ATOM Rides Market Wave with 4% Surge as Cosmos Lures Wall Street’s Crypto-Curious

Institutional money finally discovers what degens knew all along—Cosmos’ modular blockchain design might actually be useful. ATOM outpaces major cryptos as the ecosystem shrugs off last year’s ’interchain summer’ hangover.

Behind the surge: VC-backed projects like Celestia and dYdX v4 stake their claims in Cosmos SDK territory. Meanwhile, TradFi players dip toes in—probably while shorting Bitcoin on the side.

The kicker? This rally coincides with yet another ’institutional adoption’ narrative. Because nothing says ’serious investment’ like chasing pumps during a macro squeeze.

Technical Analysis: ATOM’s Recovery Pattern

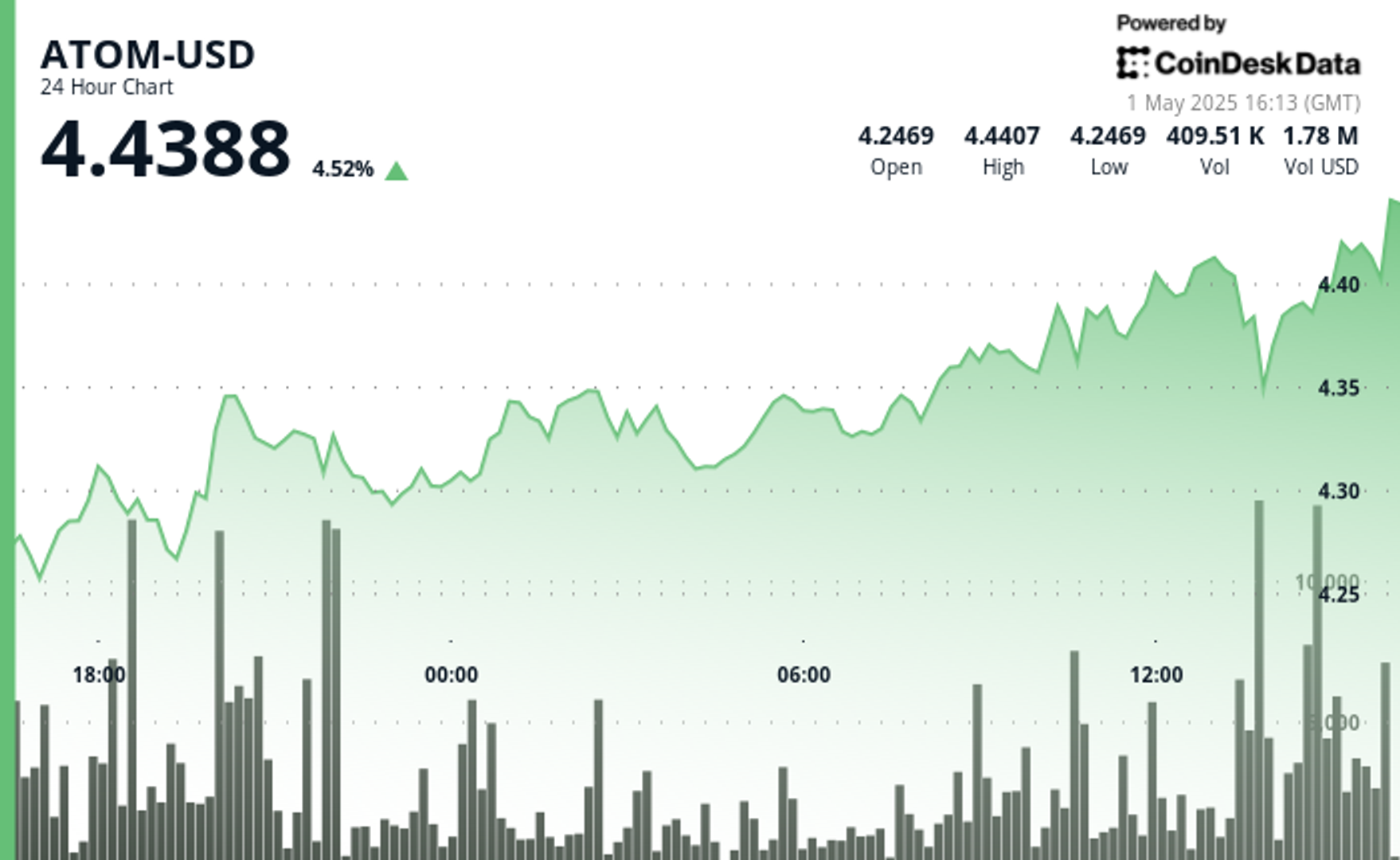

- ATOM-USD has demonstrated remarkable resilience over the analyzed period, recovering from a significant drop to $4.23 on April 30th to stabilize above $4.38 by May 1st.

- The overall range of $0.31 (6.9%) reflects moderate volatility, with strong support established at $4.30-$4.32, according to CoinDesk Research’s technical analysis data.

- Recent price action shows a developing uptrend with higher lows forming since April 30th, accompanied by increasing volume during recovery phases.

- The Fibonacci retracement from the April 29th high suggests the current price has reclaimed the 61.8% level, with resistance at $4.41-$4.42 representing the next significant hurdle before potential continuation toward previous highs.

- ATOM-USD has shown significant volatility in the last 100 minutes, experiencing a sharp decline from $4.41 to a low of $4.35 before staging a recovery to $4.38.

- The price action formed a V-shaped pattern, with strong buying emerging at the $4.35-$4.36 support zone. This was accompanied by notably higher trading volumes during both the selloff (peaking at 103,987 units at 14:00) and subsequent recovery.

- Recent price movement has established a short-term uptrend with higher lows since 13:57, with the current price consolidating near $4.38-$4.39, suggesting stabilization after the earlier volatility and potential for continued upward momentum if the $4.39 resistance level can be breached.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

References: