Monero (XMR) Surges 40% in Wild Rally as XRP Outpaces Crypto Majors

Privacy coin Monero just pulled off a 40% moonshot—because nothing says ’bull market’ like sketchy alts outperforming Bitcoin. Meanwhile, XRP leads gains among top cryptos, proving once again that even ’dead’ projects can zombie-walk their way back when liquidity floods the market.

The real winner? Traders who bought the rumor and sold the news—before the inevitable ’regulatory concerns’ tank the party. Classic crypto.

XRP led majors gains with a 4% move higher from the past day, driven by a ProShares ETF approval that will see three futures-tracked products go live on April 30. Cardano’s ADA, BNB Chain’s BNB and ether (ETH) showed moves between 1-3%.

One exception to the relatively dormant market has been privacy coin Monero (XMR), up more than 40% in the past 24 hours. It traded over $320 in Asian morning hours Monday, a level last seen in May 2021.

Trading volumes zoomed from an average of $50 million on a 7-day rolling basis to over $220 million in the past 24 hours.

"There appears to be no clear catalyst behind $XMR’s recent rally,” Min Junng, a research analyst at Presto told CoinDesk in a Telegram message, Network activity remains consistent with typical levels, suggesting the move may be more speculative in nature."

The privacy-centric token is based on the CryptoNote protocol, which ensures that all its transactions are unlinkable and untraceable.

Sentiment among traders carries over from last week with a near-term bullish view intact but with a cautious attitude as macroeconomic headwinds remain.

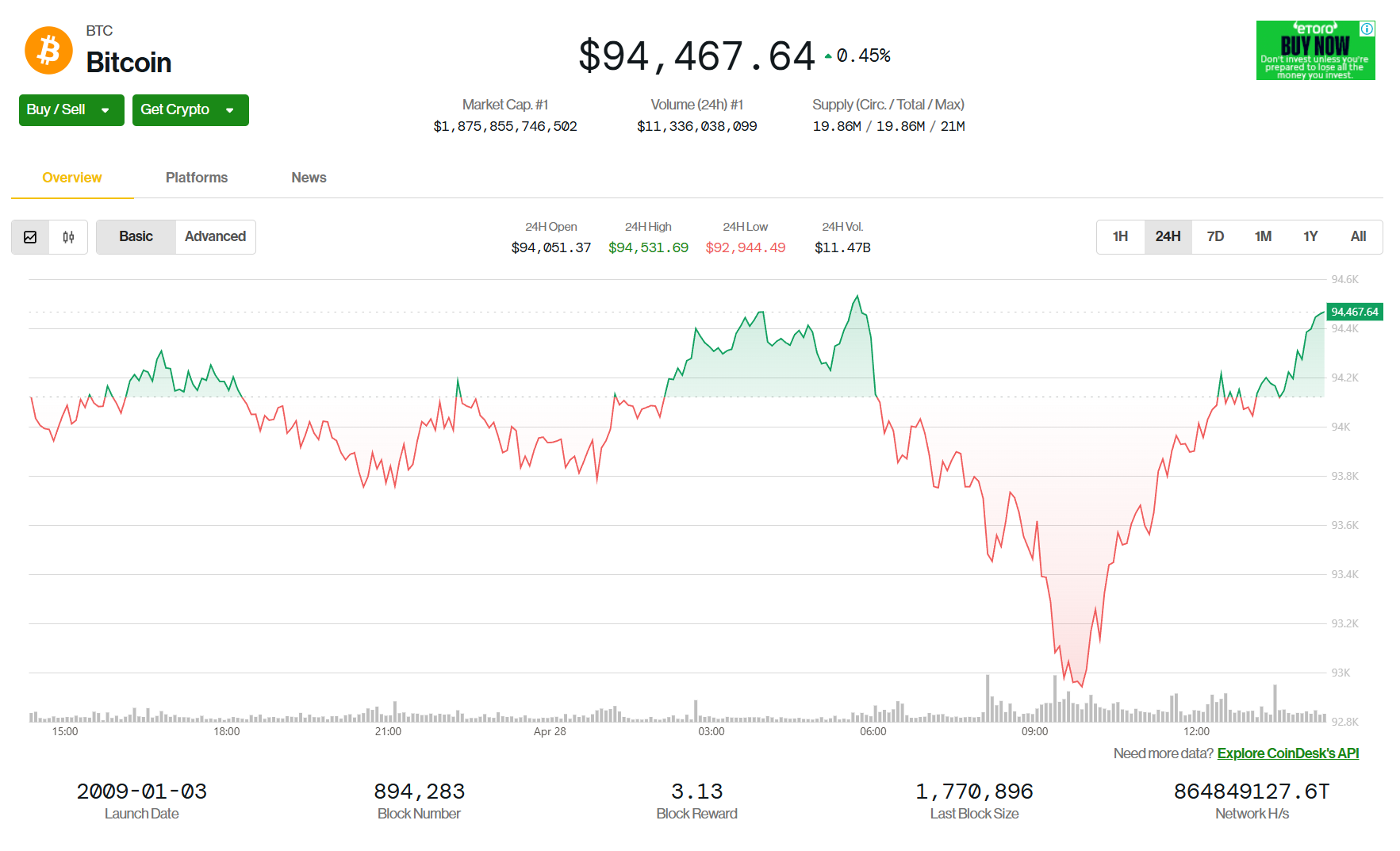

“Bitcoin has maintained a relatively stable range above $92k as Trump’s administration soften tariff policies of the crypto industry,” Jupiter Zheng, Partner, Liquid Fund and Research, HashKey Capital, told CoinDesk in a Telegram message. “This crypto-friendly attitude can boost Bitcoin and other cryptocurrencies to develop their own market direction, less correlated with US equities, and enable more growth and innovation in the industry."

Broader equity markets showed mixed movements on Monday. A regional gauge advanced 0.6% while futures for the S&P 500 declined 0.6%, indicating a four-day US equities rally may snap. Gold pared last week’s gains after a record-breaking rally. Hong Kong’s Hang Seng index was also flat as were other major indices around Asia.