Bitcoin Jumps on Tariff News—Traders Eye Next Leg Up

Tariff cuts send crypto markets into rally mode as Bitcoin leads the charge. Traders are now positioning for what comes next—will the bulls break resistance or is this another head-fake before the usual Wall Street rug-pull?

Key drivers: Macro tailwinds meet crypto’s perennial volatility. Watch for liquidity flows—retail FOMO hasn’t even kicked in yet.

Bottom line: Another day, another government policy accidentally pumping digital assets. Meanwhile, traditional finance still can’t decide if crypto is a threat or just their next fee-generating product.

What to Watch

- Crypto:

- May 12, 1 p.m.-5:30 p.m.: A U.S. SEC Crypto Task Force Roundtable on "Tokenization: Moving Assets Onchain: Where TradFi and DeFi Meet" will be held at the SEC’s headquarters in Washington.

- May 13: The Singapore High Court holds a hearing to determine whether Zettai, the parent company of WazirX, can proceed with restarting the India-based crypto exchange and compensating users affected by the July 2024 hack.

- May 14: Neo (NEO) mainnet will undergo a hard fork network upgrade (version 3.8.0) at block height 7,300,000.

- May 14: Expected launch date for VanEck Onchain Economy ETF (ticker: NODE).

- May 16, 9:30 a.m.: Galaxy Digital Inc.’s Class A shares are set to begin trading on the Nasdaq under the ticker symbol GLXY.

- May 19: CME Group is expected to launch its cash-settled XRP futures.

- Macro

- Day 4 of 4: Chinese Vice Premier He Lifeng will hold trade talks with U.S. Treasury Secretary Scott Bessent during his visit to Switzerland.

- May 12, 8 a.m.: Mexico’s National Institute of Statistics and Geography releases March industrial production data.

- Industrial Production MoM Prev. 2.5%

- Industrial Production YoY Prev. -1.3%

- May 13, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases April consumer price inflation data.

- Core Inflation Rate MoM Est. 0.3% vs. Prev. 0.1%

- Core Inflation Rate YoY Prev. 2.8%

- Inflation Rate MoM Est. 0.3% vs. Prev. -0.1%

- Inflation Rate YoY Est. 2.4% vs. Prev. 2.4%

- May 14, 3 p.m.: Argentina’s National Institute of Statistics and Census releases April inflation data.

- Inflation Rate MoM Prev. 3.7%

- Inflation Rate YoY Prev. 55.9%

- Earnings (Estimates based on FactSet data)

- May 12: Exodus Movement (EXOD), post-market

- May 13: Semler Scientific (SMLR), post-market

- May 14: Bitfarms (BITF), pre-market

- May 14: IREN (IREN), post-market

- May 15: Bit Digital (BTBT), post-market

- May 15: Bitdeer Technologies Group (BTDR), pre-market

- May 15: KULR Technology Group (KULR), post-market

Token Events

- Governance votes & calls

- A Sei Network developer proposed ending support for Cosmos to simplify the blockchain and align more closely with Ethereum to reduce complexity and infrastructure overhead and boost Sei’s adoption.

- May 12: Helium (HNT) proposal HIP 144 voting ends on authorizing Nova Labs to introduce a 30-day delay, or Rewards Escrow period, to the process of claiming rewards for Helium Mobile.

- May 15, 10 a.m.: Moca Network to host a Discord townhall session discussing network updates.

- Unlocks

- May 12: Aptos (APT) to unlock 1.82% of its circulating supply worth $68.54 million.

- May 13: WhiteBIT Coin (WBT) to unlock 27.41% of its circulating supply worth $1.2 billion.

- May 15: Starknet (STRK) to unlock 4.09% of its circulating supply worth $23.87 million.

- May 15: Sei (SEI) to unlock 1.09% of its circulating supply worth $14.91 million.

- Token Launches

- May 12: Jerry The Turtle (JYAI) to be listed on LBank with JYAI/USDT pair.

- May 12: Space and Time (SXT) to be listed on Bitrue with SXT/USDT pair.

- May 16: Galxe (GAL), Litentry (LIT), Mines of Dalarnia (DAR), Orion Protocol (ORN), and PARSIQ (PRQ) to be delisted from Coinbase.

Conferences

CoinDesk’s Consensus is taking place in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

- Day 2 of 7: Canada Crypto Week (Toronto)

- Day 1 of 2: Dubai FinTech Summit

- Day 1 of 2: Filecoin (FIL) Developer Summit (Toronto)

- Day 1 of 2: Latest in DeFi Research (TLDR) Conference (New York)

- Day 1 of 3: ACI’s 9th Annual Legal, Regulatory, and Compliance Forum on Fintech & Emerging Payment Systems (New York)

- May 13: Blockchain Futurist Conference (Toronto)

- May 13: ETHWomen (Toronto)

- May 14-16: CoinDesk’s Consensus 2025 (Toronto)

- May 19-25: Dutch Blockchain Week (Amsterdam, Netherlands)

- May 20-22: Avalanche Summit London

- May 20-22: Seamless Middle East Fintech 2025 (Dubai)

- May 21-22: Crypto Expo Dubai

- May 21-22: Cryptoverse Conference (Warsaw, Poland)

- May 27-29: Bitcoin 2025 (Las Vegas)

- May 27-30: Web Summit Vancouver (Vancouver, British Columbia)

- May 29: Stablecon (New York)

- May 29-30: Litecoin Summit 2025 (Las Vegas)

Token Talk

By Shaurya Malwa

- Animal-themed memecoins are surging.

- A speculative frenzy has gripped popular memecoins from 2024, with prices for tokens like cat-themed MICHI, hippo-themed MOODENG and squirrel-themed PNUT all more than doubling since Saturday.

- That has helped alleviate some losses for the tokens. which took a 90% drawdown from peak prices in 2024, mainly around October and November.

- Talk of a "Cat Coin Supercycle” narrative has gained steam among some crypto circles on X. This suggests renewed retail investor enthusiasm, likely fueled by viral social media activity.

- Cat token mog (MOG) appears to have put the frenzy into gear, jumping over 130% last week as technology entrepreneurs from Ycombinator’s Garry Tan to Elon Musk changing their profile pictures on X to one referencing the token.

- Traders looking for short-term speculative bets may keep an eye on the animal and cat memecoin sectors, especially as the price moves bring more eyeballs — and demand — to these tokens.

Derivatives Positioning

- While BTC has largely traded between $104K-$106K in the past 24 hours, perpetual futures open interest on offshore exchanges has increased to nearly $20 billion from $18 billion.

- The growth shows the market is building energy during the consolidation and an eventual breakout could be a violent one.

- Global aggregated funding rates remain positive for BTC and ETH, pointing to bullish sentiment.

- TRX, XMR, TAO, BTC and HYPE have seen net positive cumulative volume delta for the past 24 hours, a sign of net buying pressure in the market.

- In Deribit’s options market, SOL traders chased upside with the $200 call option expiring on June 27.

- BTC traders bought the $120K call expiring at the end of June and sold higher strike calls in longer duration expiries.

Market Movements

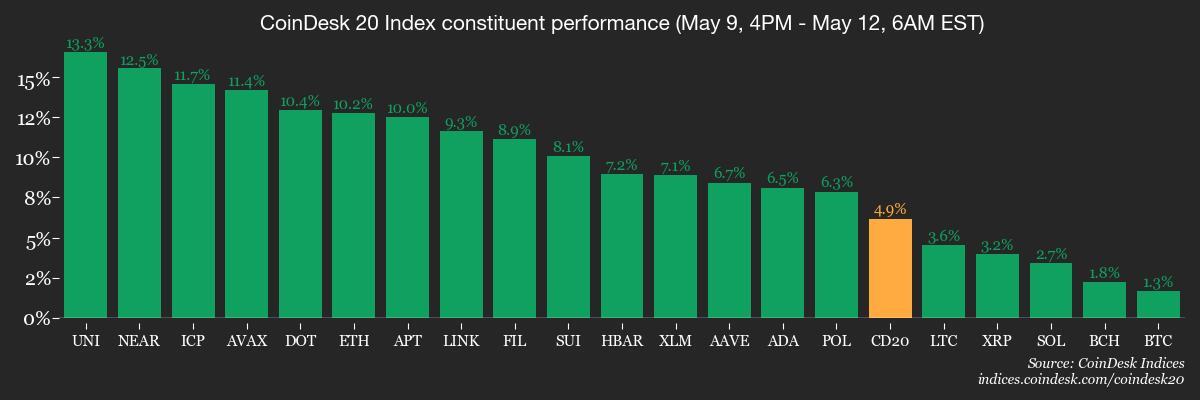

- BTC is up 1.21% from 4 p.m. ET Friday at $104,445.95 (24hrs: -0.16%)

- ETH is up 8.81% at $2,546.56 (24hrs: +1.43%)

- CoinDesk 20 is up 4.27% at 3,265.29 (24hrs: +1.18%)

- Ether CESR Composite Staking Rate is up 10 bps at 3.23%

- BTC funding rate is at 0.0072% (7.8687% annualized) on Binance

- DXY is up 1.14% at 101.48

- Gold is down 3.22% at $3,219.31/oz

- Silver is down 1.54% at $32.23/oz

- Nikkei 225 closed +0.38% at 37,644.26

- Hang Seng closed +2.98% at 23,549.46

- FTSE is up 0.48% at 8,595.81

- Euro Stoxx 50 is up 2.01% at 5,416.72

- DJIA closed on Friday -0.29% at 41,249.38

- S&P 500 closed unchanged at 5,659.91

- Nasdaq closed unchanged at 17,928.92

- S&P/TSX Composite Index closed +0.41% at 25,357.74

- S&P 40 Latin America closed +0.83% at 2,578.58

- U.S. 10-year Treasury rate is up 5 bps at 4.44%

- E-mini S&P 500 futures are up 2.82% at 5838.25

- E-mini Nasdaq-100 futures are up 3.81% at 20,904.00

- E-mini Dow Jones Industrial Average Index futures are up 2.16% at 42,216.00

Bitcoin Stats

- BTC Dominance: 62.77 (-0.60%)

- Ethereum to bitcoin ratio: 0.2448 (+1.39%)

- Hashrate (seven-day moving average): 897 EH/s

- Hashprice (spot): $55.70

- Total Fees: 3.43 BTC / $357,259

- CME Futures Open Interest: 149,160 BTC

- BTC priced in gold: 31.9 oz

- BTC vs gold market cap: 9.04%

Technical Analysis

- The total market cap of all cryptocurrencies, excluding BTC and ETH, has topped the 200-day simple moving average (SMA).

- The breakout indicates positive outlook for altcoins, in general.

Crypto Equities

- Strategy (MSTR): closed on Friday at $416.03 (+0.4%), up 2.59% at $426.80 in pre-market

- Coinbase Global (COIN): closed at $199.32 (-3.48%), up 4.96% at $209.20

- Galaxy Digital Holdings (GLXY): closed at $0.03 (0%)

- MARA Holdings (MARA): closed at $15.76 (+10.29%), up 4.44% at $16.46

- Riot Platforms (RIOT): closed at $8.48 (+0.47%), up 4.83% at $8.89

- Core Scientific (CORZ): closed at $9.32 (-1.38%), up 5.69% at $9.85

- CleanSpark (CLSK): closed at $9.2 (+5.99%), up 5.11% at $9.67

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $15.55 (+0.13%), up 5.98% at $16.48

- Semler Scientific (SMLR): closed at $34.79 (-1.28%), up 9.95% at $38.25

- Exodus Movement (EXOD): closed at $50.13 (+17.98%), up 3.73% at $52

ETF Flows

- Daily net flows: $321.4 million

- Cumulative net flows: $41.2 billion

- Total BTC holdings ~ 1.17 million

- Daily net flows: $17.6 million

- Cumulative net flows: $2.49 billion

- Total ETH holdings ~ 3.46 million

Source: Farside Investors

Overnight Flows

Chart of the Day

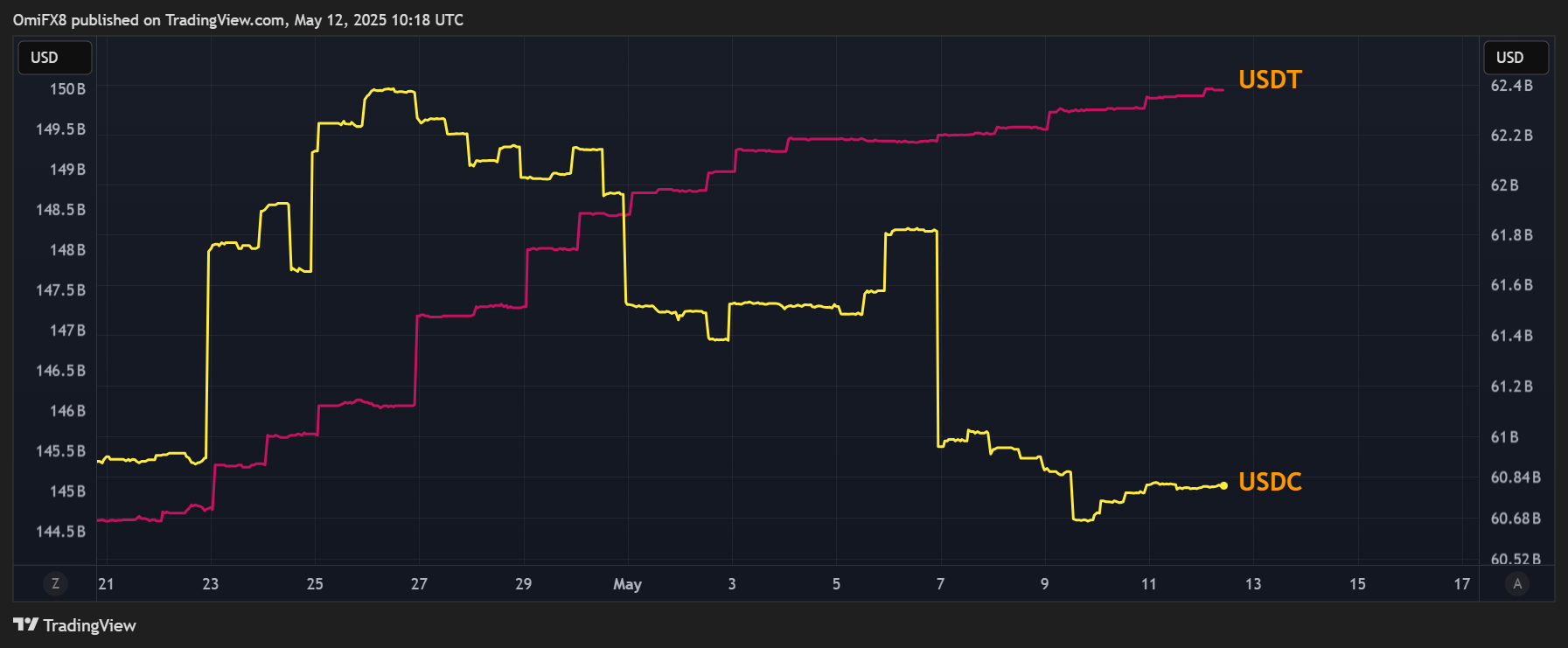

- The chart shows the market cap for USDC, the world’s second-largest dollar-pegged stablecoin, has declined from $62.28 billion to $60.68 billion.

- Meanwhile, the market cap for Tether’s USDT, its larger rival, has risen further, greasing the crypto market rally.

While You Were Sleeping

- Military Officials of India, Pakistan to Discuss Next Steps, India Says, as Ceasefire Holds (Reuters): India may retaliate for future ceasefire violations after sending a hotline message Sunday about alleged breaches of the prior day’s truce, a senior military official said.

- Metaplanet Overtakes El Salvador With $126M Bitcoin Purchase (CoinDesk): Asia’s biggest corporate holder of bitcoin bought 1,241 BTC for 18.4 billion yen ($126 million), raising its holdings to 6,796 BTC and surpassing El Salvador’s total.

- Ethereum Staking Giant Lido Loses Just 1.4 ETH in Hacking Attempt (CoinDesk): Ethereum’s largest liquid-staking protocol escaped with only minor gas fee theft, with no user funds affected, after a key at validator Chorus One was compromised.

- Privacy-Focused Zcash Tops Key Resistance Above $40 to Flash Bull Signal (CoinDesk): On Sunday, Zcash (ZEC) reached $45.80 on HTX, its highest since Jan. 26, after trading in a narrow range since February, suggesting potential for further gains.

- China Courts Lula and Latin America After Trump’s Tariff Shock (The New York Times): China is positioning itself as both an economic partner and counterweight to U.S. influence, with a senior official saying Latin Americans want self-determination, not a new “Monroe Doctrine.”

- Traders Bet the Euro’s Ascent Is a Tidal Wave in the Making (Bloomberg): Deutsche Bank, which just months ago predicted the euro would dip below dollar parity, now expects it to climb to $1.20 this year and $1.30 by 2027.

In the Ether