Stablecoins: The Revolution in Global Money Transfers

Stablecoins are quietly dismantling the traditional financial infrastructure—one cross-border payment at a time.

The Speed Revolution

Forget waiting days for international settlements. Stablecoins deliver funds in minutes, bypassing the entire correspondent banking system that's been slowing money down for decades.

Cost Slashers

Traditional wire transfers bleed you dry with fees and hidden exchange rate markups. Stablecoins cut those costs by up to 80%—because apparently banks thought 3-5% per transfer was reasonable.

Borderless by Design

No permission needed. No geographic restrictions. Stablecoins operate on a simple premise: if you have internet access, you deserve financial access. A concept that somehow eluded traditional finance for centuries.

The Transparency Advantage

Every transaction lives on a public ledger. No more wondering where your money got lost in the banking system's black box—though watching Wall Street institutions suddenly discover the benefits of transparency is almost worth the price of admission.

They're not just changing how money moves—they're exposing how unnecessary most financial intermediaries actually are. The revolution won't be televised, but it will be tokenized.

Stablecoins vs. SWIFT: reinventing cross-border money

What’s being disrupted is not SWIFT in general, but. For decades, the U.S. dollar has been the, and SWIFT has been the messaging system coordinating those flows. Now, instead of SWIFT as the intermediary,: programmable, verifiable and available 24/7.

Stablecoins aren’t yet replacing SWIFT at scale — they still account for less than 1% of global money flows — but in remittances, B2B payments and e-commerce,

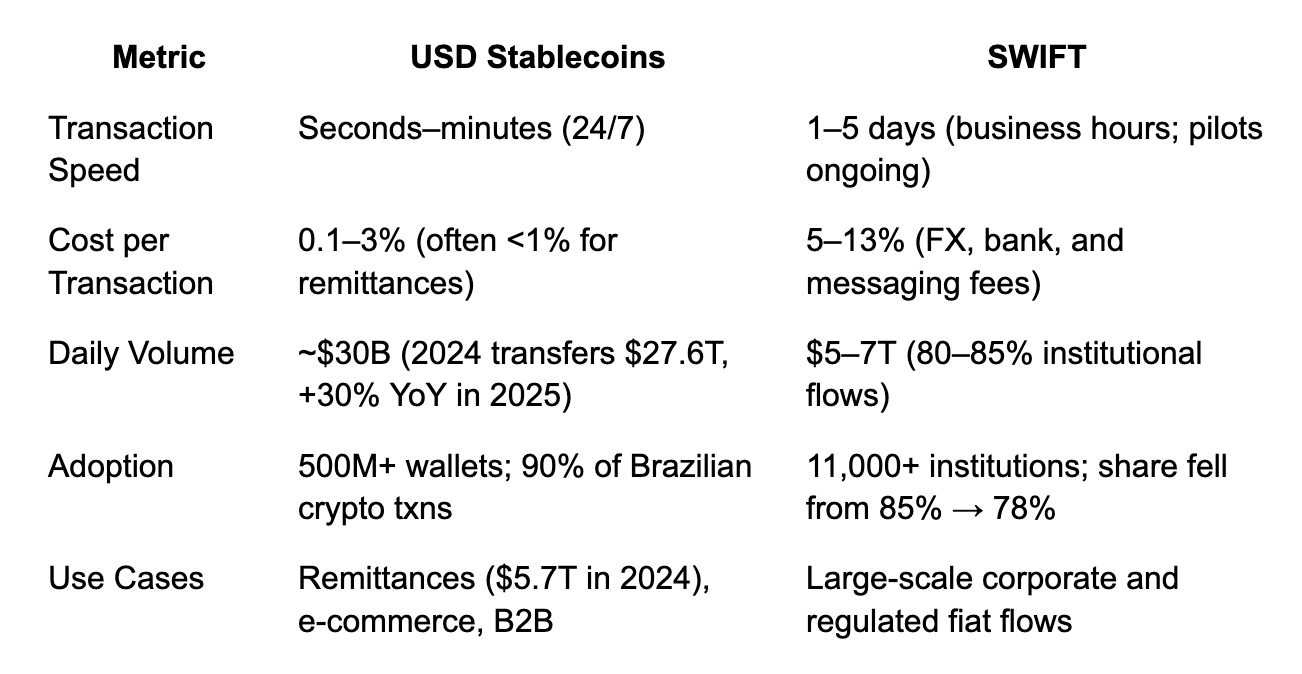

Speed, cost, adoption — here’s the comparison (2025):

The problem: two states of money

While USD stablecoins move instantly in the digital world, the real economy still runs on. That forces liquidity providers to bridge two different states of money:

- Digital (USD stablecoins).

- Fiat (local currencies).

Today, this mismatch creates friction. Liquidity providers end up holding pesos, reals or naira overnight, unable to recycle capital until banks reopen. The fintech or end-user benefits from instant settlement — but the provider absorbs the cost of locked balances. In effect,.

The solution: FX on-chain = one state

Instead of moving between stablecoins and fiat through banks, FX-on-chain enables.

This unlocks two key advantages:

By unifying flows digitally, liquidity providers are no longer stuck warehousing risk. Instead, capital circulates continuously on-chain — just as it does in global FX markets, but with.

Looking ahead

Stablecoins are no longer just a bridge between crypto and fiat — they are becoming the. From households in Argentina hedging inflation, to exporters in Nigeria settling invoices, to institutions arbitraging spreads, stablecoins are embedding themselves everywhere.

The future hinges on three fronts:

If the past decade was about Bitcoin as “digital gold,” the next will be about stablecoins as