Crypto Whale Who Netted $192M From Market Crash Doubles Down on Bitcoin Short Position

Betting against the king of cryptocurrencies takes guts—or maybe just a really good track record.

The Short Seller Returns

Fresh off a $192 million profit from timing the last crypto collapse, this trader's diving back into bearish territory. They're positioning against Bitcoin once again, testing whether history will repeat itself in these volatile markets.

Market Impact

When whales make moves this bold, the entire ecosystem feels the ripple effects. Other traders watch closely, institutions recalculate risk models, and retail investors start questioning their own positions.

Contrarian Strategy

Going against the crypto crowd requires either brilliant insight or spectacular hubris—and with nine-figure profits already banked, it's hard to argue with the results. Still, betting against an asset class that's proven resilient through multiple cycles takes serious conviction.

Because nothing says 'financial wisdom' like making fortunes from other people's losses while claiming it's all just smart market positioning.

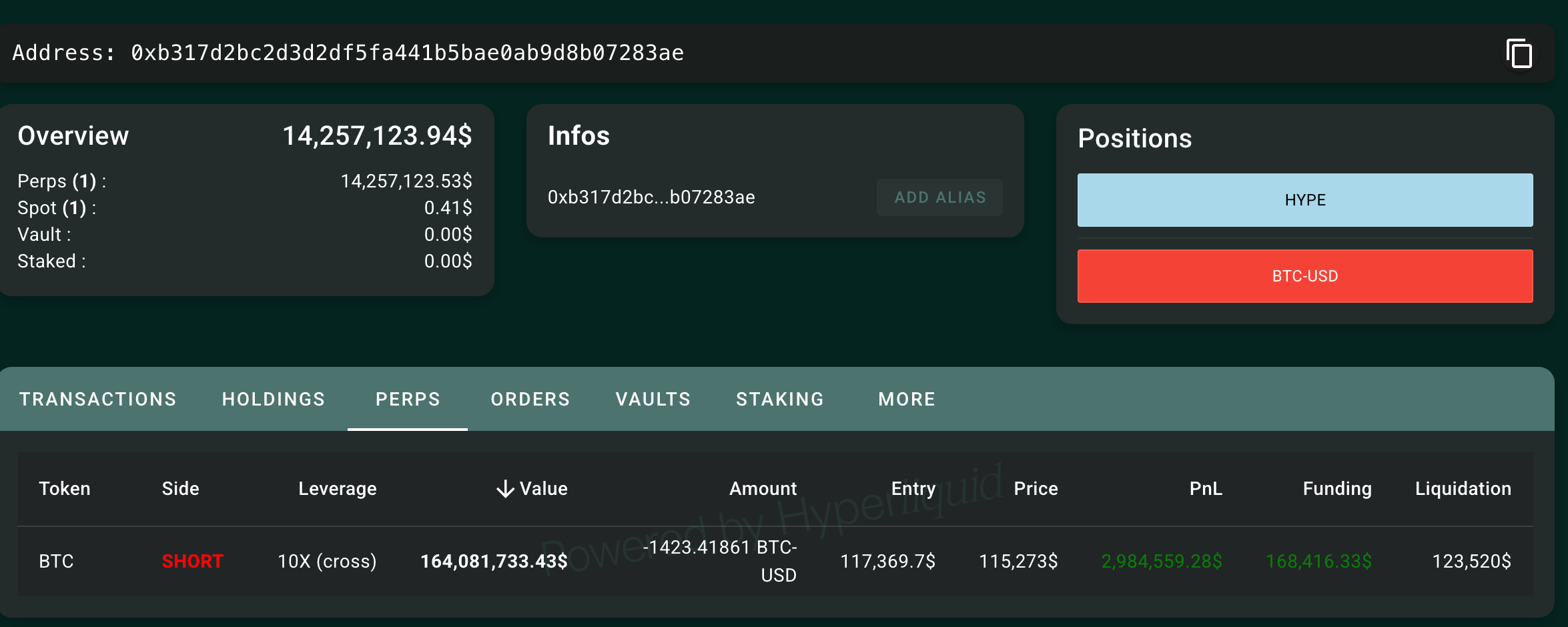

The same trader first drew attention on Friday when it opened a massive short roughly 30 minutes before former President Donald Trump’s surprise announcement of 100% tariffs on Chinese imports — a move that erased over $19 billion in crypto market value and triggered the largest-ever day of liquidations in the market.

The perfectly timed bet led to a gain of nearly $200 million, sparking speculation that the entity may have had advance knowledge of the policy shift.

On-chain analysts and traders have since dubbed the address an “insider whale.” Some even argue that the position itself could have accelerated the crash.

What’s Hyperliquid and Why It Matters

Hyperliquid is the biggest decentralized perpetuals exchange that lets traders open high-leverage futures positions directly on-chain, without relying on centralized intermediaries like Binance or OKX.

It has become a favorite among high-frequency traders and whales because of its DEEP liquidity, transparent order book, and lightning-fast execution, making it one of the few DeFi platforms capable of handling institutional-sized flows.

The platform also features Auto-Deleveraging (ADL), or a built-in safety mechanism that prevents bad debt during extreme volatility. When insurance funds are drained, ADL forcibly closes profitable positions to cover losses from bankrupt accounts. It ensures solvency, but it can also worsen selloffs, as profitable traders get liquidated to balance the system.

Over 6,000 wallets were hit during the weekend’s ADL-triggered flush, according to HyperTracker data, wiping more than $1.2 billion in trader capital on Hyperliquid alone.

The new short adds intrigue to a market already on edge as participants continue to assess contagion effects following the weekend slide.