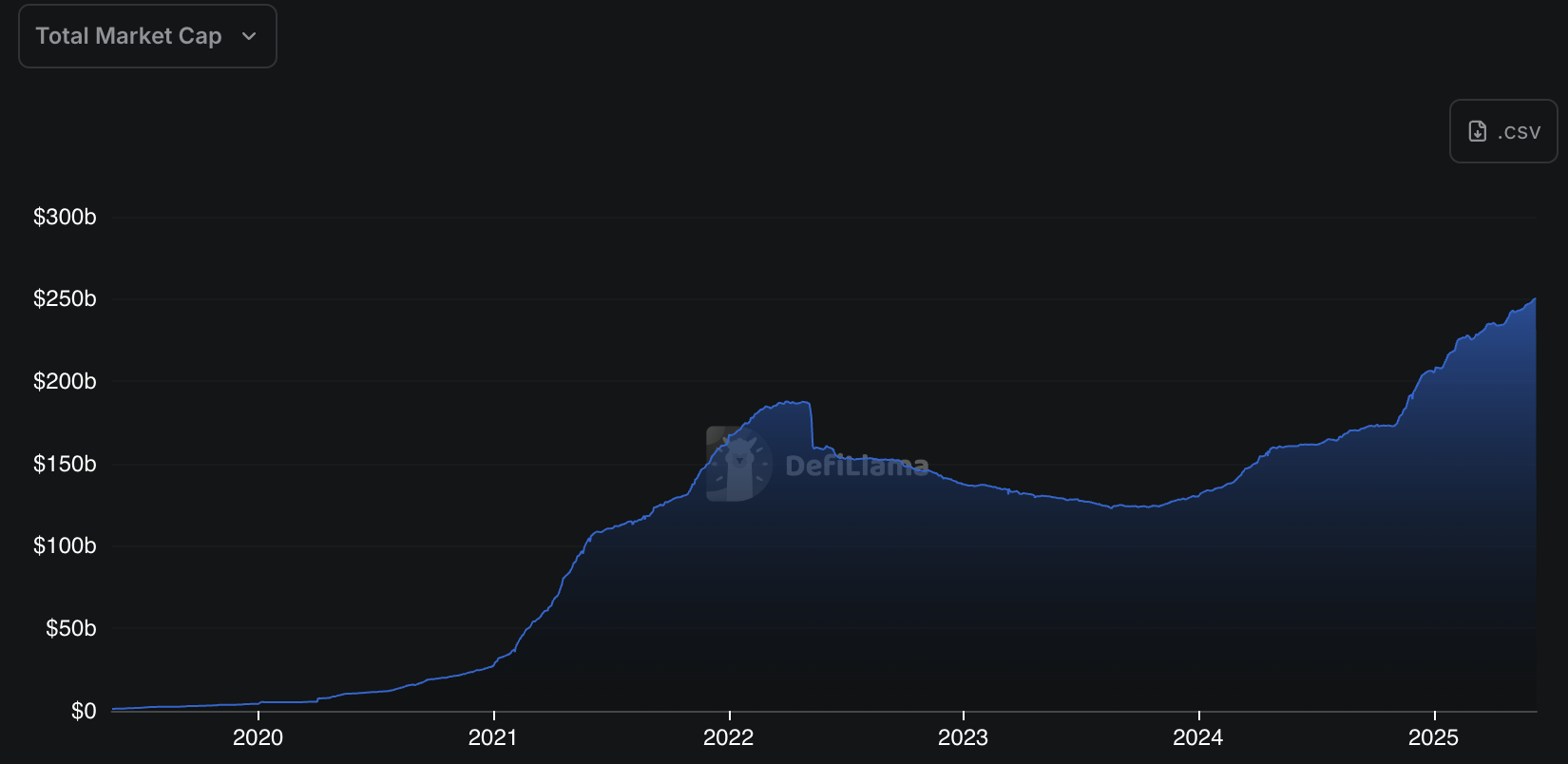

- The total stablecoins market cap surpasses $250 billion for the first time.

While You Were Sleeping

- South Korea’s Ruling Party Unveils Plan to Allow Stablecoins (Bloomberg): The proposed Digital Asset Basic Act lets local firms meeting a minimum equity threshold issue reserve-backed stablecoins, reviving central bank concerns that non-bank issuers could undermine monetary policy.

- SocGen’s Crypto Arm Unveils Dollar Stablecoin on Ethereum and Solana (CoinDesk): SocGen said it became the first global bank to issue a public U.S. dollar stablecoin. USD CoinVertible (USDCV) begins trading in July with BNY Mellon as custodian but excludes “U.S. persons.”

- Riot Sells $1.58M of Bitfarms Shares as Part of Investment Review (CoinDesk): As part of a continuing review of its investment in Bitfarms, Riot sold 1.75 million shares on June 9 at $0.90 each, lowering its stake to 14.3%.

- Trump Administration More Than Doubles Federal Deployments to Los Angeles (The New York Times): The Pentagon’s deployment of 700 Marines raised troop levels in Los Angeles to 4,700, as Trump backed a federal official’s threat to arrest California’s governor for mishandling the deportation protests.

- Price Wars Grip China as Deflation Deepens, $30 for a Luxury Coach Bag? (Reuters): Industrial overcapacity, real estate losses and wage cuts are fueling deflation in China, driving luxury consumers to steep discounts in a booming second-hand market now gripped by price wars.

- UK Will Launch Market for Private Share Sales Later This Year (Bloomberg): The Financial Conduct Authority will pilot a five-year private share market with looser disclosure rules and restricted access, responding to rising demand from firms and investors stalled by delayed IPOs.

In the Ether