Bitcoin Flexes Safe-Haven Muscle as Trade Wars Roil Markets—While Traders Still Pay 2% Fees for ’Instant’ Settlements

BTC dominance hits 18-month high as capital flees risk assets

Traditional markets reel from US-China tariff escalation—crypto volatility stays oddly muted

Gold bugs seethe as institutional flows pivot toward digital stores of value

Meanwhile, Wall Street still charges premium pricing for stone-age settlement speeds

What to Watch

- Crypto:

- April 25, 1 p.m.: U.S. Securities and Exchange Commission (SEC) Crypto Task Force Roundtable on "Key Considerations for Crypto Custody".

- April 28: Enjin Relaychain increases active validator slots to 25 from 15 to enhance decentralization.

- April 29, 1:05 a.m.: BNB Chain (BNB) — BSC mainnet hardfork.

- April 30, 9:30 a.m.: ProShares expects its XRP ETF, offering exposure through futures and swap agreements, to begin trading on NYSE Arca.

- April 30, 10:03 a.m.: Gnosis Chain (GNO), an Ethereum sister chain, will activate the Pectra hard fork on its mainnet at slot 21,405,696, epoch 1,337,856.

- Macro

- Day 4 of 6: World Bank (WB) and the International Monetary Fund (IMF) spring meetings in Washington.

- April 24, 8:30 a.m.: The U.S. Census Bureau releases March manufactured durable goods orders data.

- Durable Goods Orders MoM Est. 2% vs. Prev. 0.9%

- Durable Goods Orders Ex Defense MoM Est. 0.2% vs. Prev. 0.8%

- Durable Goods Orders Ex Transp MoM Est. 0.2% vs. Prev. 0.7%

- April 24, 8:30 a.m.: The U.S. Department of Labor releases unemployment insurance data for the week ended April 19.

- Initial Jobless Claims Est. 221K vs. Prev. 215K

- April 25, 10:00 a.m.: The University of Michigan releases (Final) April U.S. consumer sentiment data.

- Michigan Consumer Sentiment Est. 50.8 vs. Prev. 57

- Earnings (Estimates based on FactSet data)

- April 29: PayPal Holdings (PYPL), pre-market, $1.16

- April 30: Robinhood Markets (HOOD), post-market, $0.33

- May 1: Block (XYZ), post-market, $0.97

- May 1: Reddit (RDDT), post-market, $0.02

- May 1: Riot Platforms (RIOT), post-market, $-0.23

Token Events

- Governance votes & calls

- Lido DAO is voting to extend its delegate incentivization program (DIP) through Q4 with a $225,000 LDO budget. Voting ends April 28.

- Uniswap DAO will vote on establishing a licensing and deployment framework for Uniswap v4 to accelerate its adoption across multiple chains. The proposal grants the Uniswap Foundation a blanket exemption to deploy v4 on any DAO-approved chain and gives the Uniswap Accountability Committee authority to update deployment records. Voting occurs April 24-April 30.

- April 24, 8 a.m.: Alchemy Pay to host an Ask Me Anything (AMA) session on its 2025 roadmap.

- April 24, 9 a.m.: IOTA to host an X spaces session on staking, validators and the mainnet launch.

- April 24, 8 a.m.: Ronin to host a town hall meeting.

- April 30, 12 p.m.: Helium to host a community call meeting.

- Unlocks

- April 30: Optimism (OP) to unlock 1.89% of its circulating supply worth $23.45 million.

- May 1: Sui (SUI) to unlock 2.28% of its circulating supply worth $221.99 million.

- May 1: ZetaChain (ZETA) to unlock 5.67% of its circulating supply worth $11.28 million.

- May 2: Ethena (ENA) to unlock 0.73% of its circulating supply worth $13.69 million.

- May 7: Kaspa (KAS) to unlock 0.56% of its circulating supply worth $13.91 million.

- May 9: Movement (MOVA) to unlock 2.04% of its circulating supply worth $11.33 million.

- Token Launches

- April 24: Initia (INIT) to be listed on Binance, CoinW, WEEX, KuCoin, MEXC and others.

- May 2: Binance to delist Alpaca Finance (ALPACA), PlayDapp (PDA), Viberate (VIB) and Wing Finance (WING).

- May 5: Sonic (S) to be listed on Kraken.

Conferences:

CoinDesk’s Consensus is taking place in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

- Day 3 of 3: Money20/20 Asia (Bangkok)

- Day 2 of 2: Blockchain Forum 2025 (Moscow)

- Day 2 of 3: Semafor’s World Economy Summit 2025 (Washington)

- April 24: Bitwise’s Investor Day for Bitcoin Standard Corporations (New York)

- April 26: Crypto Vision Conference 2025 (Manilla)

- April 26-27: Harvard Blockchain in Action Conference (Cambridge, Mass.)

- April 27: N Crypto Conference 2025 (Kyiv)

- April 27-30: Web Summit Rio 2025

- April 28-29: Blockchain Disrupt 2025 (Dubai)

- April 28-29: Staking Summit Dubai

- April 29: El Salvador Digital Assets Summit 2025 (San Salvador, El Salvador)

- April 29: IFGS 2025 (London)

- April 30-May 1: TOKEN2049 (Dubai)

Token Talk

By Shaurya Malwa

- Infrared, a liquid staking platform on Berachain, late Wednesday introduced a points program to reward users before its token debuts in the third quarter.

- Points have no fixed supply and are earned through activities like staking or providing liquidity.

- Users earn points by contributing to Infrared’s liquidity vaults, providing liquidity on exchanges like Kodiak and BEX, or staking iBGT and iBERA tokens. Longer participation increases points.

- Infrared leads Berachain’s ecosystem with $1.5 billion in total value locked.

- The program includes retroactive rewards since Infrared’s February launch, and will run for about three months. Users can track points in real time on a dashboard, with additional rewards through partners like Pendle. Points will convert to Infrared’s native token at a ratio to be announced closer to the token launch.

Derivatives Positioning

- Notional open interest in bitcoin CME options has climbed to $5 billion, the most since November.

- Open interest in the CME futures has bounced to over $12 billion, but remains well below the December peak of $22.7 billion, pointing to persistent caution.

- BTC CME futures basis suggests the same, still hovering under an annualized 10%.

- On offshore exchanges, open interest in perpetual futures exchanges has dropped with the overnight BTC price pullback. This suggests the weakness is likely led by profit-taking rather than an influx of fresh shorts.

- In altcoins, NEAR, UNI and PEPE futures have seen the most increase in open interest in the past 24 hours.

- On Deribit, BTC, ETH skews continue to show a bias for calls across time frames. Traders are increasingly selling cash-secured put options tied to BTC, Lin Chen, Deribit’s business development head told CoinDesk.

Market Movements:

- BTC is down 1.36% from 4 p.m. ET Wednesday at $92,411.92 (24hrs: -1.76%)

- ETH is down 2.94% at $1,743.77 (24hrs: -2.66%)

- CoinDesk 20 is down 2.21% at 2,669.87 (24hrs: -3.02%)

- Ether CESR Composite Staking Rate is up 10 bps at 3.125%

- BTC funding rate is at 0.0069% (7.5873% annualized) on Binance

- DXY is down 0.45% at 99.40

- Gold is up 2.19% at $3,347.90/oz

- Silver is down 0.57% at $33.33/oz

- Nikkei 225 closed +0.49% at 35,039.15

- Hang Seng closed -0.74% at 21,909.76

- FTSE is down 0.3% at 8,378.12

- Euro Stoxx 50 is down 0.74% at 5,060.91

- DJIA closed on Wednesday +1.07% at 39,606.57

- S&P 500 closed +1.67% at 5,375.86

- Nasdaq closed +2.5% at 16,708.05

- S&P/TSX Composite Index closed +0.69% at 24,472.70

- S&P 40 Latin America closed +1.28% at 2,475.90

- U.S. 10-year Treasury rate is down 4 bps at 4.35%

- E-mini S&P 500 futures are down 0.62% at 5,368.00

- E-mini Nasdaq-100 futures are down 0.86% at 18,642.25

- E-mini Dow Jones Industrial Average Index futures are down 0.68% at 39,503.00

Bitcoin Stats:

- BTC Dominance: 64.56 (0.22%)

- Ethereum to bitcoin ratio: 0.01884 (-1.72%)

- Hashrate (seven-day moving average): 823 EH/s

- Hashprice (spot): $48.61

- Total Fees: 11.29 BTC / $1,042,496

- CME Futures Open Interest: 140,610 BTC

- BTC priced in gold: 27.8 oz

- BTC vs gold market cap: 7.92%

Technical Analysis

- The chart shows XRP, currently at $2.15, remains stuck in a downtrend that began in January.

- The Ichimoku cloud is capping the upside, threatening to derail the recovery rally seen since April 7.

- The immediate support is at $2, followed by the month’s lows near $1.60.

- On the higher side, the cloud and the descending trendline are levels to beat for the bulls.

Crypto Equities

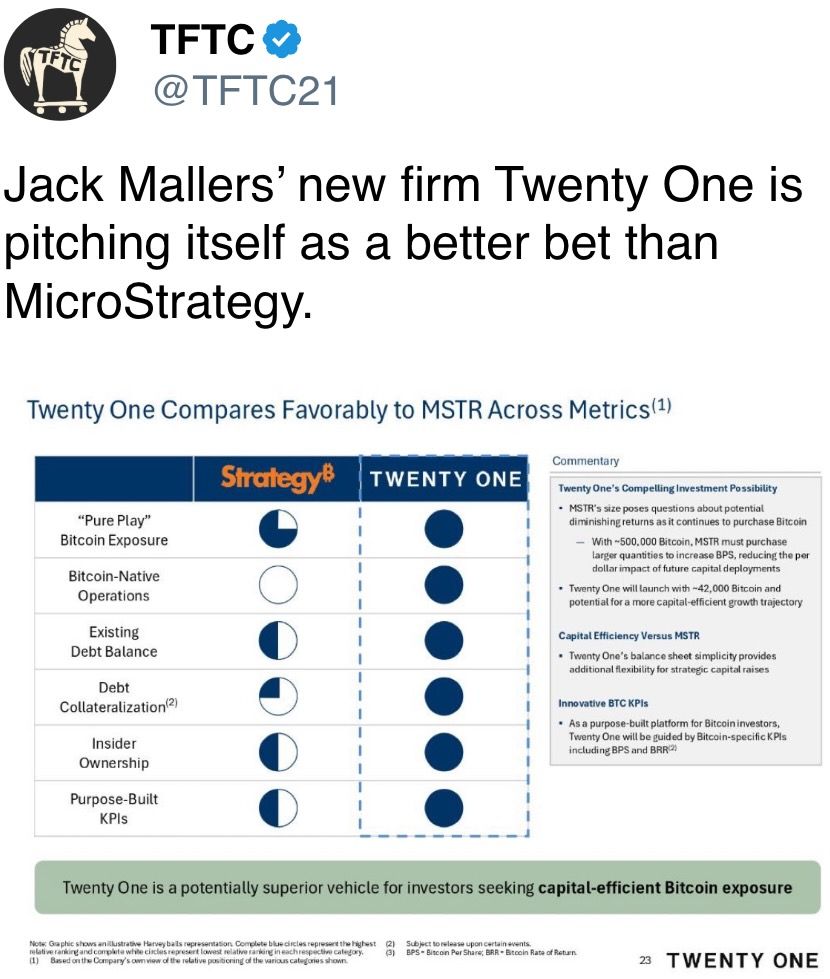

- Strategy (MSTR): closed on Wednesday at $345.73 (+0.79%), down 1.85% at $339.33 in pre-market

- Coinbase Global (COIN): closed at $194.80 (+2.53%), down 1.53% at $191.82

- Galaxy Digital Holdings (GLXY): closed at C$18.73 (+2.86%)

- MARA Holdings (MARA): closed at $14.13 (+0.5%), down 2.55% at $13.77

- Riot Platforms (RIOT): closed at $7.50 (+5.34%), down 2.4% at $7.32

- Core Scientific (CORZ): closed at $7.12 (+2.89%), down 1.12% at $7.04

- CleanSpark (CLSK): closed at $8.87 (+1.14%), down 1.92% at $8.70

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $13.51 (+3.13%), down 2.59% at $13.16

- Semler Scientific (SMLR): closed at $34.28 (+3%), down 1.6% at $33.73

- Exodus Movement (EXOD): closed at $44.09 (+12.5%), up 0.7% at $44.40

ETF Flows

- Daily net flow: $917 million

- Cumulative net flows: $37.68 billion

- Total BTC holdings ~ 1.13 million

- Daily net flow: -$23.9 million

- Cumulative net flows: $2.25 billion

- Total ETH holdings ~ 3.33 million

Source: Farside Investors

Overnight Flows

Chart of the Day

- The chart shows the dollar value of the number of active or open ether options contracts on Deribit.

- The $2,000 strike call is the most popular bet, with an open interest of over $260 million.

- Strikes with large open interest often act as magnets, meaning ether could rise to $2,000 in the coming days.

While You Were Sleeping

- Russia Reserves Right to Use Nuclear Arms in Event of Western Aggression — Shoigu (TASS News Agency): Russia’s Security Council secretary warned that the country’s defense policy permits a nuclear response to conventional attacks, including when foreign powers offer support through territory or logistics.

- Why Gold Became the Safe Haven of Choice as U.S. Treasuries and Dollar Sold Off (CNBC): Analysts attribute gold’s strength to its inflation-hedging appeal, insulation from fiscal and monetary policy, a weaker dollar and strong buying by emerging market central banks.

- Bitcoin’s April Rally Driven by Institutions, While Retail Flees ETFs: Coinbase Exec (CoinDesk): Bitcoin’s surge to $93,000 has been driven by institutional and sovereign wealth fund accumulation, not retail ETF flows, according to Coinbase Institutional’s John D’Agostino.

- The Dollar Has Further to Fall (Financial Times): Goldman’s chief economist says the dollar is overvalued by historical standards and a cooling U.S. economy will curb foreign appetite for American assets, weakening demand for the currency.

- Bitcoin Traders Eye Long Term BTC Accumulation by Selling Put Options

(CoinDesk): Traders are using a cash-secured approach by holding stablecoins, ensuring they can buy bitcoin if prices drop and puts are exercised at the higher strike price. - Long-Term Bitcoin Holders Show Commitment, Buy More BTC Than Short-Term Holders Sell (CoinDesk): Long-term investors’ holdings have increased by 635,340 BTC since January, absorbing more than what’s been distributed by short-term holders at a 1.38:1 accumulation ratio.

In the Ether